How do I elect on a rights issue or an open offer via My IG?

1. Log in to My IG

2. Navigate to the ‘live accounts’ tab

3. Select the relevant account from the dropdown menu on the left-hand side

4. Choose the ‘corporate actions’ option. Here, you’ll find any corporate actions affecting your account. You’ll see the stock name, live status and the IG deadline, which is the date by which you’ll need to elect for new shares, trade out of them or fund your account

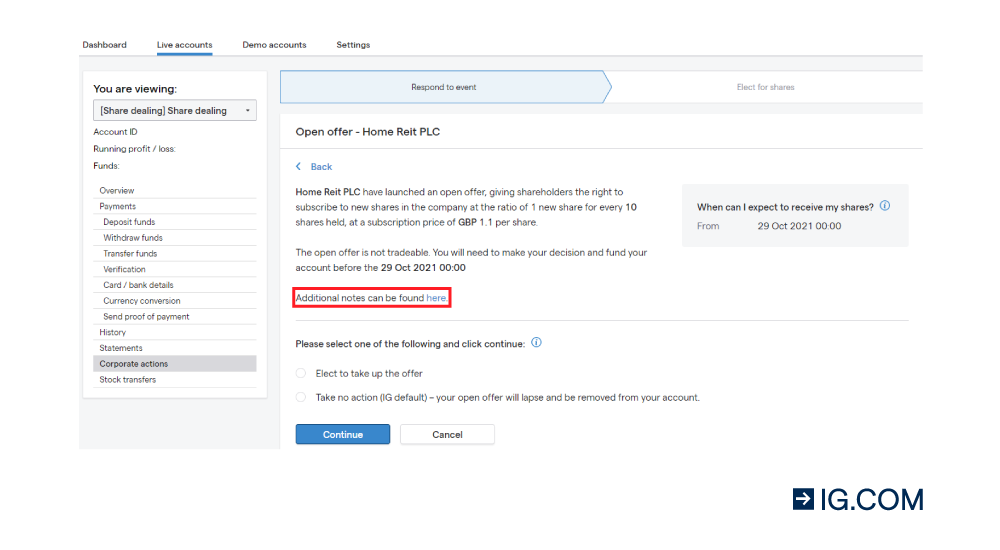

5. Click on an event to see the actions available to you, plus key information such as subscription prices, ratios and key dates/times. You’ll have a range of options to choose from depending on the event and whether the rights are tradable or not

6. From here, you can choose the action you want to take and follow the on-screen prompts

Possible actions to take on rights issues and open offers

Elect for new shares

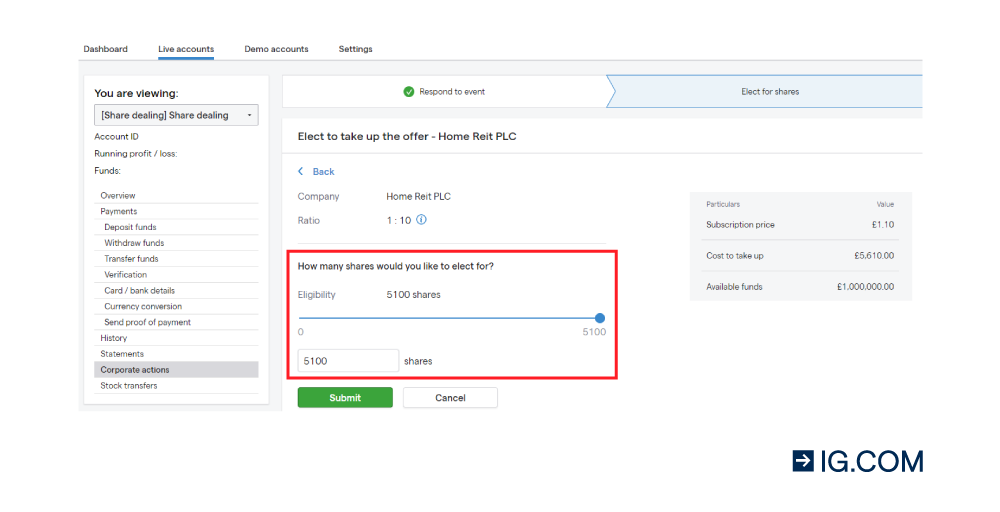

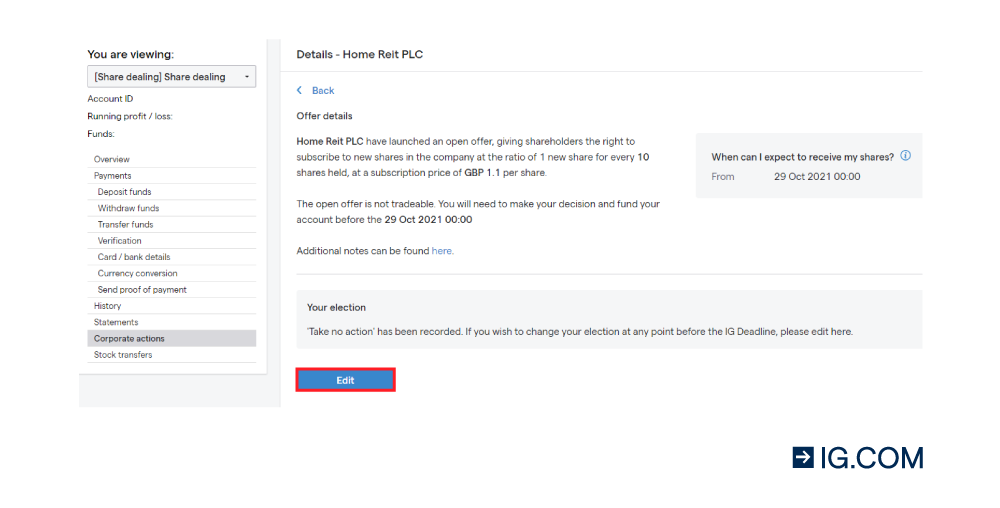

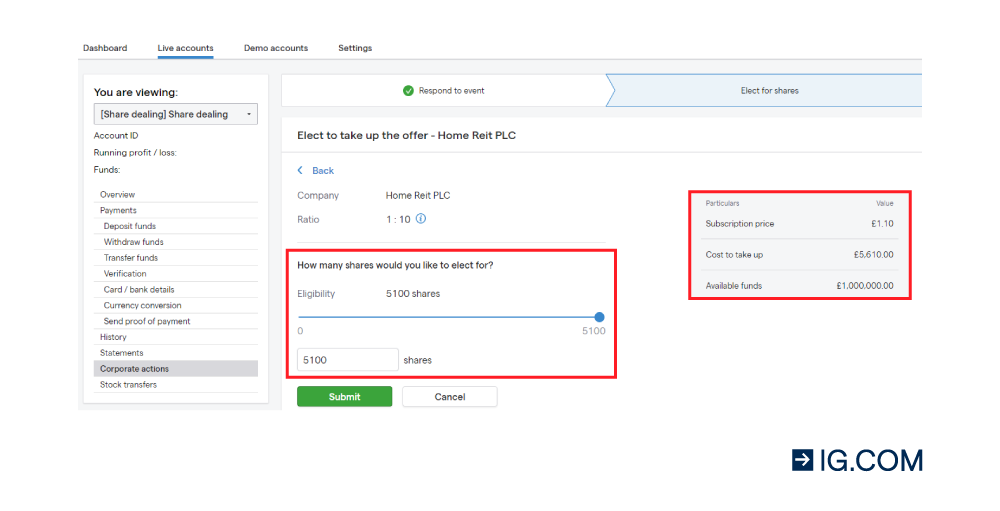

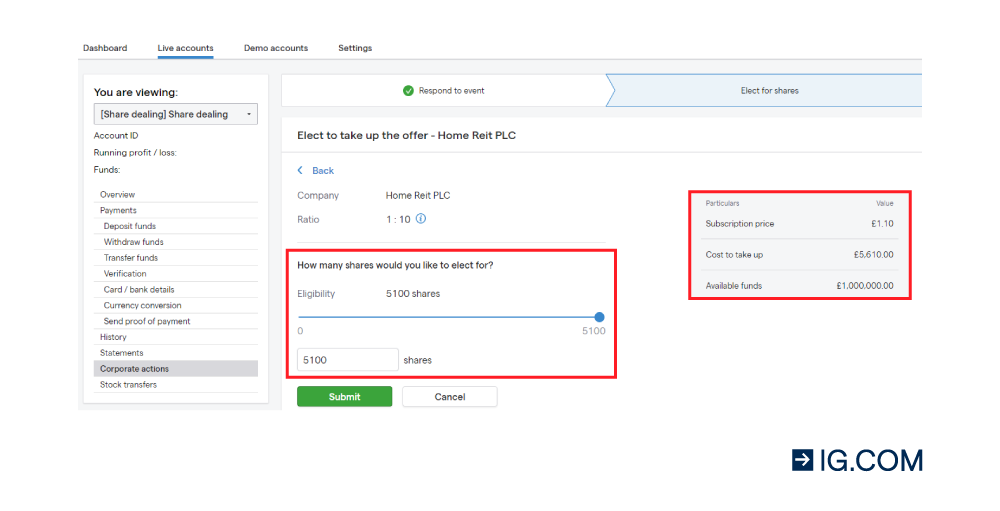

If you select this option, you’ll see the screen below.

You can then choose the size of the holding you wish to elect for, and the cost to take up the offer will be shown on the calculator (only available for share dealing and ISA accounts). The total cost will change depending on the election size (ie the number of shares) you manually type into the election box or how much you move the slider back and forth.

When you’re happy with your election, click the ‘submit’ button.

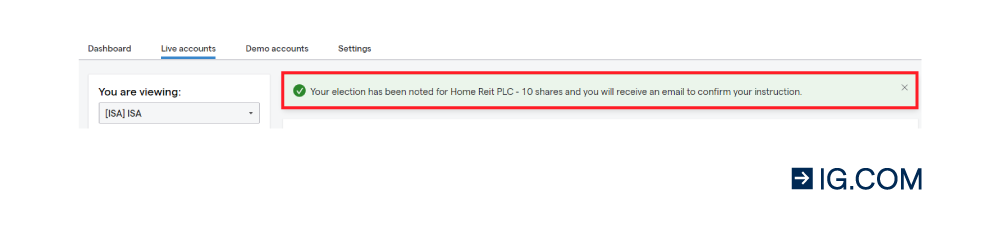

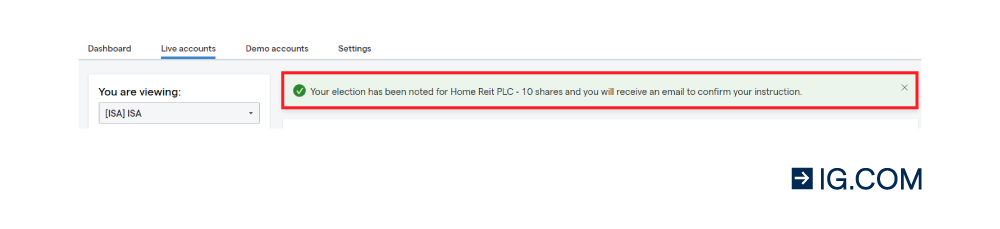

A green banner will appear at the top of the screen, confirming your election.

You’ll then receive written confirmation of your election via your registered email address.

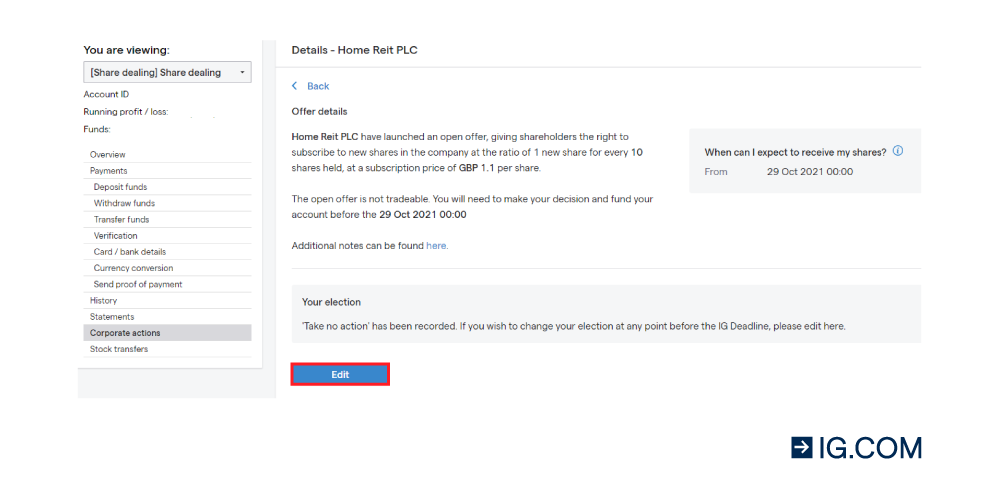

If you change your mind, you can amend your election before the IG deadline. To do so, simply select the relevant event from your dashboard, click on ‘edit’ to make your changes and then submit as before.

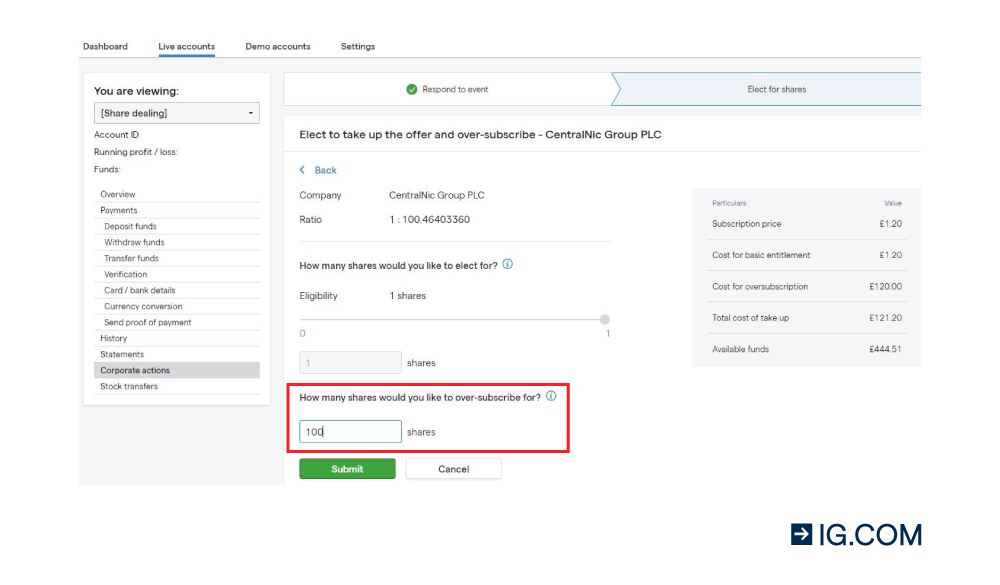

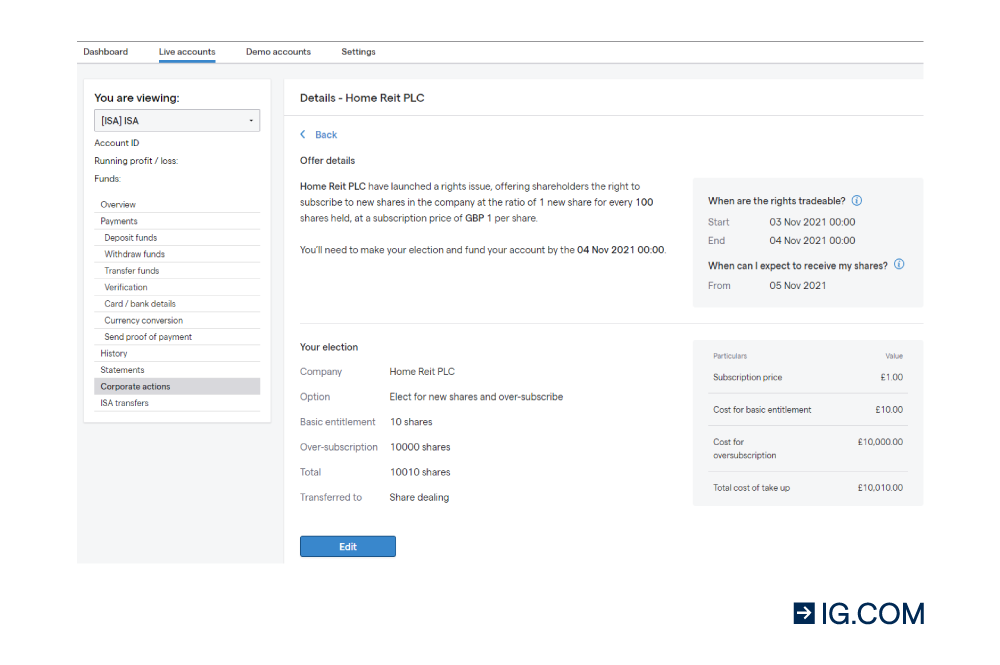

Elect for new shares and oversubscribe

This will only appear as an option if it’s possible to oversubscribe for an event. To proceed with the oversubscription, select the relevant option and click on ‘continue’.

By selecting the oversubscription option, your basic entitlement will by default be taken up in full and greyed out from editing. You’ll need to enter the number of shares for which you’d like to oversubscribe. For share dealing and ISA accounts, the calculator will help you work out the costs involved.

It’s important to ensure that the basic and excess entitlements are covered by settled cash (ie funds shown as ‘available to withdraw’) in your account by the IG deadline or the elections may be declined.

Once you’ve submitted your election, a green banner will appear at the top of the screen, confirming your election. You’ll then receive written confirmation of your election via your registered email address.

If you change your mind, you can amend your election before the IG deadline. To do so, simply select the relevant event from your dashboard, click on ‘edit’ to make your changes and then submit as before.

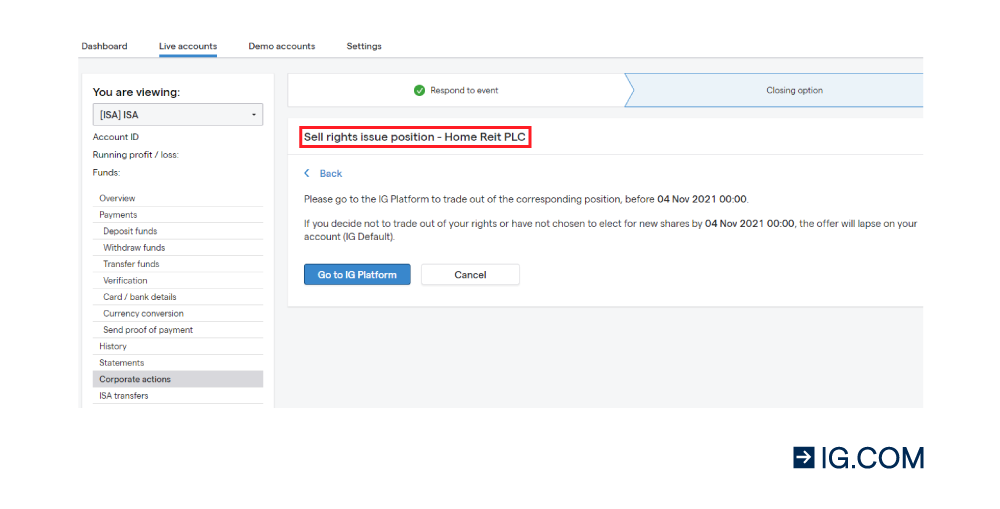

Trade out rights issue position

Select this option if you want to buy or sell out of a tradable rights issue. Once you’ve made your selection, click on ‘go to IG platform’ to trade out of the position during trading hours. You’ll need to do this before the IG deadline.

Once you’ve traded out of your position, the status of the event will change to ‘traded out’.

Take no action (IG default)

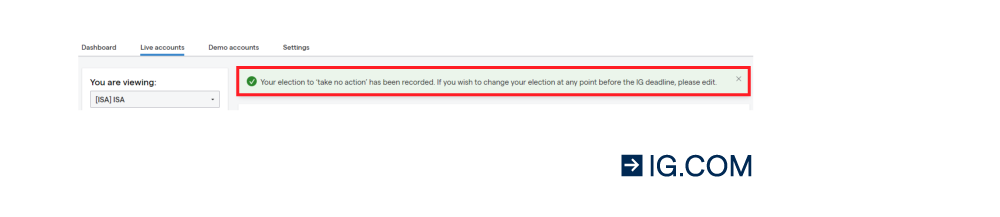

If you don’t want to participate in the event, you can select ‘take no action’ from the event menu. Note that this is the IG default action, meaning that if you do nothing before the IG deadline, this option will apply automatically.

Once selected, you’ll see this green confirmation banner:

You can still change your mind at any point for any of these elections, but you have to do so before the IG deadline for that specific event.

Note for short positions on a CFD or spread betting account

Doing nothing could mean having the rights removed around the pay date and potentially having a new short position in the stock booked at the subscription price.

Because you’re short, you may have a position that’s larger than your original entitlement – for which you’ll be liable – booked on to your account at the pay date.

Further information

Transferring shares from your ISA account to your share dealing account

If a rights issue or an open offer takes place on your ISA account, you can transfer the new position to your share dealing account. However, the process will be slightly different when you elect for new shares, so please follow the instructions detailed below.

Choose your ISA account from the ‘live accounts’ dropdown menu.

If you select ‘elect for new shares’, you’ll see the screen below.

First, enter the number of shares for which you’d like to elect. Then, click on the slider next to ‘transfer my shares to my share dealing account’.

A dropdown menu will appear, where you can select the share dealing account into which your new shares should be transferred.

The calculator will show you how much settled cash is needed to take up the offer. It will also show you the cash available in your ISA account and the selected share dealing account.

Once you’ve submitted your request, a green confirmation banner will appear at the top of the screen. You’ll then receive written confirmation via your registered email address.

If you change your mind, you can amend your election before the IG deadline. To do so, simply select the relevant event from your dashboard, click on ‘edit’ to make your changes and then submit as before.

The rights issue/open offer position will be transferred to your share dealing account on, or just after, the IG deadline.

Account transfer with oversubscription

If a rights issue or an open offer takes place on your ISA account, you can transfer the new position to your share dealing account. However, the process will be slightly different when you elect for new shares, so please follow the instructions detailed below.

Choose your ISA account from the ‘live accounts’ dropdown menu.

If a rights issue or an open offer takes place on your ISA account, you can transfer the new position to your share dealing account. However, the process will be slightly different when you elect for new shares, so please follow the instructions detailed below.

Choose your ISA account from the ‘live accounts’ dropdown menu.

If you select ‘elect for new shares’, you’ll see the screen below.

First, enter the number of shares for which you’d like to elect. Then, click on the slider next to ‘transfer my shares to my share dealing account’.

A dropdown menu will appear, where you can select the share dealing account into which your new shares should be transferred.

The calculator will show you how much settled cash is needed to take up the offer. It will also show you the cash available in your ISA account and the selected share dealing account.

Once you’ve submitted your request, a green confirmation banner will appear at the top of the screen. You’ll then receive written confirmation via your registered email address.

The above screenshot is shown as a generic example, as events have different terms and options available. Make sure you’re viewing the relevant account.

If you change your mind, you can amend your election before the IG deadline. To do so, simply select the relevant event from your dashboard, click on ‘edit’ to make your changes and then submit as before.

The rights issue/open offer position will be transferred to your share dealing account on, or just after, the IG deadline.

If you select ‘elect for new shares’, you’ll see the screen below.

First, enter the number of shares for which you’d like to elect. Then, click on the slider next to ‘transfer my shares to my share dealing account’.

A dropdown menu will appear, where you can select the share dealing account into which your new shares should be transferred.

The calculator will show you how much settled cash is needed to take up the offer. It will also show you the cash available in your ISA account and the selected share dealing account.

Once you’ve submitted your request, a green confirmation banner will appear at the top of the screen. You’ll then receive written confirmation via your registered email address.

If you change your mind, you can amend your election before the IG deadline. To do so, simply select the relevant event from your dashboard, click on ‘edit’ to make your changes and then submit as before.

The rights issue/open offer position will be transferred to your share dealing account on, or just after, the IG deadline.

Insufficient Funds

If you don’t have enough funds to cover the new position on your share dealing or ISA account, you’ll be informed of this in the calculator on the right-hand side of the election page. You’ll see the cash amount needed before the IG deadline and how much of your available funds will need to be held on the account until the pay date for that event. You can still submit your election, but please ensure that your account is adequately funded by the deadline or the election could be rejected.

If the account isn’t funded 24 hours before the deadline, you’ll receive an email reminder.

Trading into a rights issue

If you trade into a rights issue, you should receive an email from us (see the example below).

This will explain the terms of the offer and direct you to My IG to learn more about the event and which actions you can take.

Pay date

After the pay date, we’ll receive the new stock from our custodians. This can take up to five working days. We’ll then remove the issue/offer and book the new shares on to your account. An automated confirmation email will be sent to your inbox once the booking has been made, which can take up to five working days after the pay date or longer.

If a deadline date/time for an event had been added or amended during the subscription period, we’ll update the event in My IG and notify you by email.

Additional Notes

If there are ever additional notes connected to an event, this will be clearly indicated on the election screen, as shown below. Click on the link to view the corresponding PDF.If there are ever additional notes connected to an event, this will be clearly indicated on the election screen, as shown below. Click on the link to view the corresponding PDF.