NEW: Trade US-listed Options and Futures with IG

On an award-winning platform brought to you in partnership with our friends at tastytrade 1

- Open contracts from $1.00; zero commission to close 2

- Live webinar walk-throughs

- Trade with a cash or margin account 3

More than a trading platform

We support you at every stage of your journey

IG Academy

Learn how to trade options contracts and take our thorough introduction into their principles.

Round-the-clock support

Available every hour from 8am Saturday to 10pm Friday (UK). Access live chat and designated support team members for 1-2-1 calls.

Inspirational content

Watch and learn, live and on-demand, courtesy of the team at tastylive.

Low commissions

Capped at $10 a leg for opening trades 4 and $0 commission to close. 5

Go long, short or non-directional

Speculate based on your bullish or bearish stance, or use options strategies for a range-bound, neutral market assumption when you think prices will move sideways.

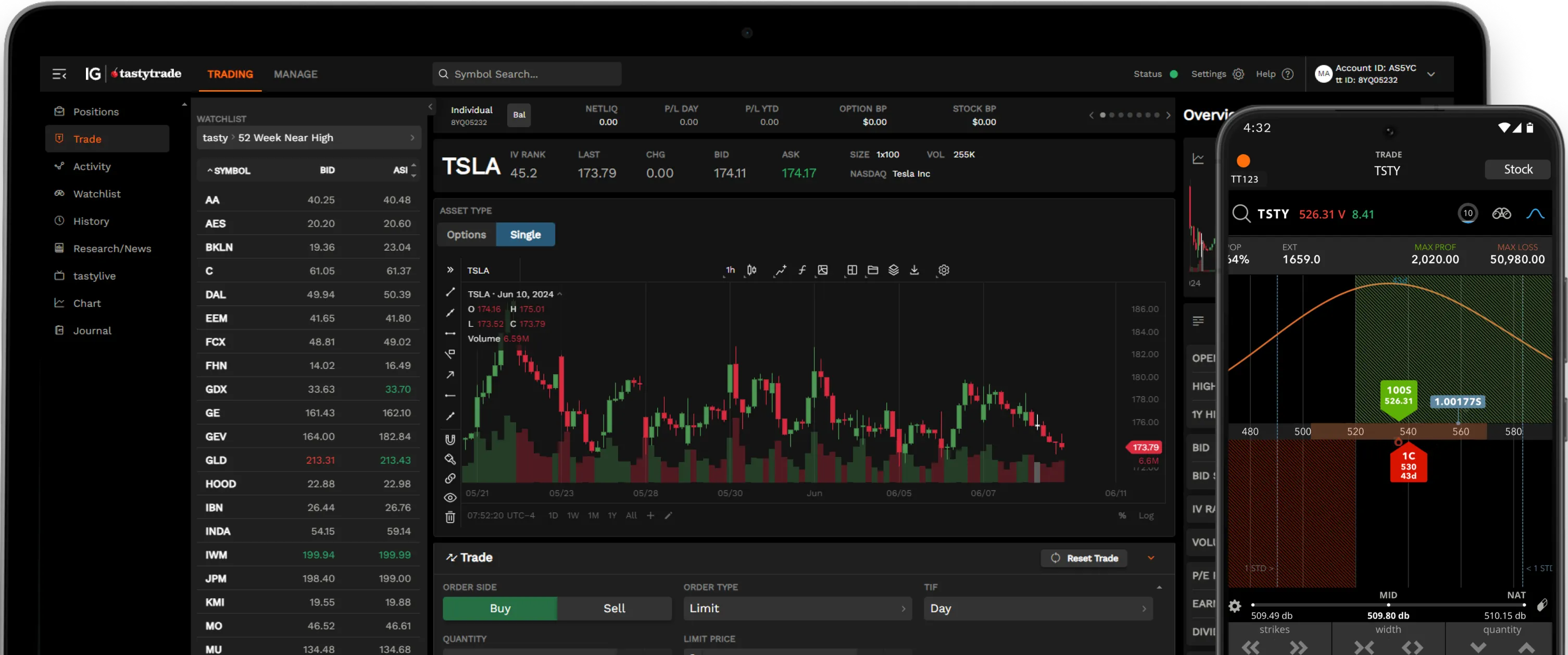

Innovative platform

Open positions on our award-winning 1 platform with advanced capabilities, including sophisticated risk management tools.

Trade your way

Find the right account for you to trade options and futures

A margin account enables you to open a much bigger trade at a smaller initial deposit and gives you amplified potential for profit. It also magnifies potential losses, should they occur. 6

- Buy stock

- Short sell stock

- Buy options

- Sell covered options

- Defined-risk options spreads

- Sell naked puts

- Sell naked calls

- Futures

- Futures options

Cash accounts allow investors to establish positions with the cash in their accounts, meaning you can never lose more than you put in.

- Buy stock

- Buy options

- Sell covered calls

- Sell cash secured puts

The platform built for today’s traders

Access US-listed options and futures at low commissions. 1 Trade on an award-winning platform brought to you by our friends at tastytrade. 2

Proudly award-winning

2024

Best Options Trading Platform ADVFN International Finance Awards

2024

Best Overall Options

Trading Platform Investopedia

2023

Best Platform for the Active Trader ADVFN International Financial Awards

Join IG

It takes just 3 simple steps

A few questions

Let us know a bit more about you

Get verified

We can usually verify your identity immediately

Fund and start trading

We accept all major credit cards, Apple Pay and bank transfers

The numbers speak for themselves

0

years’ expertise

0

countries

0

global clients

0

+worldwide markets

Always transparent

- From $1.00 per contract to open and no commission charge to close options positions 2

- Commissions capped at $10.00 per leg (i.e. one part of a multi-component trade) for equity and ETF options 2

- From $0.85 commission per contract to open and close a futures position, each way

Our commissions

Below are the commissions you’ll pay for placing equity options positions.*

| Product | Commissions |

|---|---|

| 1 call or put: 1 contract (1 leg) | $1.00 |

| 1 vertical: 2 contracts (2 legs) | $2.00 |

| 1 iron condor: 4 contracts (4 legs) | $4.00 |

* No commission payable to close.

Below are the commissions you’ll pay for placing equity options positions.*

| Product | Commissions |

|---|---|

| 10 calls or puts: 10 contracts (1 leg x 10) | $10.00 |

| 10 verticals: 20 contracts (2 legs x 10) | $20.00 |

| 10 iron condors: 40 contracts (4 legs x 10) | $40.00 |

For lot sizes of 25, 50, 100, 200 and 500, the commission is capped at $10.00 per leg. So, commissions for these would be the same as commissions for the 10-lot values above. It’s important to note that other fees will apply regardless of the lot size, eg clearing fees are charged at $0.20 per contract ($0.10 each way, ie opening and closing the trade). 2

* No commission payable to close.

Below are our futures commission rates per contract.

| Product | Opening commission | Closing commission |

|---|---|---|

| Futures | $1.25 | $1.25 |

| Micro futures | $0.85 | $0.85 |

| Options on futures | $2.50 | $0.00 |

| Options on micro futures | $1.50 | $0.00 |

Our foundations

- Established and trusted: FTSE 250 listed

- Join the market leaders: 7 50 years’ trusted experience

- Always be informed: direct access to expert analysis and IG’s latest news

- IG Academy: acquire vital knowledge and crucial skills

- Peer support: join and interact with a community of expert traders

FAQs

tastytrade and tastylive are brainchildren of options traders who wanted to empower ambitious and self-directed traders. The content brand – tastylive – launched in 2011, and the brokerage service – tastytrade – followed in 2017. Both joined IG Group in 2021. Offering options, futures, stocks and more, tastytrade enables your pursuit of financial freedom. Access the award-winning broker’s options and futures products, using fast and reliable software, straight from the My IG dashboard through our streamlined platform. 1 tastylive is a free online financial network with over 100 original shows broadcasting to its team, viewers and listeners – affectionately known as ‘the tastynation’. With 40 hours of live programming each week, there’s something for everyone – inspiration, live trades, education and so much more. This global community has garnered around 27 million YouTube views through its fun and engaging content. 8

We provide our clients access to trade US-listed products through our US options and futures account. To do this, we’ve partnered with the Apex Clearing Corporation in the USA. Apex is a third-party firm that’s regulated by the Securities and Exchange Commission (SEC) – it specialises in providing clearing and other back-office financial services for US-listed options and futures products.

Apex clears and processes US options and futures account transactions, and provides asset custody and settlement services. In essence, Apex deliver the behind-the-scenes services that allow us to offer US-listed options and futures.

Any money or securities you hold in a US options and futures account is held by Apex in the USA in accordance with SEC and FINRA (Financial Industry Regulatory Authority) rules. Apex accounts are covered by the US Securities Investor Protection Company (SIPC), which provides protection for money and assets up to $500,000.

For more details about our relationship with Apex and for relevant market data agreements, see the information on customer agreements.

Your funds and securities held by Apex aren’t subject to Financial Conduct Authority (FCA) client money and asset rules and may not be protected by the UK Financial Services Compensation Scheme (FSCS).

Learn more about what we do with your moneyOptions trading is taking a position as a buyer or a seller in a contractual agreement to exchange an underlying asset at a specific price by a certain expiration date. The holder of an options contract has the right, but not the obligation to buy or sell the underlying asset. Whereas the counterparty is obligated through assignment if the owner exercises their right to buy or sell the underlying.

Options are standardised and you can choose a call or a put to speculate on a financial instrument's price movements. Possible profits and losses don’t depend on direction only, though, as options are non-linear – they’re also affected by factors such as implied volatility (IV), time to expiration and location of the strike price in relation to the underlying price. You can combine calls and puts to employ a variety of strategies across different market environments.

Futures trading is an agreement to buy or sell an underlying asset at a specified price by a certain expiry date. You’ll exchange the underlying using a futures contract.

Because both parties are obligated to make the exchange, the trade will happen automatically upon expiration at the agreed-upon price if the holder doesn’t do it before the expiry date. This is one of the differences between options and futures.

Comparatively, options allow for more flexibility as there’s no obligation for the owner to exchange the underlying. But these contracts are also similar in ways, eg both are standardised and traded on regulated exchanges.

Here are the key risks of trading pure-form options and futures:

Trading on margin

A margin account gives you access to leverage. 9 Trading with leverage comes with complexity and risk. It magnifies both your potential profits and possible losses. You could even incur losses that exceed your initial outlay.

High-risk strategies

Uncovered options trading can expose you to potentially unlimited losses if the market moves against your position. Using certain strategies can help reduce this risk but typically limits your profit potential. It also doesn’t guarantee complete protection against unexpected losses.

Currency risk

Potential profits and losses will be in US dollars on our listed options and futures account as it’s denominated in USD. If you deposit or withdraw funds in a different currency, an adverse move in exchange rate could reduce the real value of your funds.

Expiration risk

US-listed options are physically settled in most cases, and can be exercised by the holder at any time up to expiry, not just on the expiry date like European-style options. This means if you sell (or 'write') options, you may have to buy or sell the full amount of the underlying asset to fulfil the contract’s terms.

This is called ‘assignment’. The frequency at which options get assigned can vary significantly, depending on several factors. These can include the type of option, its state of moneyness (whether it's in the money, at the money, or out the money), time to expiration, volatility of the underlying asset, and dividends.

Learn more about options expiration riskAs a retail client, your money and assets are protected in several ways with us. We’re authorised and regulated by the Financial Conduct Authority (FCA), which has strict regulatory requirements that govern precisely what we can do and how we must do it. Here are some of the measures we take to ensure that we protect your money and assets:

- We separate your money and assets from our own resources

- Your money is held in segregated client accounts at regulated banks

- Your assets are held by a custodian in segregated client asset accounts

- Client bank and asset accounts are named accordingly to be easily identifiable as such

- Your money and assets (eg shares) are never merged with our own money or assets

- We don’t use your money and assets in the course of our business activities

It’s vital to understand the risks and complexity of trading in a margin account as it may not be suitable for you. When you use this account type, you’ll typically trade on a leveraged basis, which gives you magnified exposure. To open a position, you’ll only need to pay a certain percentage of the trade’s total worth, ie notional value. However, pure-form options are non-marginable – even when trading them in a margin account.

Leverage enables you to open a much bigger trade at a smaller initial deposit and gives you amplified potential for profit. But it also magnifies your possible losses, and you could lose money rapidly. Any profits made or losses incurred are calculated based on the full value of the trade.

When trading in a margin account, you’ll have more options and futures strategies available to employ, eg selling naked call options, defined-risk options spreads, and buying and selling futures and futures options.

Trading using a margin account carries increased risks compared to a cash account and can result in your losses exceeding your deposits. You can find detailed information about this in our risk disclosure notice.