Federal Reserve meeting

Everything you need to know about the Federal Reserve’s FOMC announcement – including when it is, and why it’s important.

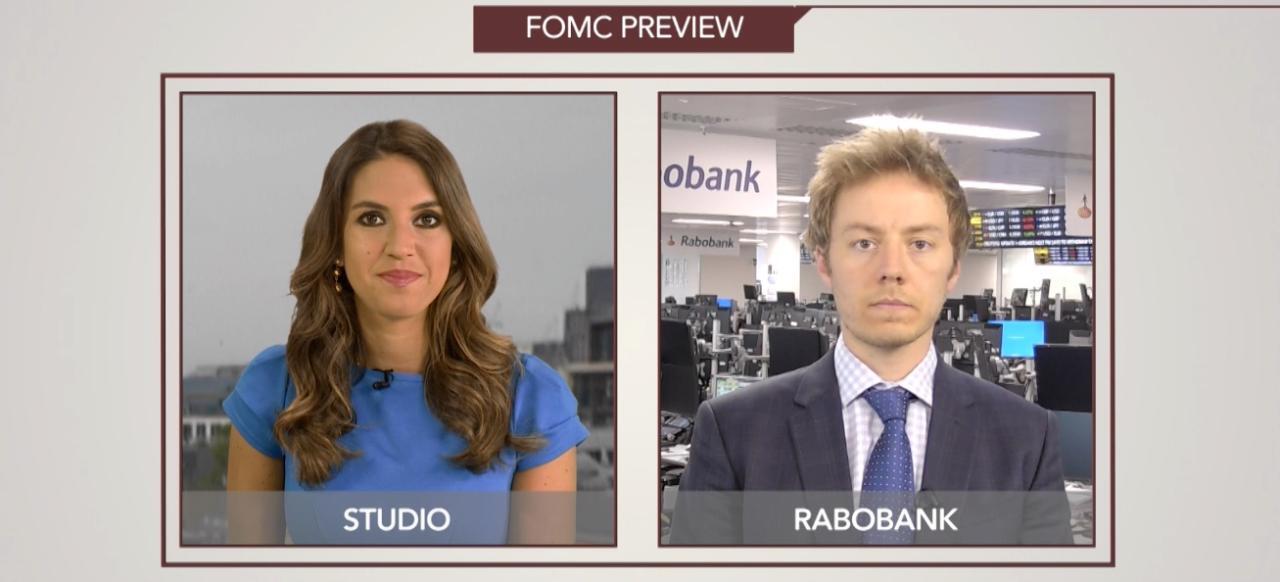

Lyn Graham-Taylor, fixed income strategist at Rabobank, talks to IGTV’s Victoria Scholar about what to watch from Wednesday's rate decision by the Fed and the FOMC’s economic projections.

The Federal Reserve (Fed) is widely expected to raise rates on Wednesday 13 June, which would be the second hike this year after March, and the seventh hike since the central bank began its upward climb in December 2015.

A lift in June will raise the Fed’s target interest rate to between 1.75% and 2%, in line with both its inflation target and the most recent data on the Fed’s preferred measure of inflation, the personal consumption expenditure (PCE) deflator, which came in at 1.8% for April. Lyn Graham-Taylor, fixed income strategist at Rabobankn, says the main interest in the market is around the dot plot and the Fed’s economic projections. He says that if the market moves to expect three more rate hikes from the Fed this year in light of Wednesday’s decision, there could be a reaction from the US markets.

Everything you need to know about the Federal Reserve’s FOMC announcement – including when it is, and why it’s important.

The US dollar has staged an impressive turnaround so far this year after 2017, which was characterised by a sliding greenback. However, in 2018 (since February’s trough) the US Dollar Index has gained more than 7% to reach its peak in May. As for treasuries, the market continues to sell-off, prompting investors to speculate that the 30-year bull market for bonds could be coming to an end. The yield on the 10-year US treasury bond is up more than 46% from the trough in September. Analysts are watching closely to see when the yield will climb back up above the psychological 3% handle, and what that might mean for equity markets.

In theory, the allure of higher bond yields should drive investors into bonds and spur selling in the equity markets. However, for financial stocks, higher yields are seen as a positive, with increasing interest rates meaning improved net interest margins for the banks.

The US yield curve hit the flattest level in a decade this week, with the spread between the 2-year US treasury bond yield and the 10-year US treasury bond yield shrinking to 41 basis points, the narrowest level since August 2007. An inverted yield curve is often considered to be a precursor to a recession, which is why the market is keeping a close eye on the curve’s gradient. However, there is variability between the time lag between an inversion and a recession.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication.