Amazon Q2 earnings preview: Anticipation builds for tech giant's upcoming results amid competitive cloud market

Amazon is set to release its Q2 earnings report amidst keen market anticipation. With a strong emphasis on their cloud services performance, analysts predict a volatile reaction as Amazon faces off against Alphabet and Microsoft.

Amazon's second quarter results: Key dates and expectations

Mark your diary for Thursday, August 3. That’s when the tech giant is expected to release its figures for the second quarter of this year.

Forecasts for amazon's share price following q2 results

There were volatile moves in its share price last time around. Although it managed to beat estimates for revenue in the first quarter with its clouding unit besting forecasts, lower future growth rates took their toll. Amazon is expected to continue dominating in this field. It won’t just be about whether it can beat estimates (of $21.7bn) that are higher than what it has posted in the past, but what their outlook will be for the crucial segment of its business.

Both Alphabet and Microsoft are key competitors in this field, and both will be releasing their figures beforehand on 25th July. As a result, investors are expected to note the extent to which Amazon can keep the competition at arm’s length.

Rise in advertising and expectations for gross margin

Advertising was also a beat in the first quarter. That aspect of the business delivered “robust growth” according to its CEO in its earnings statement for that period. It’s expected to rise from $9.5bn then to $10.33bn, a figure far larger than the same period last year.

Managing costs has been a significant theme. The redundancies in the past quarter weren’t as pronounced as those that preceded it. The gross margin is expected to remain within the 46% handle (source: Refinitiv).

Projected increase in revenue and earnings per share

In all, expectations are for an increase in revenue to over $131bn from $127.4bn in the first quarter and $121.2bn for the same period last year. This falls within the upper half of Amazon’s own $127-$133bn range. The Earnings per share (EPS) is expected to rise to $0.35, improving from Q1 $0.31 and Q2 2022 $0.18 (source: Refinitiv).

Analyst recommendations and target average

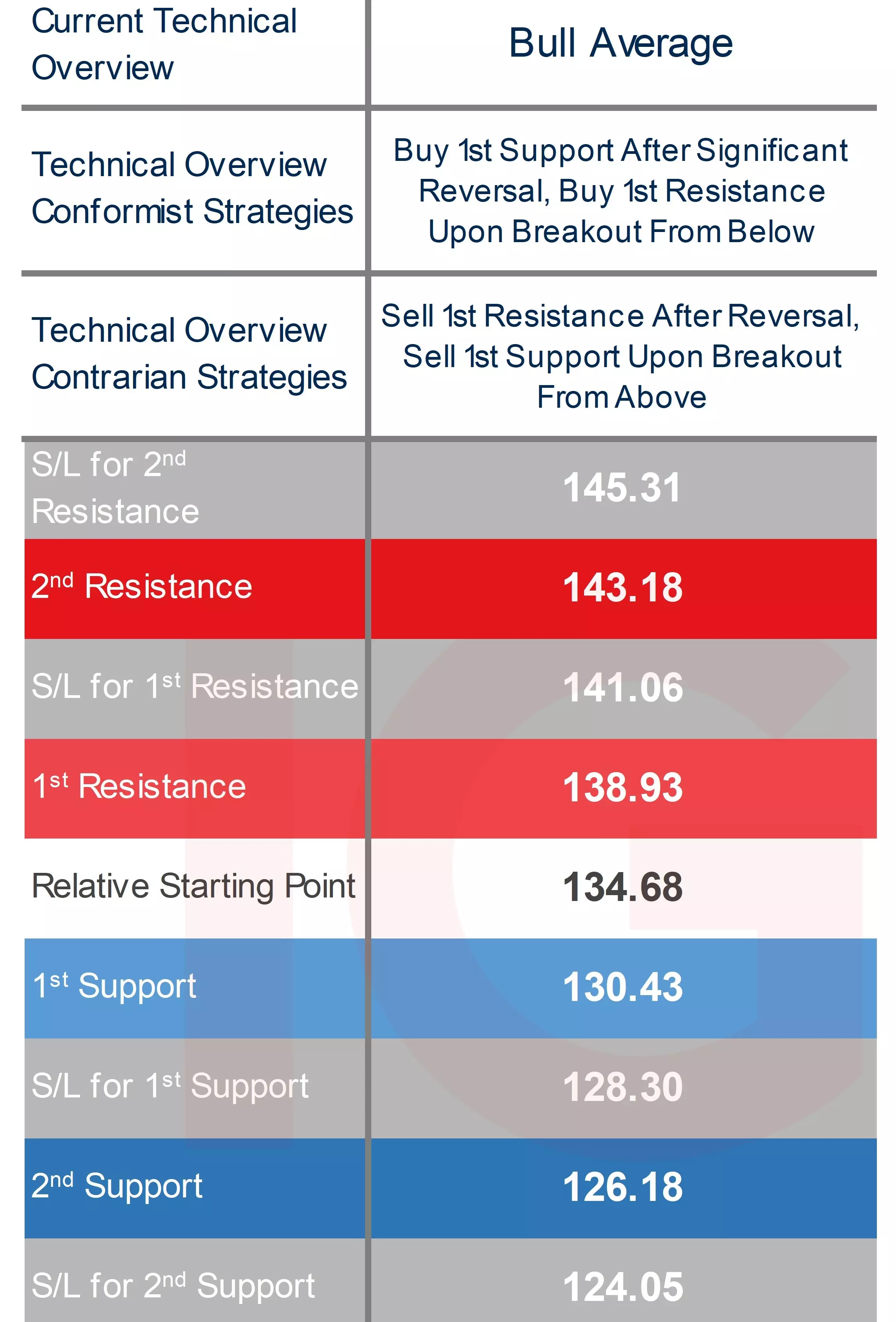

When it comes to analyst recommendations out of Refinitiv, the tally is heavily in favour of the buys. With 17 ‘strong buy’ (from 16 when we did the Q1 earnings preview), 35 ‘buy’ (rising from 31), two in favour of holding (from four prior), and (like before) only one in ‘sell’ territory. The average target amongst them? It's raised from $136 to over $143, and it is nearly identical to the weekly 2nd Resistance level (see table below).

Trading Amazon’s Q2 results: Weekly technical overview and trading strategies

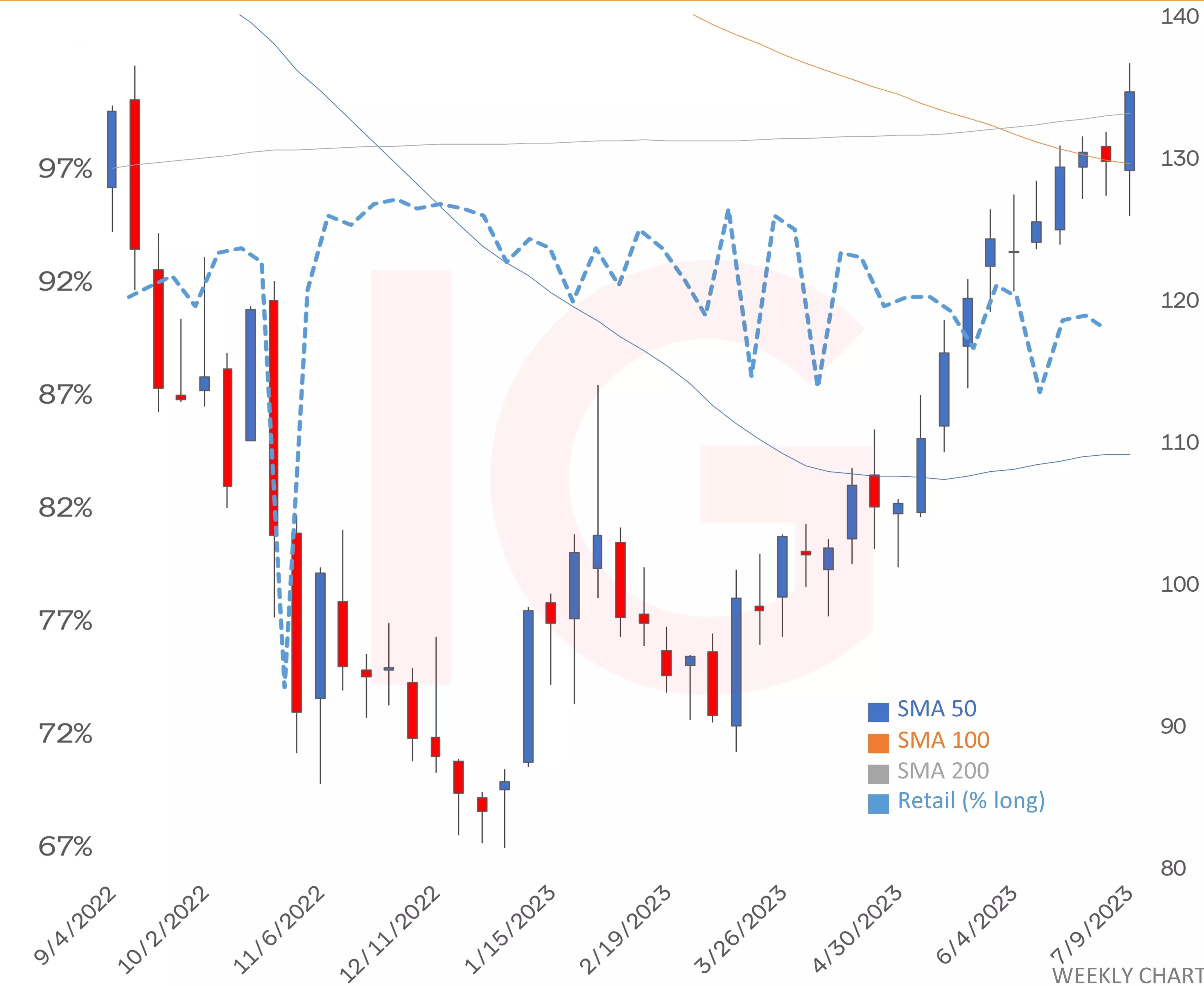

The picture is promising for Amazon’s share price from a technical standpoint. If we look at the weekly timeframe, the moves over the past quarter have not only breached its wide and long-term bear trend channel, which held from late November 2021 until April of this year, but they have also managed to keep price action relatively contained within an emerging bull trend channel.

In the earnings preview for the first quarter, we noted that the negative technical bias was weakening considerably. It needed only a slight push to shift and it most certainly has shifted.

The price is now back above all its main weekly moving averages, which include the 5, 10, 20, 50, 100, and 200. It is not far off the upper end of the Bollinger Band, having followed it closely for May and much of June. The ADX (Average Directional Movement Index) reading is well into trending territory. On the DMI (Directional Movement Index) front, there's a strong gap between DI+ and DI-, favouring the former.

These signs usually point to a bull trend technical overview, even if there's some stalling in the sense of failing to offer much intra-week follow-through past key weekly levels.

However, given the journey of the price and the RSI (Relative Strength Index) being in overbought territory, it’s a close call between that and 'bull average'. This situation necessitates further caution for conformist buys off the weekly 1st Support level. Ideally, this should be done only after a significant reversal, and conformist buy-breakouts off the 1st Resistance should take into account the context of current ranges and the band.

For those anticipating a reversal or at least a move back down to the lower end of the channel (or the band), contrarian sell strategies can be considered. These could be via a reversal off the 1st Resistance or a breakout off the 1st Support.

Bear in mind that the relatively range-bound movement has considerably narrowed weekly technical levels. This means an uptick in volatility can seriously test 1st levels and push price action towards, if not beyond, 2nd levels. A fundamental event like earnings, where technicals are of less relevance, can certainly cause significant price action.

Amazon weekly chart with key technical indicators

Amazon weekly chart with IG client sentiment

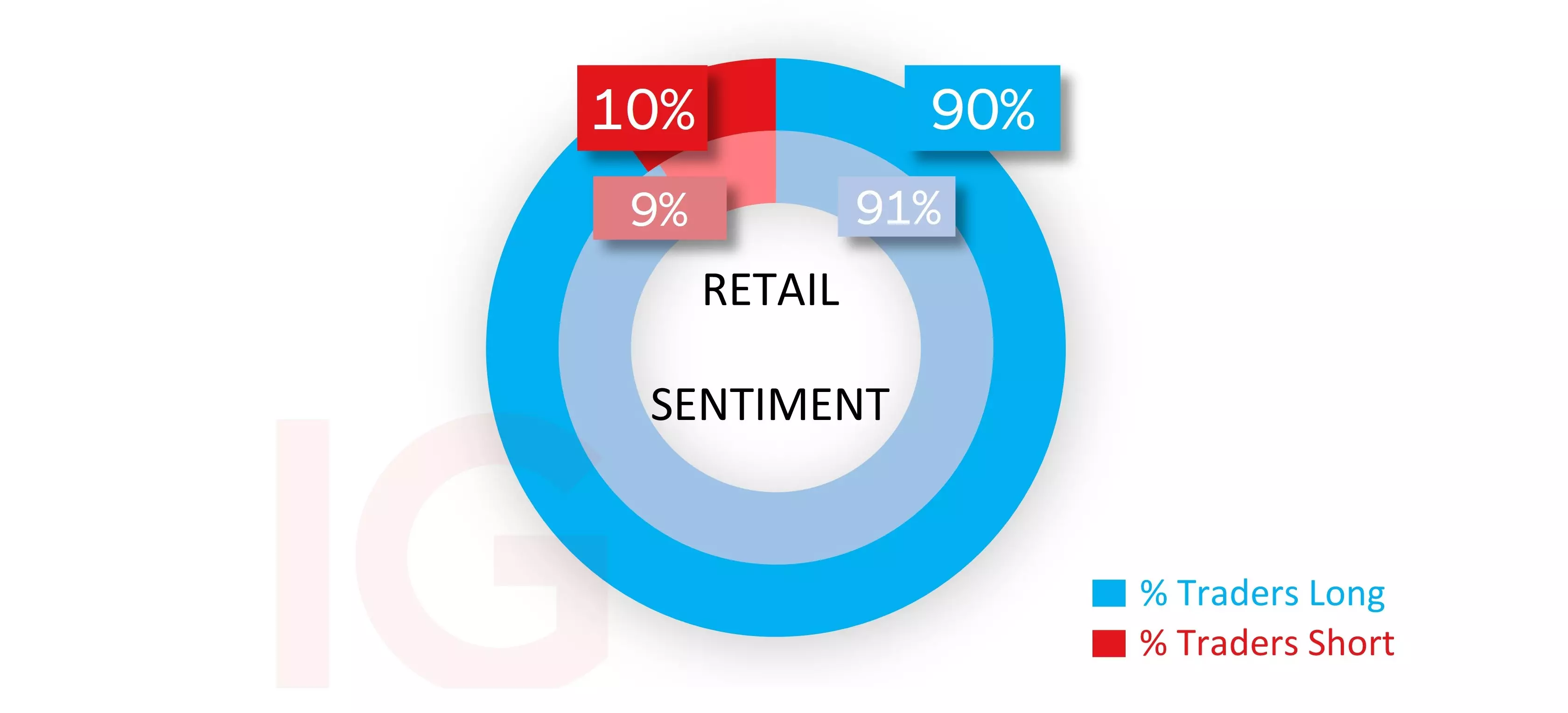

IG client sentiment* and short interest for Amazon shares

In terms of short interest, it's around 76.7m shares, not far off the average observed over the past four years or so. This represents less than 1% of the total, a territory it's become comfortable with (source: Refinitiv).

As for sentiment amongst retail traders, looking at the chart above where it has been plotted as a blue-dotted line using the left axis as % long, it's clearly been a story of extreme buy bias for months on end. The positive moves since the start of the year have made them beneficiaries of the latest moves. There has only been a slight pullback to 90% from what was a peak of 96%, suggesting even fresher longs are anticipating further gains.

*The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of July 20th for the outer circle. Inner circle is from Monday, July 10th, 2023.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.