ASX 200 afternoon report: July 6, 2023

Find out below who have been the shakers and movers in today’s session on the ASX 200.

The ASX 200 trades 89 points (-1.23%) lower at 7164 at 3.00 pm AEST.

In a holiday-shortened week in the US, the release of hawkish FOMC meeting minutes this morning has seen the bond market and higher yields elbow their way back into the driver’s seat after a lengthy absence.

The yield on the benchmark 10-year bond rose above 3.90% for the first time in four months. A move replicated locally as the yield on the Australian 10-year bond surged 10bp to 4.11%, its highest level since October.

The interest rate-sensitive ASX 200 Financial sector, which is also the largest in the ASX 200, fell 1.3% today. The decline was led by NAB, which fell 2.04% to $25.98, ANZ fell 1.9% to $23.54, Macquarie fell 1.7% to $174.67, Westpac fell 1.63% to $21.17, and CBA fell 1.4% to $100.35.

The fallout from yesterday’s soft Chinese PMI data and a disappointing trading update from BHP have weighed on the Materials sector. Mineral Resources fell 4% to $69.67, BHP fell 2.87% to $43.17, Fortescue fell 2.4% to $21.60, and Rio Tinto fell 2.12% to $111.74.

For a similar reason, energy stocks have fallen, led by Whitehaven Coal which fell 2.2% to $6.70. Yancoal fell 1.47% to $4.69. New Hope Coal fell 0.93% to $4.81, while Woodside fell 1.37% to $34.50.

The Consumer Discretionary sector fell 1.8% today, giving back a good chunk of its 5% gain that followed last week’s soft Australian monthly CPI print. Star Entertainment dived 7.86% to $1.05, Myer fell 5.38% to $0.61c, Domino’s fell 3.16% to $45.73, Adair’s fell 3.05% to $1.60, and the Super retail group fell 2.25% to $11.80.

The only ray of sunshine on a gloomy day, the ASX 200 technology sector edged marginally higher after Afterpay owner Block added 4.45% to $102.41. EML payments added 2.96% to $0.69c, and Wisetech Global added 0.66% to $77.18.

The share price of fund manager Magellan dived 8.1% to $8.95 after it reported $2.1 billion in outflows in June. It was better news for shareholders of Bubs Australia, which unveiled a 5-point plan to turn the company around and to stop the rot in shareholder value. Bubs' share price was trading flat at $0.22c after falling 8.5% in early trading.

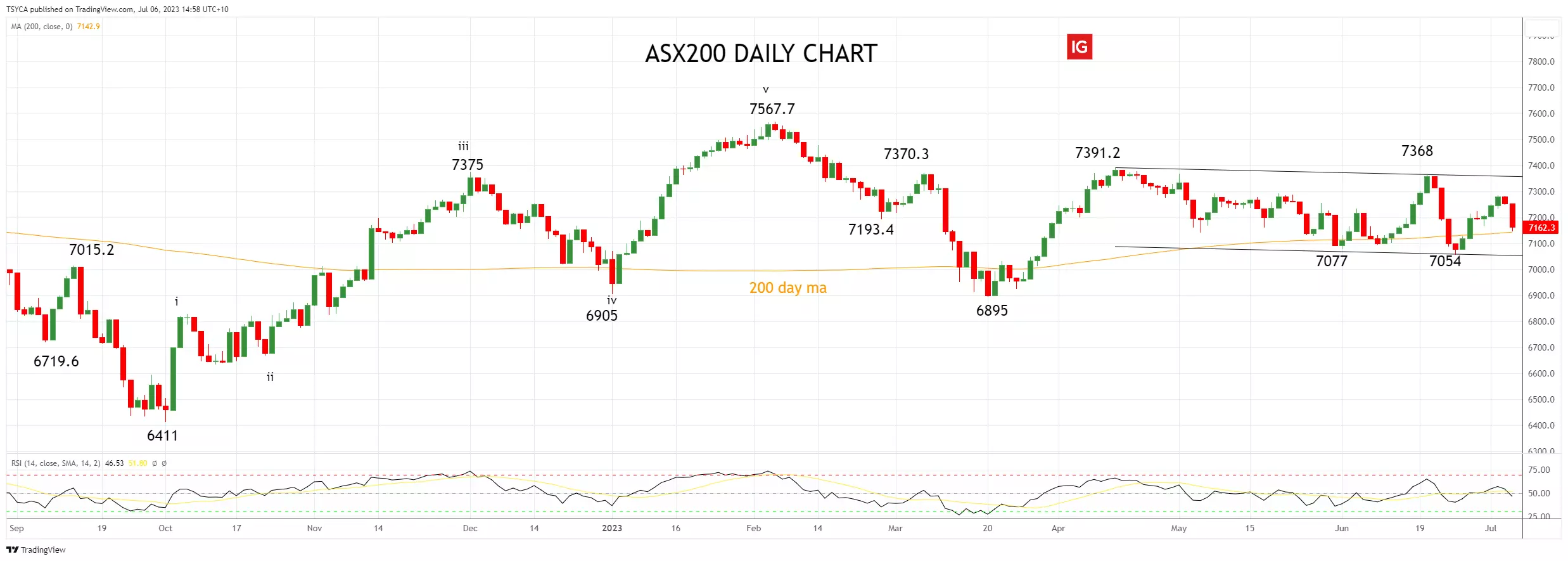

ASX 200 technical analysis

The ASX 200 has spent the past three months trading sideways between resistance at 7370/7390 and support at 7075/7055. Until there is a sustained break of either of these levels, further sideways-range trading is expected.

ASX 200 daily chart

- TradingView: the figures stated are as of July 6, 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.