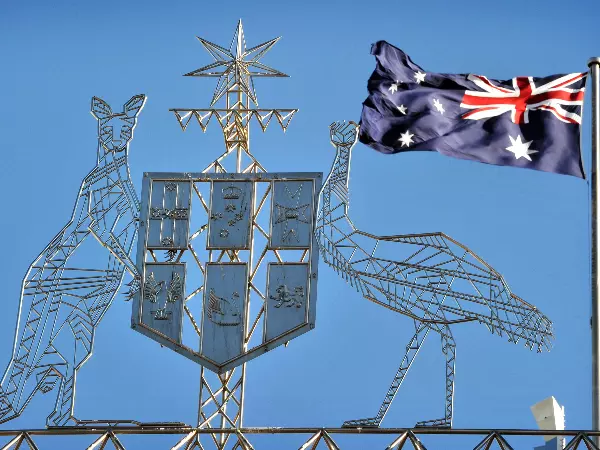

AUD/USD eyes Australian wage data after US Dollar strengthens on retail sales

Australian Dollar falls overnight after US economic data charges USD and natural gas surges in Europe and US on Nord Stream 2’s fresh regulatory woes.

Wednesday's Asia-Pacific forecast

The Australian Dollar is slightly lower against the US Dollar moving into the Asia-Pacific trading session. AUD/USD was up overnight, but upbeat US economic data sent the Greenback higher along with Treasury yields. The five-year note’s rate hit a fresh yearly high at 1.282%. Retail sales in the United States crossed the wires at 1.7% m/m versus an expected 1.5%. That cooled concerns that higher prices were tempering consumption. Technology stocks gained on Wall Street, with the US Tech 100 index closing 0.75% higher.

Meanwhile, natural gas prices surged during European trading hours after Germany suspended regulatory efforts to clear a gas pipeline from Russia. The highly-controversial Nord Stream 2 pipeline is already completed but hasn’t been put into service. Germany says the pipeline builder hasn't dedicated sufficient assets and resources to its German-based subsidiary. A company spokesperson said they would comply, according to a WSJ report. However, it’s not clear at this time how long it will take to restart the certification process.

Oil - US Crude prices fell overnight, with the WTI benchmark slicing below the critically important 80 handle. The drop comes amid reports of rising US production – particularly in the Permian Basin. The stronger US Dollar may have also worked to drag down prices. Gold and silver also fell in the commodities space. Energy traders are still awaiting word on a possible withdrawal from the US Strategic Petroleum Reserve (SPR).

This morning saw Japan’s October trade balance cross the wires along with machine orders for September. Japan’s trade balance rose to -¥67.4 billion from -¥624.1 billion, beating the consensus -¥320 billion forecast, according to Bloomberg data. September’s core machine orders missed expectations at 12.5% on a year-over-year basis.

Elsewhere, Australia will report its Q3 wage price index along with a leading index figure from Westpac. The wage price index is expected to rise 2.2% y/y. A better-than-expected print may see some AUD upside owing to an impact on RBA rate hike bets. Yesterday’s RBA minutes didn’t offer any surprises, but the central bank is forecasting higher inflation.

AUD/USD technical forecast

AUD/USD fell overnight, taking back the bulk of gains made from the prior two sessions. The bullish outlook from last week’s Bullish Engulfing candlestick is quickly evaporating. A break below the November low at 0.7276 would likely open the door for more downside, but bulls may defend the level if prices continue to fall.

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. This information Advice given in this article is general in nature and is not intended to influence any person’s decisions about investing or financial products.

The material on this page does not contain a record of IG’s trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.