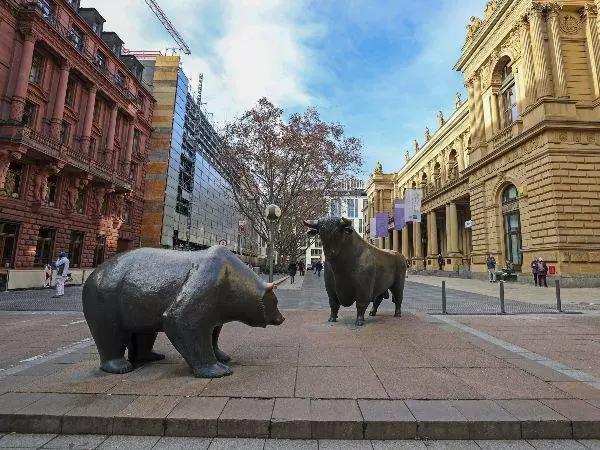

DAX hits record highs ahead of ECB meeting, awaiting key rate decision

With the DAX reaching new heights, attention shifts to the ECB's crucial meeting on interest rates amidst global economic recovery and ongoing inflation concerns. Investors await Friday's decision with keen interest.

After locking in a fourth month of gains, the DAX starts a new week riding high into this week's European Central Bank (ECB)’s monetary policy meeting.

The ECB remains one of the front runners amongst other central banks, expected to start a rate-cutting cycle following an encouraging fall in inflation. However, like the Fed, the ECB has gone to great lengths to remind us that the battle against inflation is not yet over.

Brushing off the ECB's warning, the DAX has glided onwards and upwards, benefitted from a resurgence in global manufacturing, a positive shift in sentiment towards China, and the resolution of the energy shock triggered by the Russian invasion of Ukraine.

What is expected from the ECB interest rate decision (Friday, 8 March at 12.15am)

At its last meeting in January, the ECB kept its deposit rate on hold at 4.00% for the third time since its last rate hike in September.

The statement reiterated its message from December that "future decisions will ensure its policy rates will be set at sufficiently restrictive levels for as long as necessary." Within the statement, there was some encouragement for the doves, as President Lagarde acknowledged that the rise in inflation in December was less than expected and noted that the Governing Council is data-dependent, rather than date-dependent.

The minutes from the January ECB meeting, released in mid-February, underscored a widespread consensus that it was premature to broach the subject of rate cuts, emphasising the fragile nature of the disinflationary process. This sentiment was reinforced by hawkish remarks in late February from ECB Governing Council members Stournaras and President Lagarde, who echoed, "We are not there yet" regarding inflation.

As such, while the ECB is expected to lower its inflation and growth forecasts marginally, it is expected to keep rates on hold this month. Ahead of the meeting, 90bp of ECB rate cuts are projected for 2024, with a first-rate expected in June.

ECB deposit rate chart

DAX technical analysis

Last week saw the DAX surge a cool 4.44% to a fresh record high at 17,847.

While the DAX is well and truly overnight in the short term, it would need to see a sustained break below uptrend support at 17,250 from the October 14,666 low and below a cluster of horizontal support at 17,100, to indicate that a deeper pullback towards the 200-day moving average at 16,174 is underway.

Until then, dips are likely to be well-supported initially towards 17,500 and then at 17,300/250 by buyers leaning against uptrend support looking for a push towards 18,000.

DAX daily chart

FTSE technical analysis

At the risk of sounding like a broken record, the FTSE starts the new week below resistance at 7750/65ish, which has capped for the past nine months. If the FTSE can see a sustained break above 7750/65ish, it would warrant a positive bias and open up a test of the April 7936 high, with scope to the 8047 high.

However, while the FTSE trades below resistance at 7750/60ish, there remains a high likelihood of further rotation towards the support at 7550/00, coming from the 200-day moving average and the mid-February 7492 low.

FTSE daily chart

- Source: Tradingview. The figures stated are as of 5 March 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.