DAX plummets in worst week since October as ECB meeting looms: what to expect

The DAX index's sharp decline highlights market caution before the ECB decision. With mixed Euro area data and expected steady rates, investors watch for rate cut hints amid shifting inflation and DAX technicals.

The DAX, a top performer in 2024, experienced its steepest weekly drop since last October last week, hinting at market apprehension and profit-taking before the upcoming ECB meeting.

What is expected from the ECB interest rate meeting (Thursday, 11 April at 10.15pm)

Economic data in the Euro area has been mixed in the lead-up to this week's ECB meeting. While some of the forward-looking indicators have improved, actual spot measures of growth have remained tepid.

On the inflation front - core inflation in March fell for an eighth month to 2.9% YoY from 3.1% in February, the lowest level since February 2022. However, below the surface, some measures of underlying inflation have begun to creep higher, including the persistence-weighted PCCI index.

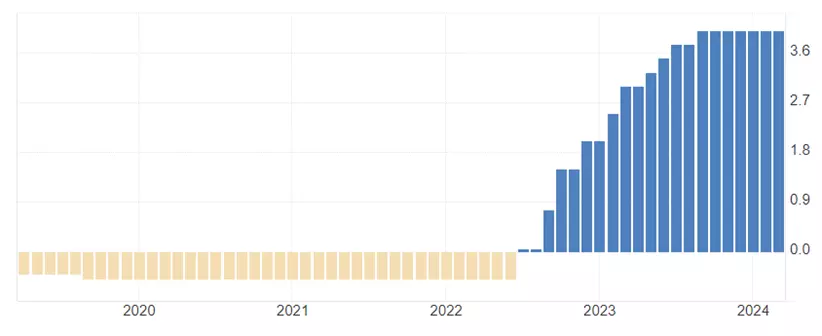

The ECB’s deposit rate is expected to stay on hold at 4% for a fourth straight month. While the ECB is unlikely to pre-commit to a rate cut in June, the ECB’s President Lagarde will likely reiterate that the bank will have “a lot of data” in June to decide whether to cut rates at its June 6 board meeting.

The rates market is 100% priced for a 25 basis points (bp) rate cut in June and has priced in an additional two 25bp ECB rate cuts before year-end.

ECB deposit rate chart

DAX technical analysis

Last week, the DAX snapped a seven-week winning streak, finishing down 1.96% for its worst week since last October.

The weakness has left a short-term bearish legacy that warns that a much-needed pullback towards support at 18,000/17,900 is underway.

Providing support at 18,000/17,900 holds, the uptrend in the DAX remains intact and with-it expectations of a retest and break of the 18,839 high.

DAX daily chart

FTSE technical analysis

Last week, the FTSE snapped a three-week winning streak after running into selling ahead of its all-time high of 8047.

While it is possible that last week, 8015 becomes a double top of sorts, this is not our base case, and we continue to look for the FTSE to test and break its all-time high of 8047 before a push towards 8250.

However, if the FTSE does fail to break above resistance at 8047 and then loses support at 7760/20, it would confirm the FTSE has put in place a double top and likely see a retest of the 200-day moving average at 7568.

FTSE daily chart

- Source TradingView. The figures stated are as of 9 April 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.