Investor Spotlight: Uranium, is it too hot to handle?

The changing dynamics in the wake of geopolitical events have reignited interest in nuclear energy generation. Uranium's sudden resurgence in the market is marked by rising prices and growing demand.

Article written by Danielle Ecuyer

The changing dynamics in the wake of geopolitical events

With concerns arising about the security of gas and oil supplies following the Russian invasion of Ukraine and the challenges associated with transitioning to zero emissions, the focus on energy production and energy security has shifted. There are also concerns about the capacity for renewable energy production and storage, which has supported the argument for nuclear power generation. This stands in contrast to the previous resistance to nuclear power, especially after the Fukushima disaster.

Not since the early days of the nuclear arms race, which began in 1945 with the Manhattan Project, has there been such a strong interest in nuclear energy generation.

Uranium's sudden resurgence

The uranium market differs significantly from traditional energy sources like oil and gas in terms of transparency. It's a market driven by long-term investments, or the lack thereof, in nuclear reactors, decommissioning of existing nuclear energy plants, and arms agreements related to nuclear weapons decommissioning.

Unlike coal, gas, and oil, the energy source isn't completely depleted after a single use; it can be re-utilised.

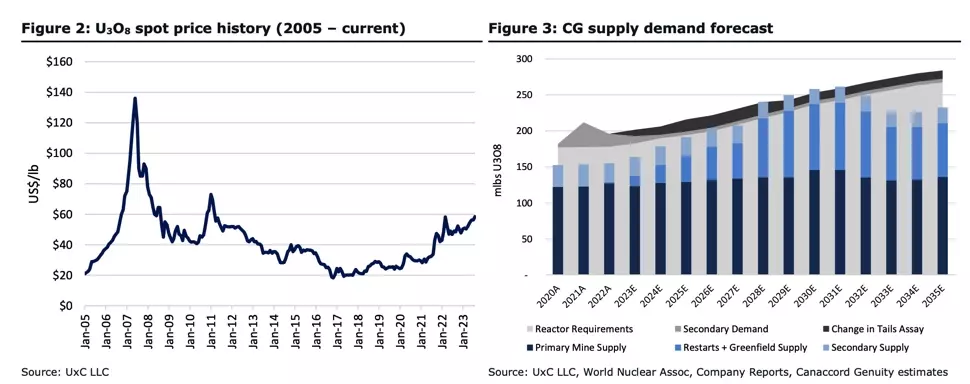

By the end of September, the price of uranium had reached a 12-year high, rising from US$18/lb in 2018 to US$70/lb. Canaccord Genuity is one of many experts who believe the market has reached a structural supply deficit.

The base case, as proposed by the broker, suggests that total nuclear capacity could grow at a rate of 3.6% by 2030 and 3.25% by 2035. This equates to a 30% annual increase in uranium demand through 2030 and 24% through 2035.

What is driving growth in the uranium market?

The forecasted demand is driven by new reactors in China and India, as well as extending the lifespan of existing reactors in the US, Canada, and Europe.

Canaccord has increased the long-term uranium price to US$75/lb from US$65/lb.

According to Macquarie, there are 266 new reactors proposed globally, with 59 currently under construction. The broker has raised the target price to US$70/lb, a 16% increase.

In the report titled "The Uranium Bull: Defying Trends and Redefining Energy Markets" by Natural Resources Investing, the authors propose that additional demand has been generated by closed-end funds like the Sprott Physical Uranium Trust and similar investment trusts, which have been purchasing 25-30 million lbs per annum in 2021 and 2022.

These authors suggest that the uranium market will face a deficit of 180 million lbs between 2020 and 2030 and that greenfield sites are not financially viable at US$60/lb.

Uranium price history and suppy and demand forecast

Reviving decommissioned uranium mines

Due to the cost of developing greenfield uranium mining sites, many decommissioned mines are coming back on stream to increase supply. Of note, these forecasts do not include small modular reactors, which are being put forward as a future energy solution but for now are at least a decade away.

Three stocks to watch

-

Paladin Energy back to production in 2024

Paladin Energy (PDN) is a $3 billion uranium production and exploration company, with its main project being the restart of its Langer Heinrich mine in Namibia.

Brokers forecast production to recommence at Langer Heinrich in the 1Q24, within budget. Additionally, the company has secured off-take agreements with "leading global counterparties," notes Macquarie.

The broker recently upgraded the FY27 onwards EPS forecasts by 7%-17% due to the higher expected uranium price, and the target price was lifted by 18% to $1.30.

Looking at some other brokers, Bell Potter recently downgraded the stock to Speculative Hold from Speculative Buy and has a $1.31 target price. FNArena has an average price target of $1.253 with meaningful EPS generation expected in FY25.

Paladin Energy weekly chart

-

Boss Energy: Who's the Boss?

Boss Energy (BOE) is a $1.64 billion uranium explorer, and Honeymoon Uranium is the company's primary project located 80 km northwest of Broken Hill.

The Honeymoon project is focusing on greenfield exploration prospects, along with upgrading the "satellite Joint Ore Reserves Committee resources of the Jason's and Gould's Dam Deposits," as noted by Refinitiv.

Macquarie expects the company to resume production at Honeymoon in the 4Q23, potentially increasing production to 2.45 million pounds per annum, thanks to recent strong production results.

Boss Energy weekly chart

While the broker recently upgraded forecasts to account for higher uranium prices, resulting in an expected EPS increase of 7% to 20% from FY27 onwards, and raising the target price to $4.50, the rating was downgraded to "Neutral" on valuation grounds.

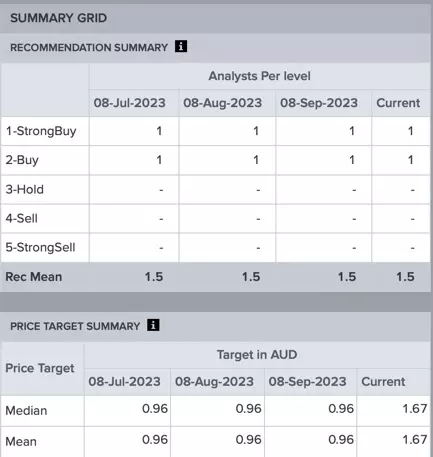

FNArena has an average target price of $4.477, with Bell Potter standing out with a target price of $5.53, along with a "Speculative Hold" recommendation.

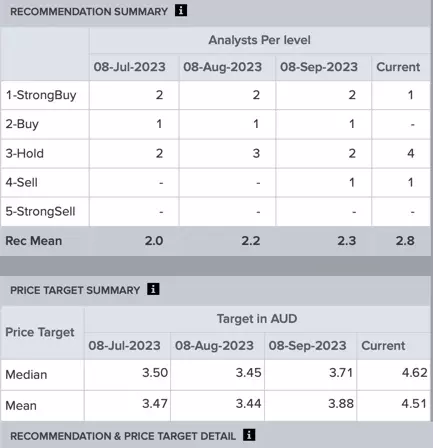

FNArena forecast chart

Refinitiv has a mean target price of $4.51, with only 1 "Strong Buy," 4 "Holds," and 1 "Sell."

Refinitiv forecast chart

Deep Yellow: A little ray of sunshine

Deep Yellow (DYL) is a $982 million uranium explorer with two projects, one in Namibia and one in Australia.

Deep Yellow weekly chart

Bell Potter has a Speculative Buy and a $1.84 target price. The broker notes an expected upgrade to the resource at Tumas (Australia).

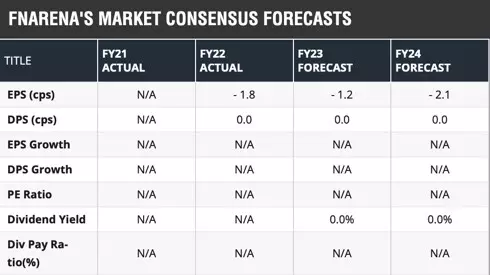

FNArena forecast chart

Refinitiv has a mean target price of $1.67 and 1 Strong Buy and 1 Buy.

Refinitiv forecast chart

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Discover how to trade the markets

Learn how indices work – and discover the wide range of markets you can trade CFDs on – with IG Academy's free ’introducing the financial markets’ course.

Put learning into action

Try out what you’ve learned in this index strategy article risk-free in your demo account.

Ready to trade indices?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Get fixed spreads from 1 point on the FTSE 100, 1.2 on the Germany 40, and 0.4 on the US 500

- Protect your capital with risk management tools

- Trade more 24-hour markets than any other provider

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.