Macro Intelligence: spotlight on Australian copper stocks

Amidst market disruptions, evolving technology needs, and environmental shifts, copper prices soar to new heights. Discover how trends from Shanghai to Chicago and innovations in AI and EVs are fuelling copper's demand.

Article written by Nadine Blayney (ausbiz)

Copper tops charts in Shanghai

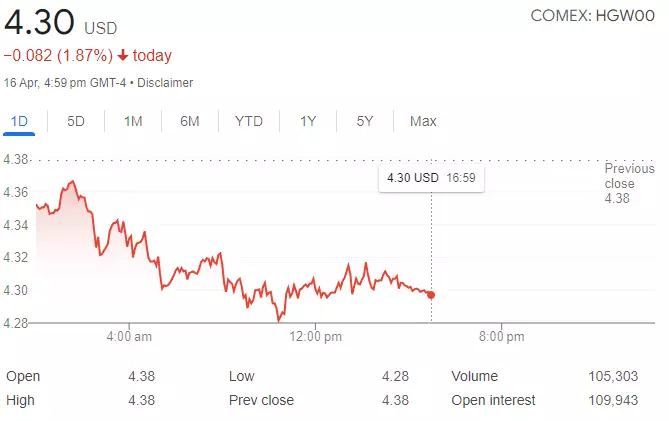

Copper prices have rallied 10% since the start of this year on the London Metal Exchange. Copper prices recently hit a record high on the Shanghai Futures Exchange and neared a two-year high of $4.34 per pound last Friday on the Chicago Mercantile Exchange. Prices are being driven by a powerful combination of rising demand, restricted supply, and a ban on Russian metal, including copper, being delivered onto the LME and the CME.

Despite the headwinds posed by the prospect of higher-for-longer US interest rates for base metals generally, ANZ commodities analyst Daniel Hynes confirms the broader backdrop remains positive for copper with supply disruptions and a pick-up in global manufacturing to keep the market tight.

COMEX: HGW00 - Hexaware Technologies stock price chart

Copper's pivotal role in technology

Demand for Copper is widely seen as a barometer for global economic health, considering it is one of the best electrical-conducting metals and is used worldwide in motors, batteries, and wiring.

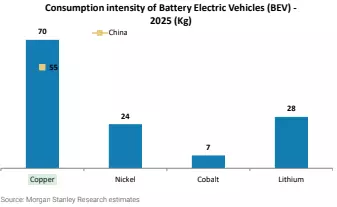

Adding to growth-driven demand is the decarbonisation of the economy. A significant amount of copper is used in electric vehicles and renewable energy technologies, which is expected to fuel a surge in copper consumption over the coming years as the world transitions away from fossil fuels as an energy source.

Comparing BEV consumption intensity across major countries

Trafigura predicts a surge by 2030 for AI servers

Now commodity trader Trafigura says data centres to power artificial intelligence servers will likely require an additional 1 million metric tons of copper by 2030. Copper is used widely in data centres; Microsoft's $500 million Chicago data centre used 2,177 tons of copper in its construction.

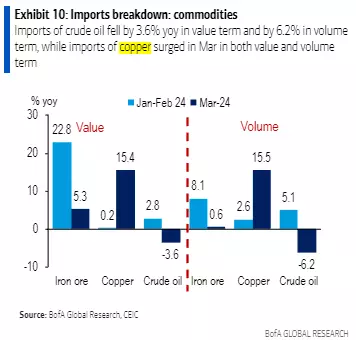

Copper demand continues to grow in China, with the most recent data showing copper imports grew sharply in volume terms, up double-digits in March.

EU's import breakdown: copper and iron ore

The copper boom: India's surging demand

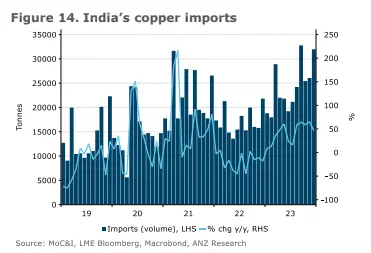

ANZ analysts also point to increasing demand for copper from India. India was a net exporter of copper until 2017, but it now imports nearly half of its refined copper demand. ANZ expects a compound annual growth rate (CAGR) of 8.6% in copper consumption between 2022 and 2030. It says domestic production will be insufficient to meet rising copper demand over that period.

India's copper import chart

From China to Africa affecting copper prices

China's smelters have proposed output cuts, which are adding to supply-side shortages driven by global mine-side disruptions. Contributing to the bullish price forecasts are additional recent production struggles by Anglo American, First Quantum, Ivanhoe Mines, Codelco, and others. Electricity supply challenges in Zambia, Africa's second-largest copper producer, are also potential drivers of price.

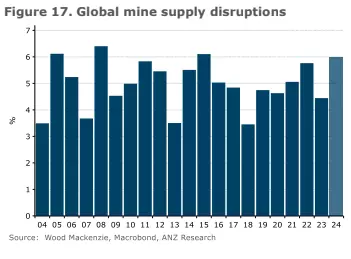

Major global copper supply disruption events from 2004 to 2024

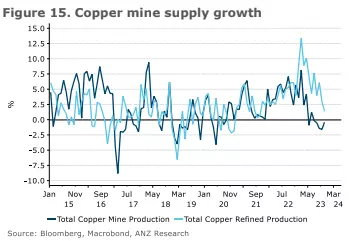

Copper mine supply growth from January 2015 to March 2024

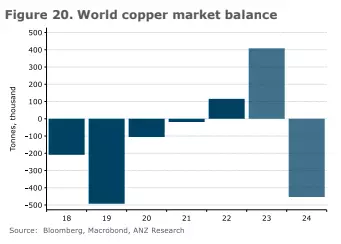

Citi cut its forecast for the global copper supply this year to an increase of just 0.7% from its previous forecast for a 2.3% rise. Bank of America, meanwhile, forecasts a market deficit of 324,000 tonnes this year, growing to 743,000 tonnes by 2026.

World copper market balance from 2018 to 2024

US and UK ban Russian imports

The US and the UK have also banned the import of Russian-origin copper and will limit the use of Russian-origin copper on the global metal exchanges and in over-the-counter derivatives trading. In terms of price, Citigroup is expecting the price of the red metal to touch $12,000 by the end of 2025, in keeping with the Bank of America’s forecast for the copper price to reach about $12,000 per tonne by 2026.

Which Australian copper producers are expected to rise to the supply/demand challenge?

Based on Citi’s view that a secular bull market in copper is imminent, it is most positive on BHP Group Ltd (BHP), which it says boasts the most copper leverage within the Australian diversified sector at 34% of attributable EBITDA in FY28.

Citi analysts expect Rio Tinto (RIO) to double its copper leverage from 10% in FY24 to 20% in FY28. While South32’s (S32) copper leverage drops from 19% in FY24 to 14% in FY28, Citi maintains that South32 remains the most exposed to base metals in FY28. It has a ‘buy’ rating on those three stocks.

BHP Group daily chart

Rio Tinto daily chart

South32 daily chart

Evolution (EVN) and Sandfire Resources (SFR)

Shaw and Partners Chief Investment Officer Martin Crabb prefers gaining exposure to copper via Australian copper/gold producers including Evolution (EVN) and Sandfire Resources (SFR) in the mid-cap space.

Evolution Mining daily chart

Sandfire Resources daily chart

AIC Mines (A1M)

Among the small caps, Shaw and Partners has a 'buy' rating on AIC Mines (A1M) with a $0.90 price target, saying it offers investors one of the few ways to invest in quality, leveraged exposure to copper production on the ASX after it delivered a significant upgrade in ore reserve, which it says proves there is plenty of upside to come.

AIC Mines daily chart

FireFly Metals (FFM)

Shaw and Partners also has a 'buy' rating on FireFly Metals (FFM) with a price target of $1.10. It recently raised $52 million to accelerate drilling at its Green Bay project, which has led analysts to expect a sizable resource upgrade in the September quarter, saying it is well-funded for growth.

FireFly Metals daily chart

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.