Market update: last week’s pause pushed crude oil retail traders to add upside bets

Crude oil prices paused rallying last week, while retail traders slightly increased upside bets and pondered the short-term outlook for WTI.

Crude oil sentiment outlook: bearish

Crude oil prices took a breather last week, leaving West Texas Intermediate (WTI) little changed by Friday. This meant a pause after weeks of consistent gains.

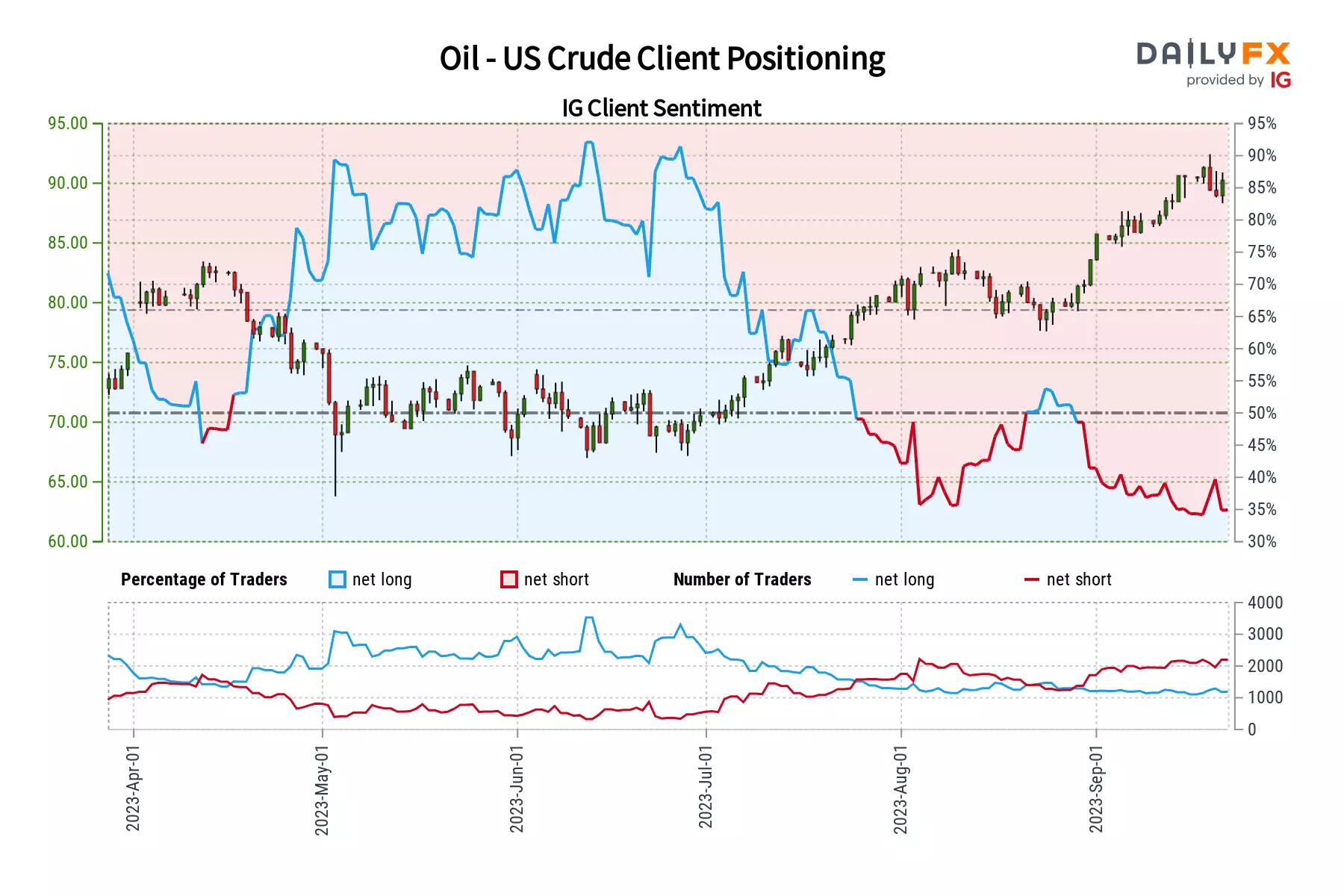

Recent data from IG Client Sentiment (IGCS) shows that there has been a cautious increase in upside exposure in crude oil. IGCS tends to function as a contrarian indicator, with that in mind, could oil aim lower in the near term?

According to IGCS, only 36% of retail traders are net-long crude oil. Since most of them are biased to the downside, this continues to suggest that prices may rally down the road.

That said, upside exposure has increased by 7.73% and 1.81% from the last trading day and one week ago, respectively. With that in mind, recent changes in positioning hint that prices might soon reverse lower ahead.

IG Client Sentiment chart

WTI crude oil technical analysis

On the daily chart below, WTI has pushed higher over the past 48 hours (trading days). This is somewhat undermining the emergence of a Bearish Engulfing from last week.

This followed a rejection of the 61.8% Fibonacci extension level of 88.75, where support was reinforced. As such, this is leaving a neutral technical setting in the very short term.

Key resistance is the 92.43 – 93.72 range, made up of highs from November. Meanwhile, the 20-day moving sverage is creeping higher. The latter may hold as support, maintaining the upside technical bias.

Otherwise, a breakout below it subsequently places the focus on the 84.84 inflection zone.

WTI crude oil daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.