Nasdaq 100: record close as tech outperforms

Technical overview remains bullish, and retail traders’ short bias rises into heavy sell territory.

Sector performance puts tech on top

Most sectors finished yesterday's session in the green, with defensives generally at the bottom. On top were tech, consumer discretionary, and communication—the exact trio needed to power the tech-heavy Nasdaq 100 higher to a record close, outperforming both Dow 30 and S&P 500. It was a record close for key large-cap equity indices, with added attention on the S&P 500 as it approaches 5,000.

Light on data, heavy on Fed member speak

There wasn’t too much impactful economic data out of the US: the trade deficit for December was not far off forecasts, consumer credit change for the same month plummeted to just $1.56 billion after the big and unexpected jump for November, potentially signifying a tested consumer in the next phase. Weekly mortgage applications were up 3.7%.

But it was heavy on central bank member speak, with the Federal Reserve’s (Fed) Barkin on policy "very supportive of being patient to get where we need to get to," Kugler "pleased with the disinflationary progress thus far" expecting it to continue but any stalling in that progress means holding "the target range steady at its current level for longer," and Kashkari on interest rates expecting only "two or three cuts" and that there are "compelling arguments to suggest we could be in a longer, higher rate environment going forward."

Treasury yields finished the session only slightly higher, and so did real terms. Market pricing (CME's FedWatch) still anticipates the first rate cut in May after holding in March. More Fed member speak is on offer today, along with the 30-year auction after yesterday's decent 10-year results.

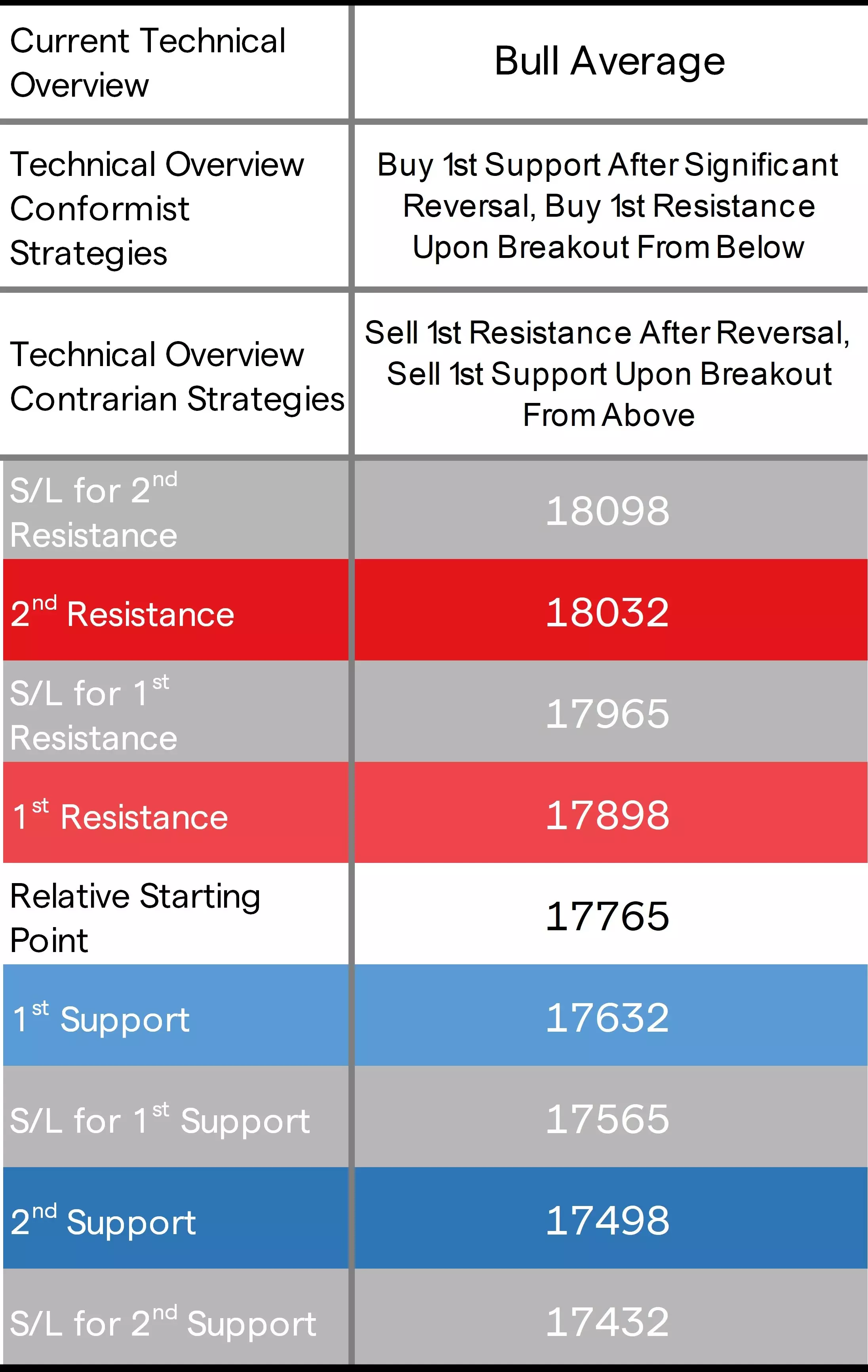

Nasdaq technical analysis, overview, strategies, and levels

Its price eventually went beyond its previous 1st Resistance level, stopping out contrarian sell-after-reversals and favoring conformist buy-breakouts, even if the follow-through beyond it didn't reach its previous 2nd Resistance. The higher highs and record close have kept most of its key technical indicators bullish, and its ADX (Average Directional Movement Index) still in trending territory. In all, it remains a bullish technical overview, with added caution for conformist strategies only when buying on dips to key support levels.

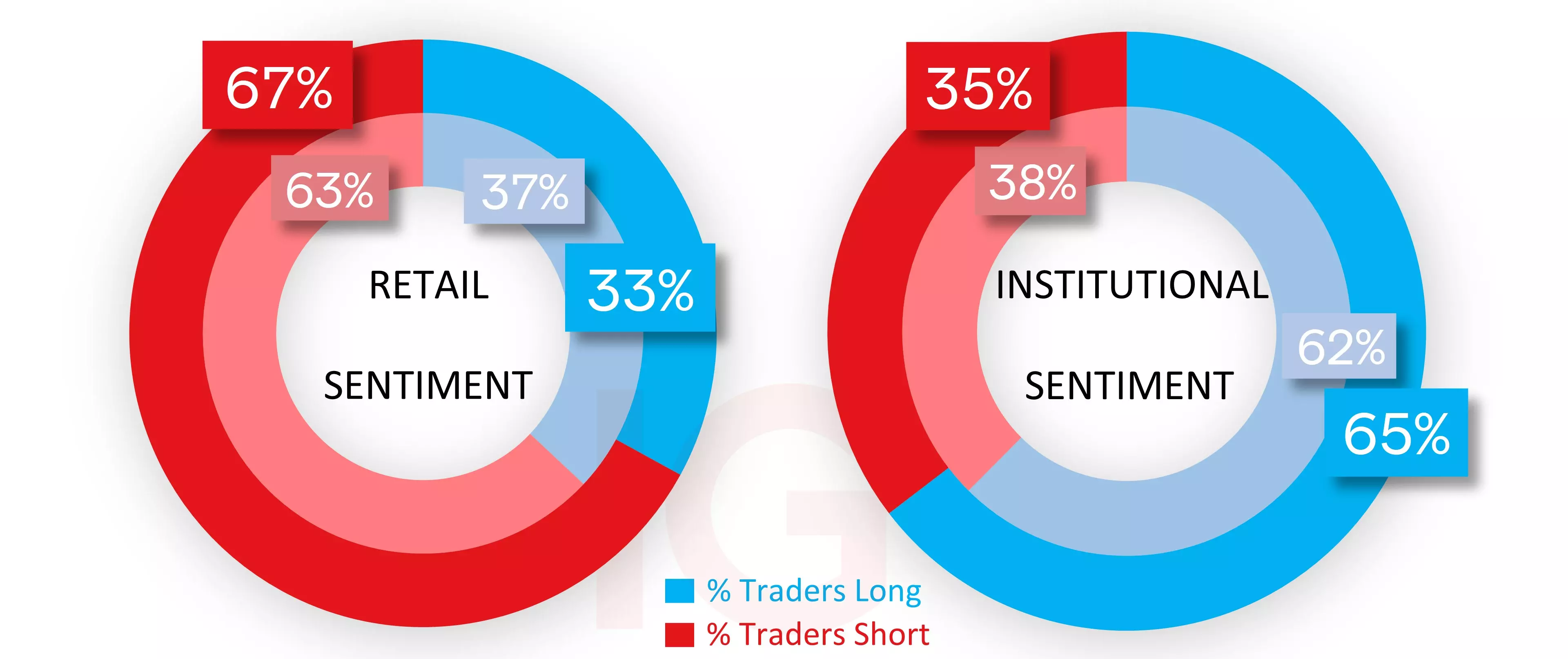

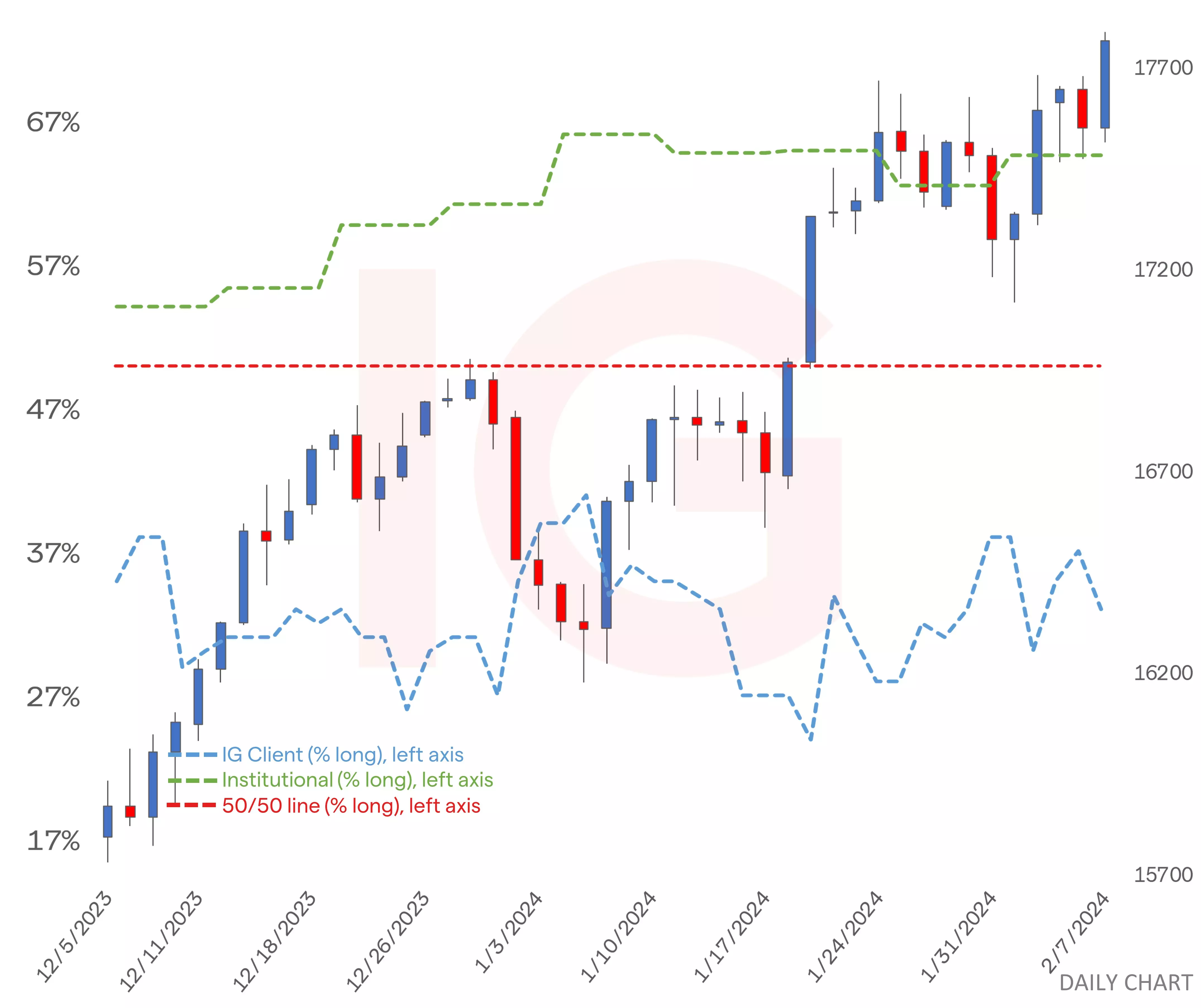

IG client* and CoT** sentiment for the Nasdaq

As for retail traders, they have upped their majority short bias to a heavy 67% from 63% yesterday morning, as fresher longs got enticed into closing out while shorts initiated. CoT speculators are an opposite heavy buy 65% according to last Friday’s report.

Nasdaq chart with retail and institutional sentiment

- *The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of today morning 7am for the outer circle. Inner circle is from the previous trading day.

- **CoT sentiment taken from the CFTC’s Commitment of Traders report, outer circle is latest report released on Friday with the positions as of last Tuesday, inner circle from the report prior.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.