RBA May preview; what comes next for the AUD/USD?

AUD/USD hits a two-month high, buoyed by a weaker dollar and anticipation of the RBA's rate decision amidst a light US economic calendar and inflation concerns.

Last week saw the AUD/USD finish the week above .6600c for the first time in two months, benefiting from broad-based weakness in the US dollar that followed a less hawkish than expected FOMC meeting, and softer than expected US jobs report.

This week's economic calendar in the US is relatively light, with the main highlights being speeches from several Fed officials and the Michigan Consumer Confidence Index. This means that if the AUD/USD is to make further gains, it will likely come courtesy of Tuesday's RBA Board meeting, previewed below.

RBA interest rate decision and press conference

Date: Tuesday, 7 May from 2.30pm AEST

As widely expected, the Reserve Bank of Australia (RBA) kept its official cash rate on hold at 4.35% at its Board meeting in March. The RBA noted that higher interest rates were working to establish a more sustainable balance between demand and supply. However, while goods inflation continues to moderate, the RBA reiterated its concerns about sticky services inflation.“Services inflation remains elevated, and is moderating at a more gradual pace,” it said.

The statement also placed emphasis on the data dependency of future decisions: "The board will rely upon the data", and observed the recent pick-up in measured productivity while noting that “the outlook for household consumption also remains uncertain.”We expect the RBA to keep rates on hold this month at 4.35% and to retain its neutral guidance with similar wording from the last Board meeting statement: “the Board is not ruling anything in or out”.

In the lead-up to the upcoming May Board meeting, firmer than-expected Australian inflation and employment data has resulted in the Australian interest rate market swinging from pricing in RBA rate cuts to pricing in rate hikes. Following a news report this morning that former Governor Philip Lowe believes that the fight against inflation “isn’t done” yet, the probability of a 25 basis points (bp) rate rise by August has risen to 40%.

While we view the bar to another RBA rate hike as very high, we acknowledge the window for rate cuts in 2024 has narrowed and have pushed back our call for a first RBA rate cut from August until November.

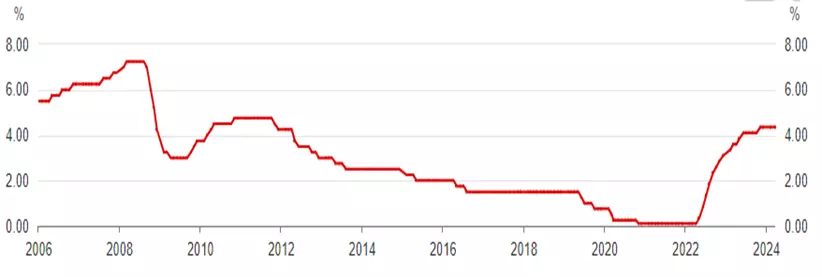

RBA cash rate

AUD/USD weekly chart technical analysis

On the weekly chart, the AUD/USD continues to move sideways within a contracting multi-month bearish triangle. Downtrend resistance from the January 2023 .7158 high is currently at .6760ish. Uptrend support from the October 2022 .6170 low is at .6340ish.

AUD/USD weekly chart

AUD/USD technical analysis

The AUD/USD starts a new week eyeing a thick resistance layer between .6650 and .6670. The AUD/USD has not traded above this level since mid-January. Should the AUD/USD see a sustained break above .6650/70, it would open the way for further gains initially towards .6700/20 before the weekly downtrend resistance identified above at .6765.

On the downside, the AUD/USD has initial support at .6595 before the 200-day moving average at .6520. Below that, a layer of support resides at .6480ish from the swing lows of March and April, reinforced by the February .6442 low.

AUD/USD daily chart

- Source: TradingView. The figures stated are as of 6 May 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Start trading forex today

Find opportunity on the world’s most-traded – and most-volatile – financial market

- Trade spreads from just 0.6 points on EUR/USD

- Analyse with clear, fast charts

- Speculate wherever you are with our intuitive mobile apps

See an FX opportunity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See an FX opportunity?

Don’t miss your chance – upgrade to a live account to take advantage.

- Get spreads from just 0.6 points on popular pairs

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See an FX opportunity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.