S&P 500 Momentum Report

A surprise expansion in US March manufacturing activities triggered mostly a downside reaction across Wall Street to kickstart the new quarter.

Strong set of US manufacturing data challenged dovish rate expectations

A surprise expansion in US March manufacturing activities triggered mostly a downside reaction across Wall Street to kickstart the new quarter, as market participants pared their dovish bets slightly in light of the economic resilience. Notably, prices paid by manufacturers have touched its highest level in 20 months (55.8 versus 52.7 consensus), which may cast some doubts on whether the Federal Reserve (Fed)’s inflation fight will be on track, given that declines in goods prices have been a key driver of disinflation over the past year. With that, the odds for a June rate cut from the Fed is now priced at 54% versus 64% just a week ago, leading the US dollar to its four-month high with a surge in US Treasury yields.

What to watch: Series of US labour market data this week

With US policymakers shrugging off the hotter-than-expected consumer price index (CPI) prints over the past months and asserting that the path of inflation towards its 2% target will be a “bumpy road”, they will remain on the lookout for the conviction that the disinflationary trend will continue. A series of labour market data will be up ahead this week, and eyes will be on any signs of softening in labour conditions to offer room for an earlier policy easing.

Today will bring the US job opening numbers for February in focus, where expectations are for a fall in job openings to 8.74 million at a four-month low, down from previous 8.86 million. This is followed by the US services Purchasing Managers' Index (PMI) on Wednesday, before the week rounds off with the key US non-farm payroll report. Expectations are for the US economy to add 200,000 jobs in March, down from the 275,000 in February, while the unemployment rate is expected to stay unchanged at 3.9%.

S&P 500 technical analysis: Rising channel pattern remains

The S&P 500 remains in its rising channel pattern since the start of the year, with the series of higher highs and higher lows thus far reinforcing an upward trend in place. It may seem that as long as the lower channel trendline support holds at around the 5,200 level, the bullish bias will remain. Its daily relative strength index (RSI) has also been trading above the key 50 level since November 2023, reflecting buyers broadly in control. Further upside may potentially leave the 5,360 level on watch, where the upper channel resistance stands. On the other hand, if the lower channel support were to give way, it may prompt a deeper retracement to the 5,070 level where its 50-day moving average (MA) stands.

Source: IG charts

Nasdaq 100 technical analysis: Upward trendline support in focus

The Nasdaq 100 index has briefly touched fresh record territory following the recent Fed meeting, but are now kept in a period of near-term consolidation as sentiments gradually return from the holiday-shortened week. An upward trendline connecting higher lows since December last year may leave the 18,163 level on watch as immediate support to hold. Failure to do so may pave the way to retest the 17,800 level next, where its March 2024 low stands. For now, its daily RSI continues to trade above the key 50 level since November 2023, which keeps the broader upward trend intact. On the upside, the post-Fed high at the 18,468 level may be key resistance to overcome.

Source: IG charts

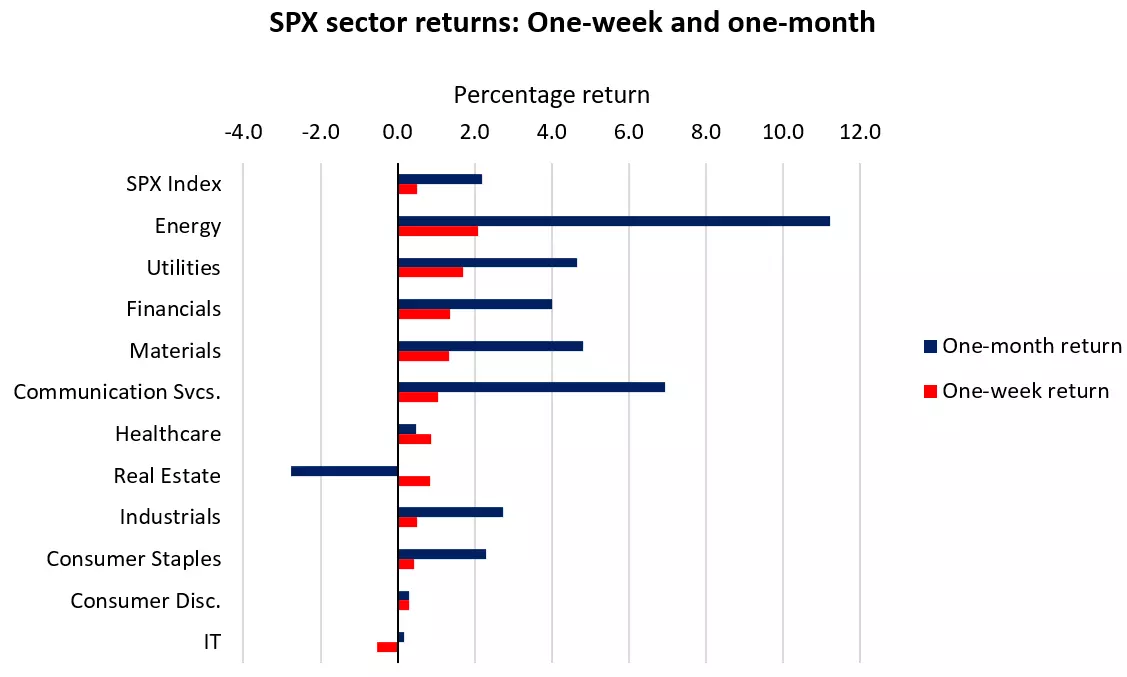

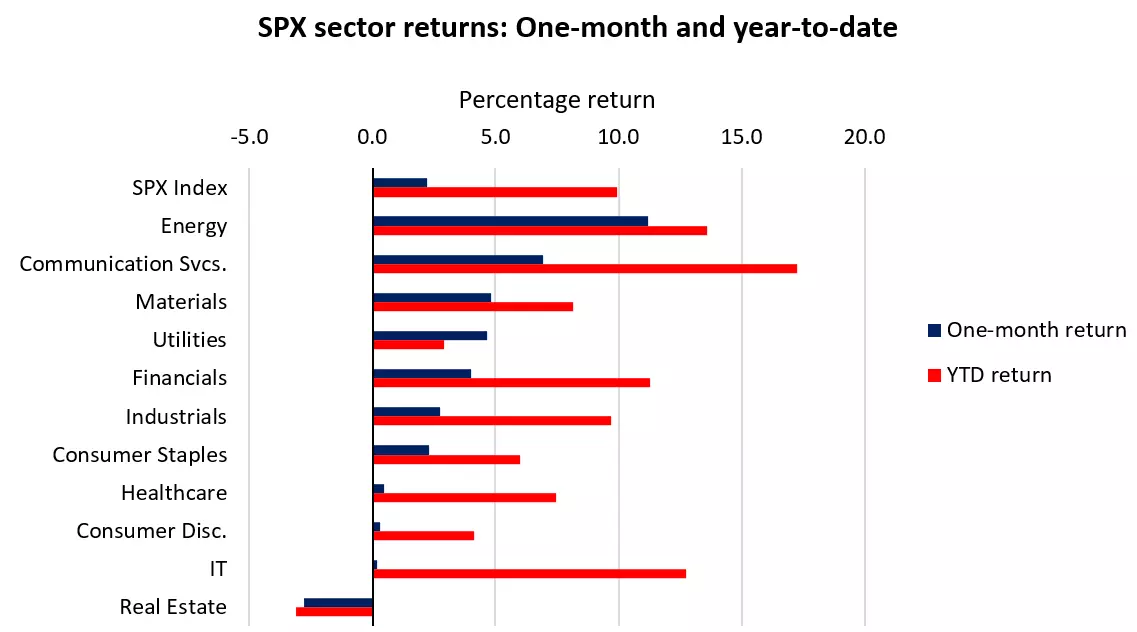

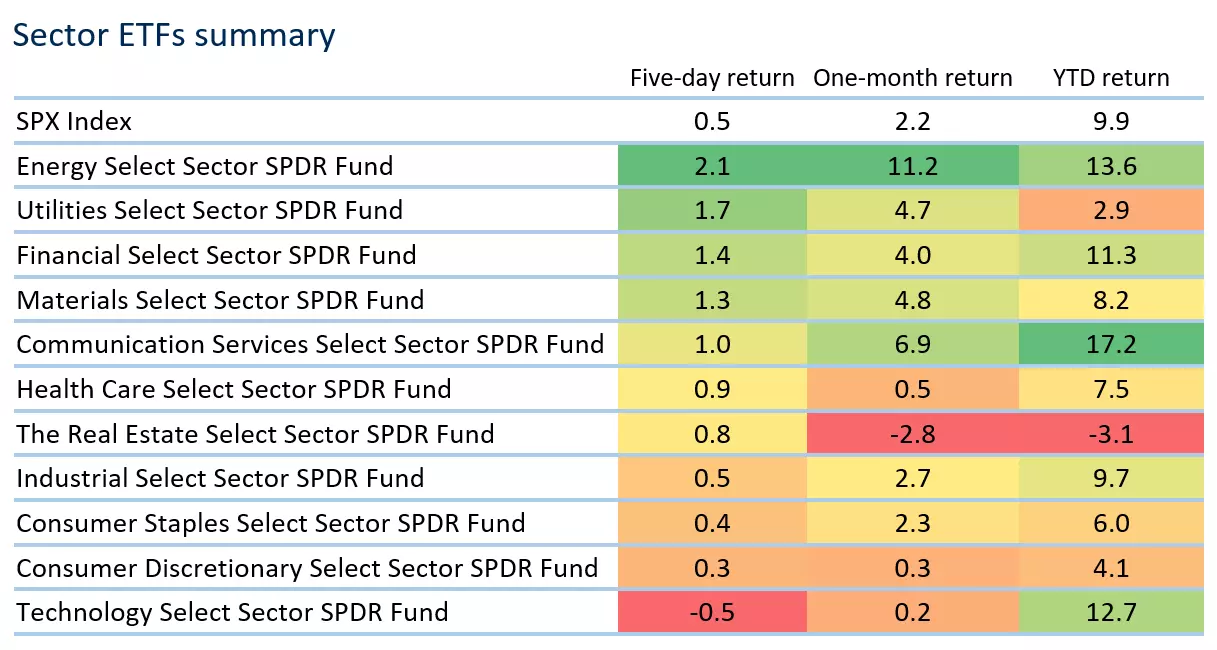

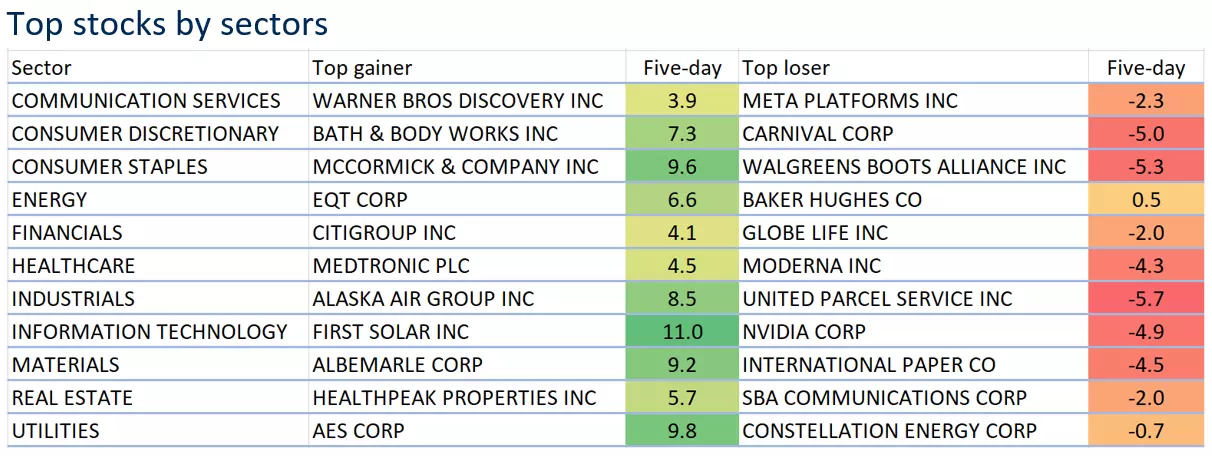

Sector performance

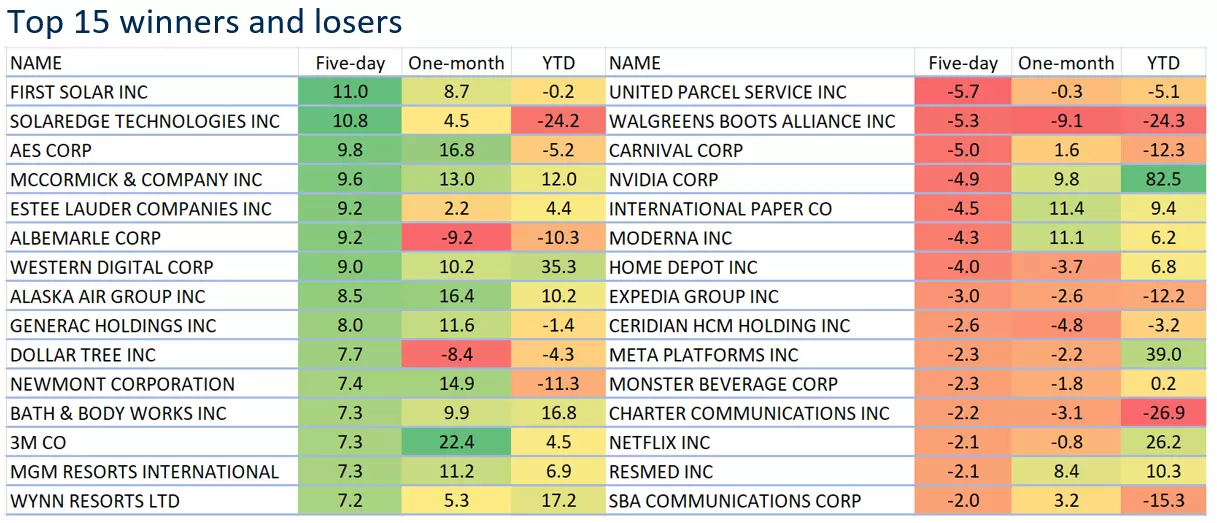

The holiday-shortened week in the US brought subdued gains across most S&P 500 sectors, but notably, the energy sector (+2.1%) continued to extend its outperformance both on a one-week and one-month basis, taking its cue from oil prices at a near five-month high. Mixed performance was seen in growth sectors however, with the technology sector dipping slightly in the red (-0.5%) while consumer discretionary was generally flat (+0.3%), as sentiments across the “Magnificent Seven” stocks took a breather amid the quiet economic front. Nvidia was down 4.2% for the week, Meta Platforms was 3.6% in the red, while resilience was presented in Alphabet (+3.1%), Tesla (+2.6%) and Amazon (+1.2%). Tesla, however, remained the worst performer among the S&P 500 constituents since the start of the year, currently still down 29.5% year-to-date.

Source: Refinitiv

Source: Refinitiv

Source: Refinitiv

*Note: The data is from 26th March – 1st April 2024.

Source: Refinitiv

*Note: The data is from 26th March – 1st April 2024.

Source: Refinitiv

*Note: The data is from 26th March – 1st April 2024.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Act on share opportunities today

Go long or short on thousands of international stocks with CFDs.

- Get full exposure for a comparatively small deposit

- Trade on spreads from just 0.1%

- Get greater order book visibility with direct market access

See opportunity on a stock?

Try a risk-free trade in your demo account, and see whether you’re on to something.

- Log in to your demo

- Take your position

- See whether your hunch pays off

See opportunity on a stock?

Don’t miss your chance – upgrade to a live account to take advantage.

- Trade a huge range of popular stocks

- Analyse and deal seamlessly on fast, intuitive charts

- See and react to breaking news in-platform

See opportunity on a stock?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.