Tips for trading the US election

- Set price alerts to notify you of significant movements before, during and after the election

- Cap your maximum risk by placing guaranteed stops on your positions1

- Be ready to go long or short whenever opportunities arise, even on weekends

- Trade on the go and react to breaking election news with our free trading app

Why trade the US election with us?

Deal GBP/USD from just 0.9 points

Go long or short on a range of currency pairs including all major USD, GBP and EUR crosses

Free risk management

Protect your capital with guaranteed stops that only incur a fee when triggered,1 and an account that’s backed by negative balance protection2

Choose from a range of price alerts

Stay informed of market movements with percentage and point-based price alerts – exclusive to IG

Trade exclusive weekend markets

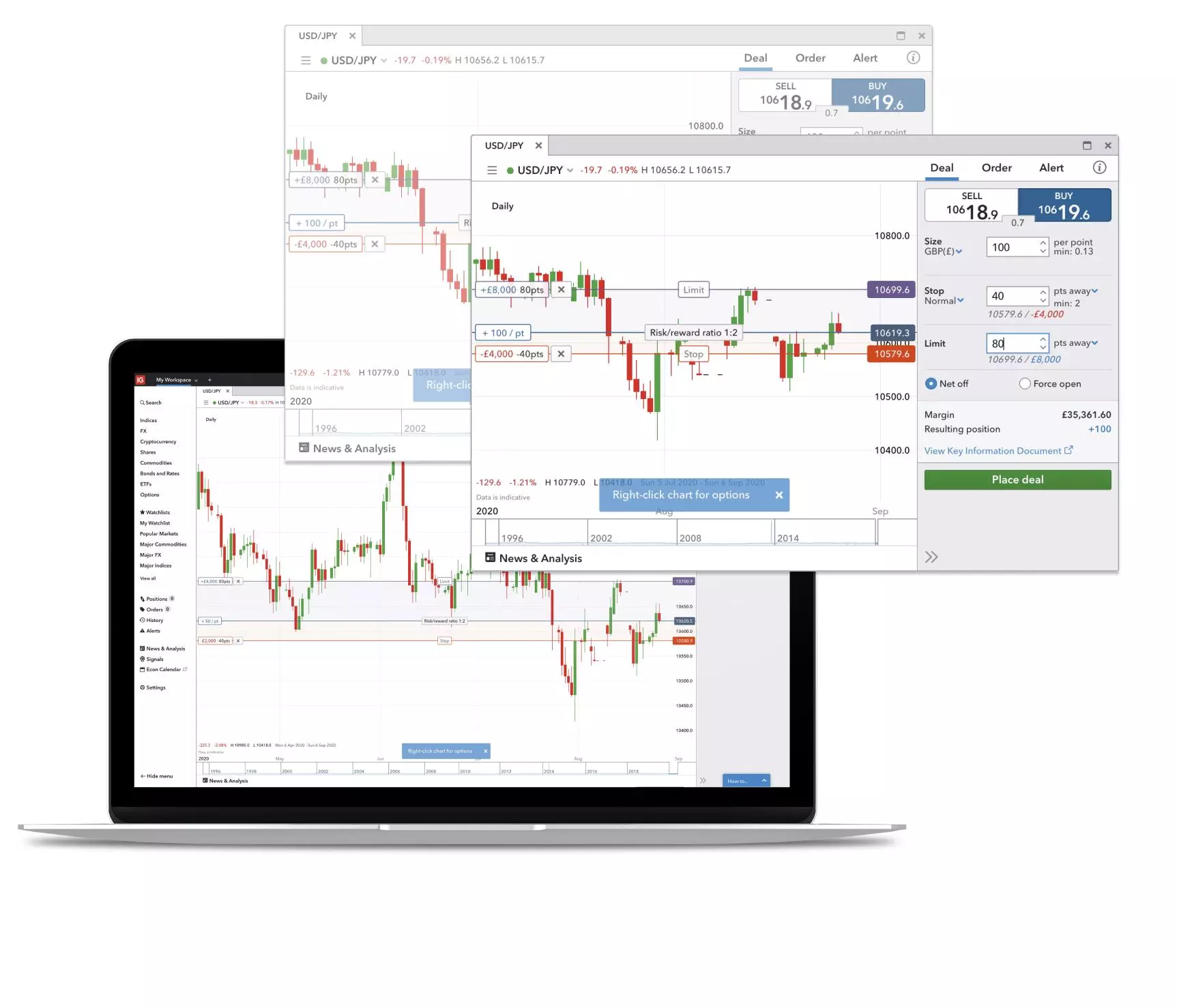

Speculate or hedge 24/7,3 with weekend trading available on the GBP/USD, USD/JPY and Wall Street.

How could each candidate affect market sentiment?

The two candidates are very different in their approach towards information and how they share it. Trump is known to go off-script during speeches and he often takes to Twitter to voice his opinions or grievances, causing markets to react.

This can be to call out individual companies such as Goodyear Tyres or even Twitter itself, which he has accused of bias. Shares can rise and fall immediately after Trump’s tweets, which can also lend itself to an increased sense of market volatility.

Trump has also taken to Twitter to criticise interest rates set by the Fed, stating that high interest rates make life difficult for American manufacturers. That’s because higher interest rates push the strength of the dollar up, making exports more expensive. Any Tweets from Trump that indicate that USD is too strong can cause the price of currency crosses like GBP/USD and EUR/USD to rise.

Biden is generally more restrained, and his speeches and Tweets often speak of a spirit of togetherness. That’s not to say that he doesn’t have his fair share of gaffes which his presidential opponent quickly seizes on. Biden has been given the moniker ‘Sleepy Joe’ from Trump, on account of his supposed lack of energy.

That said, Biden already has more years’ experience in the West Wing than Trump does, racking up eight years as Obama’s vice president. His increased experience could bring with it a larger degree of market certainty.

When is the US election?

The US election is scheduled for Tuesday 3 November 2020, when all 50 states and Washington DC will cast their votes. The vote spans six different time zones, so the first exit polls will be available at around 11pm (EST) when West Coast voting closes.

The election is likely to create opportunities for traders to profit, with price movements expected across a range of forex pairs, indices and commodities in the run-up to polling day. Volatility related to the election could continue until congress certifies the result on Wednesday 6 January 2021, or even until the winner is inaugurated on Wednesday 20 January 2021.

How to trade the US election

- Select a market

- Open an IG trading account

- Be ready to react to US election news

- Log in and place your trade

You can trade the election by speculating on markets such as indices, shares and forex pairs. The US 500, GBP/USD and US stocks all tend to move in the run-up to polling day, and often continue to move in the fall out of the result – meaning there is opportunity to profit from the election.

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app*

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app*

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a market-leading service

How can you hedge risk during the presidential election?

You can hedge risk during the presidential election by opening positions that will turn a profit if assets you own – such as currencies or stocks – start to lose money. With IG, you can hedge against:

Dollar volatility

We offer over 80 forex pairs including EUR/USD and GBP/USD, enabling you to insulate yourself from currency risk

Share portfolio risk

We enable you to go short on major indices and over 13,000 shares, so you can protect your entire portfolio from downside risk

Weekend movements

We offer an unrivalled range of weekend markets, including USD/JPY, GBP/USD and Wall street, so you can offset your risk whenever volatility arises

What should traders expect to see during the US election?

All US markets tend to experience increased volatility in the run up to a presidential election, including USD forex pairs, indices and commodities. That’s because many investors will attempt to lock in positions before the result is announced, in the hopes of taking full advantage of the price moves that occur when the country’s political direction is confirmed.

At the top level, early indications suggest that the following could be on the cards if one of these two main candidates win:

Donald Trump

A Trump win could see an escalation of the trade war, potentially causing problems for some US exporters and having a negative impact on the value of the dollar.

However, this effect could be offset by reassurances that tax cuts and deregulation will continue – boosting the US economy.

Joe Biden

A Biden win could see tensions in the trade war cool, providing a boost to US exporters and the dollar.

However, these effects could be offset by tax increases for high-income households, and more limited deregulation.

Read analysis from IG Senior Market Analyst Joshua Mahony

It’s also important to remember that the coronavirus pandemic is likely to create significant volatility over the election period. A spike in cases could see US indices and the dollar fall in value, as investors move to price in a reduction in consumer spending and economic output. Conversely, a reduction in the number of cases could see both indices and the dollar rise in value.

Markets to watch

Here are some of the financial markets that are likely to be impacted by the US presidential election.

Forex

US dollar crosses, including EUR/USD, USD/JPY and GBP/USD are likely to be volatile – as investors move to price in the effects of the probable winner’s foreign policies.

Stocks and indices

US stocks and indices including the US 500 and Wall Street are expected to experience major price moves, with each candidate favouring a different approach to international trade.

Commodities

The prices of commodities including oil and gold are likely to fluctuate, in line with expectations for the country’s economic direction over the next four years.

Popular markets

Prices above are subject to our website terms and conditions. Prices are indicative only.

How will markets react to the different candidates?

Market commentary by IG Senior Market Analyst Joshua Mahony

Stocks

Markets hate uncertainty, and historically the perception has been that a new president might bring policies that could be harmful for stocks. This happened in 2016 when analysts were confident that a Trump presidency would spark a market collapse.

But, we are now seeing that same fear creep in as people consider a Biden presidency and the potential uncertainty it could cause. Biden is openly more left-leaning, and his policies are expected to be geared towards human needs rather than those of investors and traders.

This sentiment isn’t helped by suggestions that Biden would reverse Trump’s tax cuts, and it is likely that markets will rise alongside the potentially increased chance of a Trump victory as we approach the election.

USD

The value of a currency is supposed to reflect the health of an economy and its future prospects. Many are expecting Biden to be less focused on the markets than his Republican opponent, so the dollar could weaken in the event of a Biden victory.

However, this effect could be offset if Biden is able to improve relations between the US and China after years of market anxiety. In this scenario, it would be the Chinese yuan which may benefit the most, with the trade war having sparked huge upside for USD/CNH.

Keep in mind that if the wider markets fall on a Biden victory – including US stocks and indices – the dollar would likely rally in the short-term to reflect a risk-off move as investors turn to USD.

Gold

The prospect of a more expansive fiscal policy under Biden, and from a government which is happy to embark on substantial spending programmes, could provide a boost to precious metals.

There’s a caveat here too, because in the past precious metals have also followed the same patterns as the stock markets during times of crisis. So, any collapse in equity markets that may come from a change at the White House could drag gold lower in the immediate period.

Plus, while Trump has finally seen the kind of stimulus he would have hoped for, a Biden win could result in a more substantial stimulus package if the Democrats gain a foothold in Congress.

Choose IG as your out-of-hours trading provider

It’s free to open an account, and you don’t have to fund or trade until you’re ready.

Choose IG as your out-of-hours trading provider

It’s free to open an account, and you don’t have to fund or trade until you’re ready.

Choose IG as your out-of-hours trading provider

It’s free to open an account, and you don’t have to fund or trade until you’re ready.

Choose IG as your out-of-hours trading provider

It’s free to open an account, and you don’t have to fund or trade until you’re ready.

1 A premium is incurred if a guaranteed stop is triggered

2 Negative balance protection applies to trading-related debt only, and is not available to professional traders

3 Trading is available around the clock, apart from 10pm Friday to 4am Saturday and 20 minutes just before markets open on Sunday (UK time)