Find out more or choose another breakaway

In collaboration with Dr Robert Hancké of the London School of Economics, Singapore’s No. 1 retail forex provider,1 IG, has considered...

Breakaway region Puerto Rico

Parent country United States

Old currency US Dollar (USD)

New currency New Puerto Rican Peso

The Puerto Rico economy is in a crisis caused by the country’s vast debts. Would establishing a new currency help the island back on its feet, or just add to its problems?

A softer currency could allow macroeconomic stabilisation and a more competitive exchange rate

The exchange rate would likely have to be monitored closely by a newly set-up independent central bank or currency board to avoid imported inflation

This could destroy the gains from monetary independence

Economically there would likely be very little impact

Puerto Rico is too small a part of the US to have much of an impact on the American economy

Some multinationals might relocate to the US mainland, but that process has been going on for several decades anyway

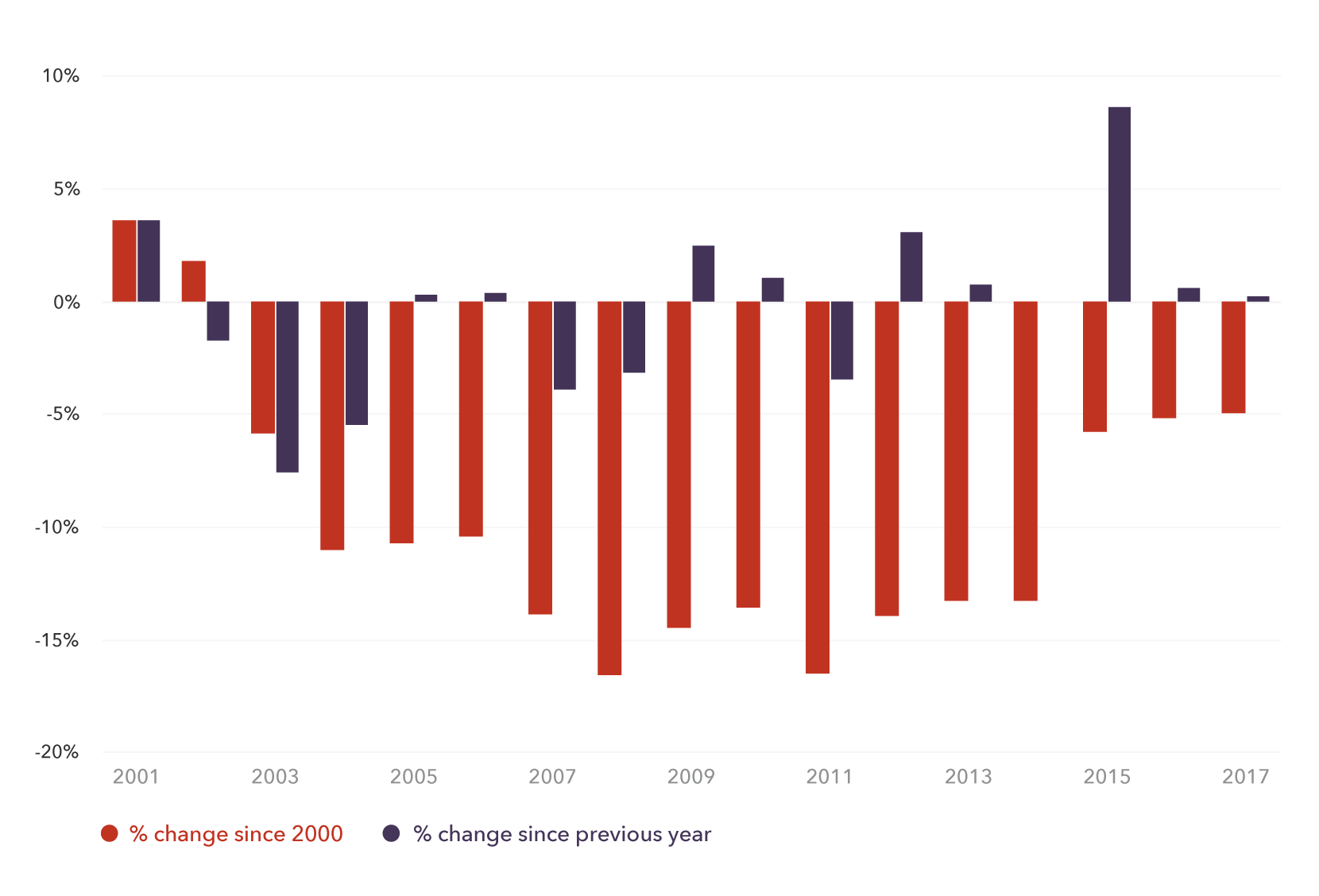

Change in value of US dollar (USD) since 2000, based on SDRs per currency unit source

Dr Robert Hancké

“Puerto Rico should develop other instruments to address its main problem, which is a lack of economic growth.”

Puerto Rico would likely instantly settle its political status as an independent country since the US is unlikely to accept a new state that used a currency other than the dollar

The weakest major political party (the Puerto Rican Independence Party, which currently gets less than 5% of the vote) would have achieved their political goals, possibly against the wishes of the vast majority of voters

This could lead to political instability, and even violence

Any political and economic benefits would likely be very small

It is also unclear if Puerto Rico’s institutions are strong enough to handle an independent currency