EUR/USD tests trendline support and GBP/USD drifts down while USD/JPY bounce stalls

The dollar has gained against the euro and sterling, while against the yen the greenback’s bounce has stalled.

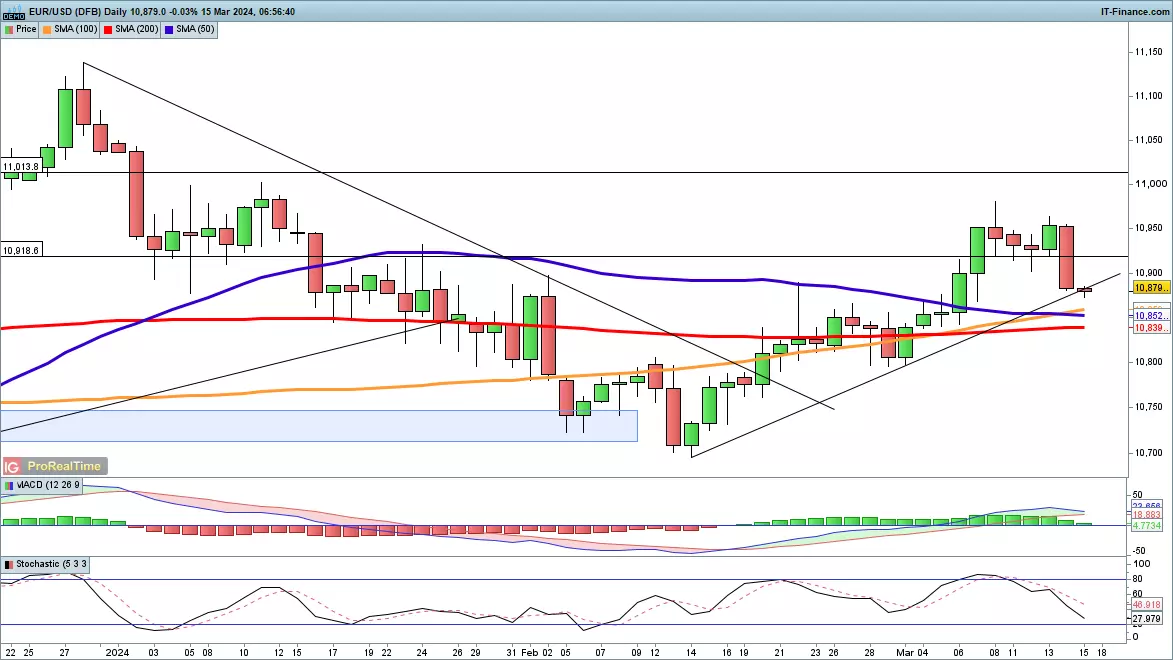

EUR/USD tests trendline support

EUR/USD dropped sharply on Thursday, giving back gains made earlier in the week, and having registered a lower high a more bearish view may prevail.

Trendline support from the early February low now comes into play. If this is broken then the bearish view will receive further reinforcement. If the price holds trendline support then a renewed bounce above $1.095 might revive the bullish view.

GBP/USD heads lower

The rally of early March has given way to losses over the past week, though the GBP/USD's price remains above the 50-day simple moving average (SMA) and above trendline support from the February low.

Continued declines target the 50-day SMA and then trendline support, it would require a close below $1.26 to suggest that the pullback has turned into something more bearish.

USD/JPY bounce stalls

USD/JPY's recovery continues here, as the price bounces off the 200-day SMA after its pullback from the February highs.

A close above the 50-day SMA helps to support the bullish view, and opens the way to the February highs around ¥150.80, and then on to the ¥151.94 high from November.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.