Amazon Q4 earnings 2023: surging growth, AWS expansion and market dominance

Amazon is poised to reveal its Q4 2023 earnings on February 2nd, 2024. Anticipated to showcase a robust increase in EPS and strong sales growth, the report is eagerly awaited by investors.

Amazon earnings date:

The tech giant is scheduled to disclose its Q4 2023 earnings on 2 February at 5.00am (GMT+8), following the US market closure.

Amazon Q4 expectations and key observations

The anticipated earnings report for the upcoming quarter indicates a substantial improvement in earnings per share (EPS), projected to be $0.79. This represents a significant increase from the corresponding quarter in 2022, where the EPS was only $0.12 per share.

Regarding revenue, Amazon's Q4 guidance from the previous earnings report suggests that net sales are expected to range between $160.0 billion and $167.0 billion. This indicates a growth rate of 7% to 12% compared to the fourth quarter of 2022, marking a double-digit increase from the preceding quarter.

Furthermore, the forecast for operating income is estimated to be between $7.0 billion and $11.0 billion, a notable rise from the $2.7 billion reported in the fourth quarter of 2022.

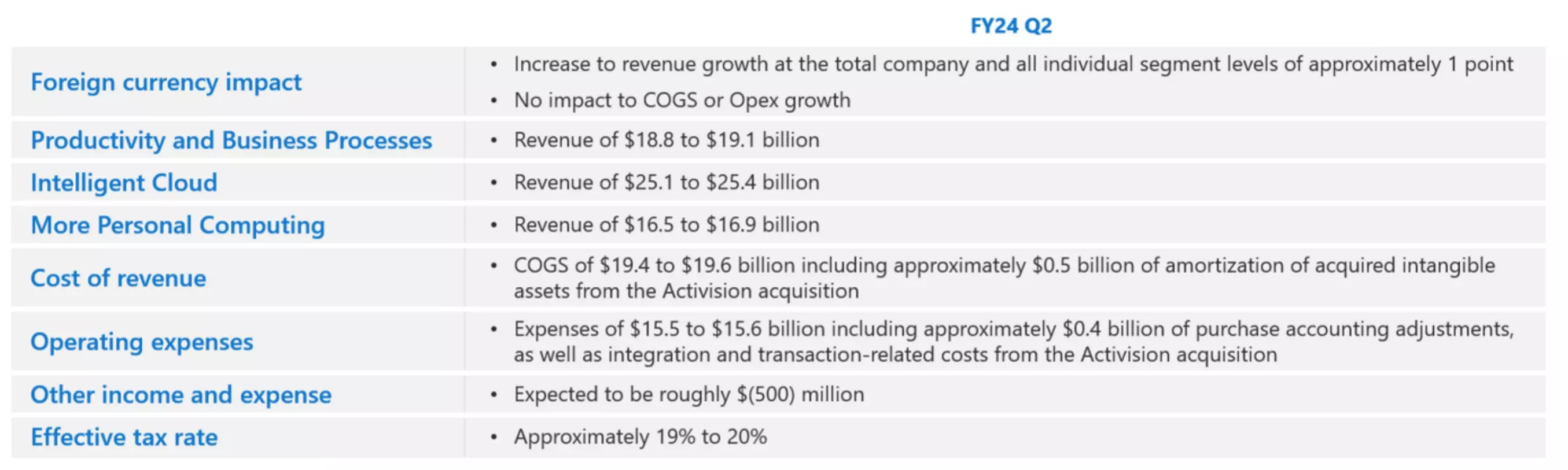

FY24 Q2 expectations

AWS and online advertising

Focusing on key business segments, Amazon's premier cloud service, AWS, is forecasted to continue its robust growth trajectory. AWS's sales are expected to increase by 15% year-over-year in Q4, slightly higher than the 12% growth observed in the prior period, while maintaining a remarkable operating margin above 30%. Despite facing stiff competition from Microsoft’s Azure and Google Cloud, Amazon's dominance in cloud services has been reinforced by the surge in AI, with existing customers launching generative AI workloads on AWS.

Another area under scrutiny in the upcoming report is Amazon's online advertising venture. This sector reported revenues of $12.06 billion in Q3, a 26% increase year-over-year. With Q4 encompassing the peak holiday shopping season, an influx of shoppers to Amazon's e-commerce platform is likely, further bolstering its retail and advertising revenues.

Analyst ratings and future projections

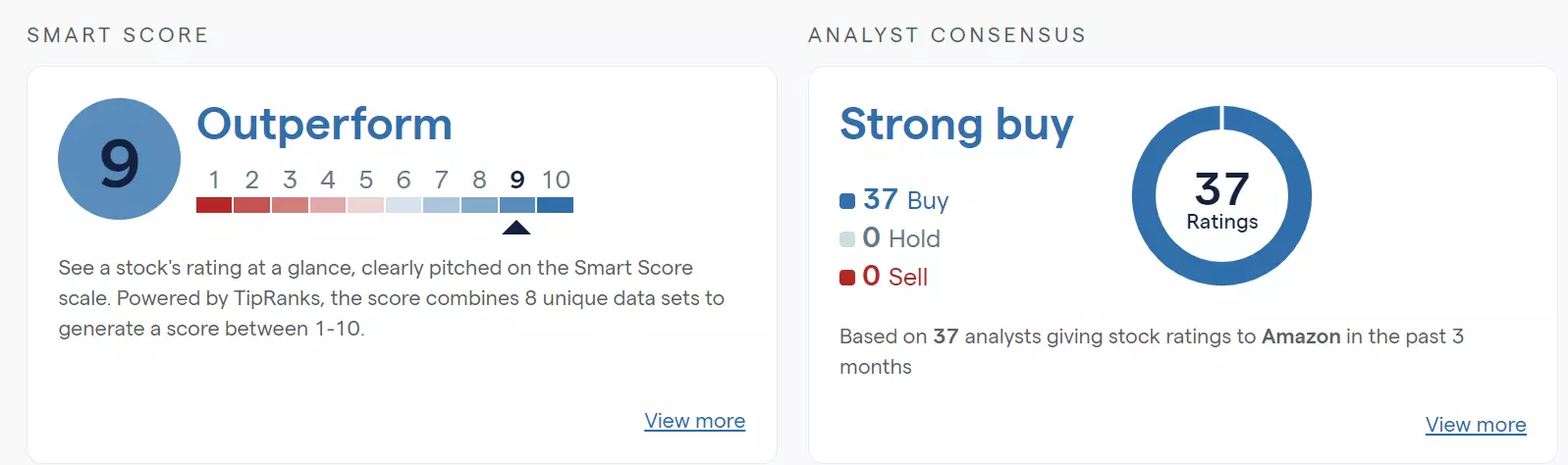

In 2023, Amazon's stock significantly outperformed the S&P 500, achieving a remarkable 63% annual gain and affirming its status among the top performers of the 'Magnificent Seven' club. Emerging from the turmoil of 2022, the retail behemoth has impressed investors with its solid growth and optimistic future prospects. Not surprisingly, based on the IG platform’s TipRanks rating, Amazon boasts a smart score of 9 out of 10.

Consensus among all 37 analysts surveyed in the last three months has been unanimous, with Amazon rated as a 'buy.'

Analyst ratings

Technical analysis

From a technical perspective, Amazon’s stock prices are advancing towards the early 2022 peak, with the $160 mark posing as a significant barrier and test ahead of the earnings announcement.

Looking at the long-term trend, the stock's price trajectory remains strong. Particularly, the reversal of the head-and-shoulders pattern suggests potential for further gains once the pattern’s neckline, also around the $160 mark, is breached.

In the short term, immediate support is identified at $155, with any further downturn potentially bringing the 20-day SMA into focus.

Amazon weekly chart

Amazon daily chart

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.