AUD/USD: Unmasking the antipodean dance; navigating economic storms

Discover the factors behind the recent downturn in AUD/USD and NZD/USD performance, as economic slowdowns, global risk sentiment, and hawkish Fed policies create a challenging landscape for these antipodean currencies.

Facing the storm: AUD/USD and NZD/USD in August

Last week, the AUD/USD closed lower for a fourth consecutive week, experiencing a decline of 3.67% in August. The situation was not much better for the NZD/USD, which suffered a decline of almost 4% month to date.

Both the Antipodean currencies faced a confluence of challenges in August. The Australian and New Zealand economies are significantly exposed to the economic slowdown in China. These currencies are often treated as risk proxies, leaving them vulnerable when equity markets turn downward, as they did this August.

The tone of the Federal Reserve remained hawkish, and the increase in issuance of US Treasury bonds, combined with robust economic data, bolstered both US yields and the US dollar. Consequently, the AUD/USD and NZD/USD were affected negatively.

Employment report

Thursday, August 17 at 11.30 am AEST

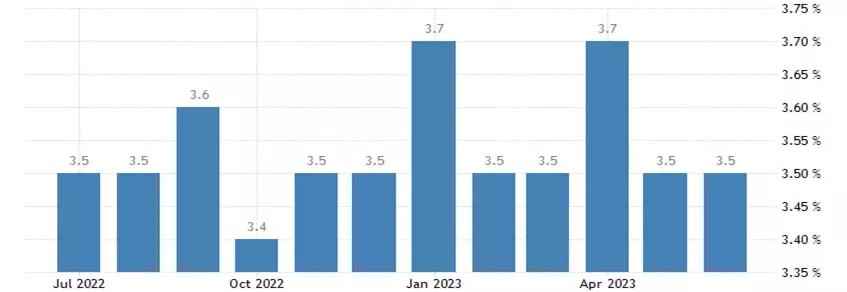

July saw June's employment surge by 32.6k, surpassing market predictions of a 15k increase, while the unemployment rate remained steady at 3.5%. The participation rate saw a slight decline of 0.1%, falling to 66.8% from the previous month's record high of 66.9%.

The rise in employment during June maintained the employment-to-population ratio at a historic high of 64.5%, reflecting a tight labor market where job growth has matched population expansion.

July's expectations call for a modest employment increase of +15k, with the unemployment rate expected to tick up slightly to 3.6%. Meanwhile, the participation rate is projected to remain unchanged at 66.8%.

AU unemployment rate

AUD/USD technical analysis

In our previous AUD/USD update, we highlighted that while the currency pair remained below the resistance level of .6600/20, we were anticipating a test of the May .6458 low. This call proved accurate, with the AUD/USD dropping to a low of .6460 recently.

Now comes the tricky part, especially given the high number of false breaks that have occurred during 2023. If the AUD/USD maintains a sustained break below the support of .6460/50, it could pave the way for a test of the downside support level around .6350.

It's crucial to note that if the AUD/USD manages to hold support at .6460/50, a rebound above resistance at .6600/20 is necessary to negate the prevailing bearish bias.

AUD/USD daily chart

- TradingView: the figures stated are as of August 14, 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.