AUD/USD rebounds, focuses on RBA minutes amid Fed-driven momentum

Despite challenges, the AUD/USD rebounded from a dovish RBA decision, propelled by the Fed's stance on 2024 rate cuts.

This time last week, the AUD/USD was in the doldrums due to a dovish RBA on-hold decision, a sub-par Australian Q3 GDP report, and a strong US jobs report which conspired to see it fall from a nineteen-week high.

The gloom lifted later in the week as the Fed rode to the rescue, validating expectations of rate cuts in 2024, sending the US dollar into a tailspin, and encouraging a new round of risk-seeking flows that supported the AUD/USD. The rebound leaves the AUD/USD just 100 pips below where it finished in 2022 at .6816, suddenly within touching distance of finishing 2023 in the green.

However, before it can cross that bridge, it must first withstand the minutes from the RBA’s board meeting in December.

RBA meeting minutes (Tuesday, December 19th at 11.30 am AEDT)

The minutes from the Reserve Banks meeting in November are scheduled to be released Tuesday, December 19th at 11.30 am.

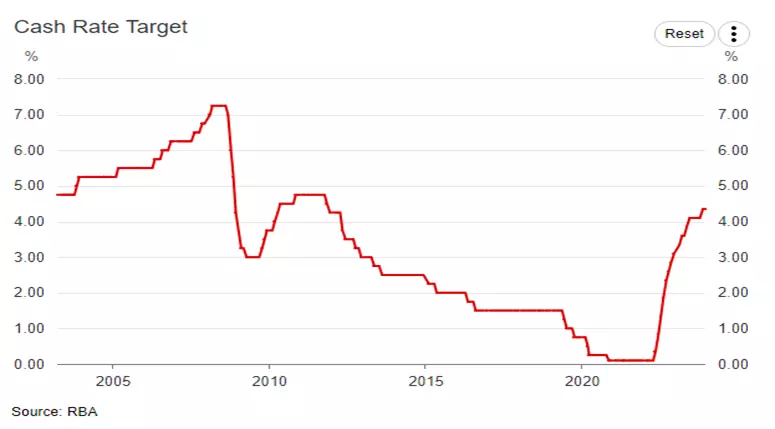

At its meeting in November, the RBA kept its official cash rate on hold at 4.35%, supported by a string of cooler-than-expected data across house prices, retail sales, and inflation. The RBA retained a tightening bias, using the same watered-down wording in the November statement:

"Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks."

The board meeting minutes will be closely scrutinised around what options the board considered at the meeting, the factors that would prompt the RBA to act on its tightening bias in 2024, including stubborn inflation and a tight labour market, and search for any clues that might suggest the RBA feels its tightening cycle is close to completion.

RBA cash rate chart

AUD/USD Technical analysis

Following last Thursday's dovish FOMC meeting, the AUD/USD springboarded from ahead of support at .6535/25, above the 200-day moving average at .6577 and downtrend resistance at .6650 from the February .7157 high.

While the AUD/USD holds above the three support points noted above, the AUD/USD could extend its rally towards the next layer of resistance at .6800/30, coming from highs between April and May of this year. Above here, resistance at .6900c comes from highs in June and July.

AUD/USD daily chart

- Source TradingView. The figures stated are as of 18 December 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.