Baltic dry, Capesize and mining stocks resume descent despite China stimulus

Baltic Dry and Capesize highlight slowing commodity demand

Baltic Dry and Capesize indices under pressure

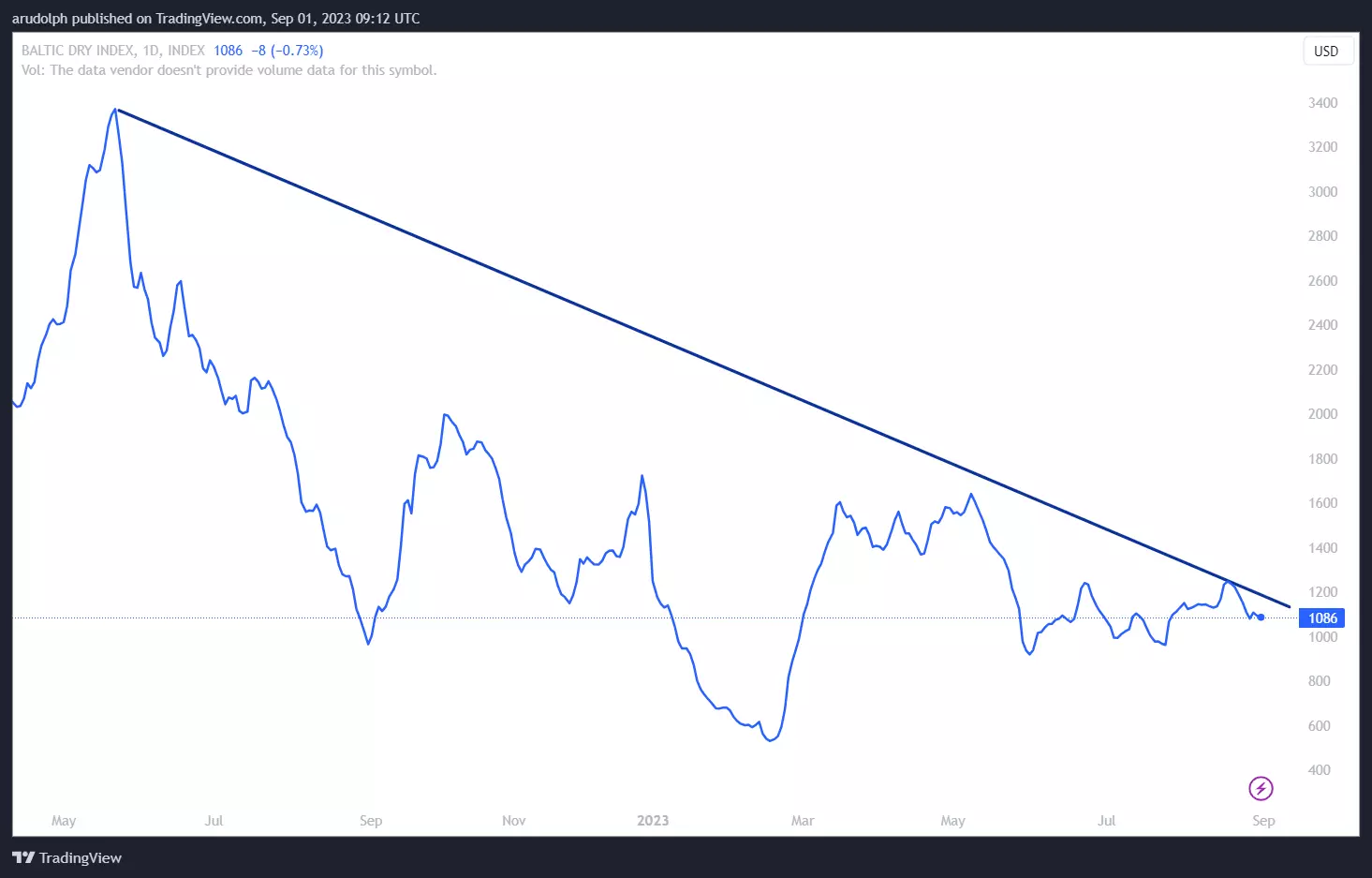

The Baltic Dry index has reached a fresh one-month low today as it resumes its descent which began in mid-August.

Meanwhile, the Baltic Capesize index, which tracks iron ore and coal cargos of 150,000 tonnes, is weighing on its June lows. It looks likely to soon be slipped through in which case levels last traded in February would be eyed.

This drop in demand for ships highlights a worsening environment for commodities, coinciding with China’s economic woes.

On Thursday China unveiled steps to increase personal income tax deductions for child care, parental care and children’s education spending in order to boost household consumption and its economy.

On Friday the People's Bank of China (PBoC) also said that it would lower the foreign exchange reserve requirement ratio (RRR) by 200 basis points to 4% from 6% mid-September. It was the first such reduction this year, as the central bank seeks to prop up the falling yuan and help China’s faltering economic recovery.

At the same time China’s government is also proposing to lift home-purchasing restrictions in non-core districts of major cities such as Beijing, Shanghai and Shenzhen in order to end the country’s two-year housing slump which is key to reviving growth because the sector and related industries make up about a fifth of the economy.

Nonetheless, unless these stimulus measures increase consumption and spending in China, commodity stocks look primed for another bout of weakness.

Baltic Dry Index Daily Line Chart

FTSE 350 miners try to bounce off a 7 ½ year low

While there are a number of ways to play commodity stocks, the FTSE 350 mining sector does do a good job of covering a wide range of stocks related to the sector.

The chart below shows how the UK mining sector dropped to a 7 ½ year low in August before gingerly recovering alongside global stock indices on hopes that the Federal Reserve (Fed) may pause its tightening monetary policy cycle on the back of slowing US growth and cooling US labour market data.

FTSE 350 Mining Sector Weekly Line Chart

On the daily timeframe, despite last week’s up to around 7% bounce, the FTSE 350 miners index clearly remains within a long-term downtrend. Only a rise above the July peak at 10,671 would negate the medium-term downtrend.

FTSE 350 Mining Sector Daily Candlestick Chart

Unless this were to happen, the odds continue to favour further declines with a fall through the August low at 8,568 putting the April and May 2016 lows at 8,478 to 8,337 on the map.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.