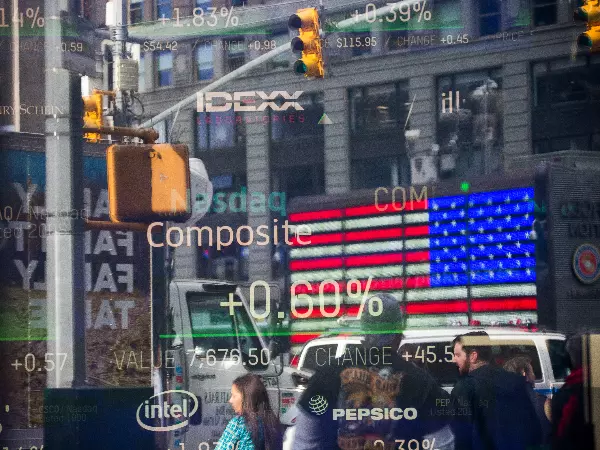

Can the S&P 500 and the Nasdaq build on their break higher?

The S&P 500 and Nasdaq surge to start the week as tech stocks rally.

US equity markets ripped higher overnight on hopes of a slower pace of Fed tightening, easing inflation and ahead of key earnings reports.

The tech-heavy Nasdaq led the charge higher for its best two-day run since November.

- Tesla surged 7.74%, taking its two-day rally to over 13%

- NVIDIA added 7.59%

- Netflix added 4.36%

- Meta added 2.8%.

In contrast to January 2022, when the Nasdaq fell 8.52% before falling a further 24%, this January, the Nasdaq is now +8.53% for the month - an interesting statistic for those who subscribe to the idea that January sets the tone for the remainder of the year.

For those who take a more bearish view of the world, there remains a lot to ponder. Despite the Fed’s rhetoric that it will raise rates by 75bp above 5% and keep rates on hold for an extended period, the market is not convinced.

An expected slowdown in growth during the second half of this year has the interest rate market pricing 55bp of rate hikes before the Fed turns in the second half of this year and cuts rates by 210 bp, taking the Fed Funds rate back to 2.75% by December 2024.

For those wondering the reason why the Fed would cut rates by 210bp, it would likely be in response to a recession which equity markets are not priced for.

What do the charts say?

Technically the S&P 500 (and the Nasdaq) have closed above the downtrend lines drawn from their January 2022 highs.

Presuming the break higher in the S&P500 sustained in the coming sessions, it opens the way for the rally to extend towards 4180 (Dec spike high) and then 4327 (Aug high).

The first cause for concern that the overnight break higher had failed would be a sustained close back below the 200-day moving average at 3970.

S&P 500 daily chart

Nasdaq

For the Nasdaq, there is more reason to be suspicious of the overnight break higher as it has yet the clear the 200-day moving average at 12,072.

If it was to see a sustained break above the downtrend and the 200-day moving average, the upside target would be the December spike higher at 12,239, followed by the August 13,740 high.

Nasdaq daily chart

Take your position on over 13,000 local and international shares via CFDs or share trading – and trade it all seamlessly from the one account. Learn more about share CFDs or shares trading with us, or open an account to get started today.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.