Japanese yen weakens to 1998 low as Nasdaq 100 rallies, eyes on Asia-Pacific trade

USD/JPY soars to highest since 1998 as Nasdaq 100 rallies; ten weakness continued after BoJ maintained dovish policy and will Nikkei 225, ASX 200, Hang Sang rally on Wednesday?

Tuesday’s market recap – market rally across the globe further sinks the yen

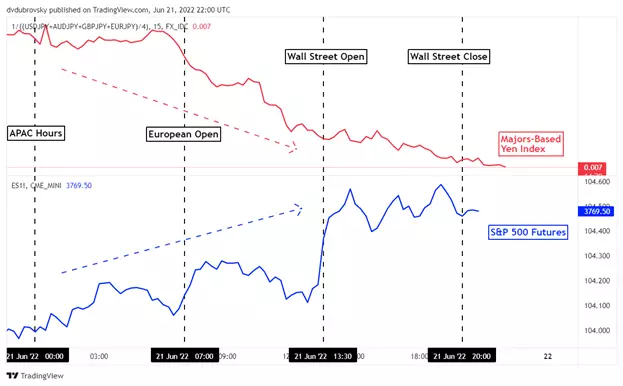

The anti-risk Japanese yen was crushed on Tuesday as market confidence struck global stock exchanges – see chart below. On Wall Street, futures tracking the Nasdaq 100, S&P 500 and Dow Jones rallied 2.48%, 2.5% and 2.2% respectively. During European hours, the Euro Stoxx 50 and FTSE 100 climbed 0.7% and 0.42% respectively. This is as Japan’s Nikkei 225 gained 1.84% while Australia’s ASX 200 rose 1.41%.

Are markets starting to price in the next easing cycle from the Federal Reserve? This does not seem so. Treasury yields were mostly little changed over the past 24 hours. US headline CPI expectations (YoY) for 2023 barely nudged from the end of last week. You can also look at the 1-year breakeven rate to gauge inflation estimates, and those were also little changed from Friday.

With that in mind, it seems there might have been a display of exhaustion to start off the holiday-shortened week for Wall Street. We are also approaching the end of the second quarter, opening the door for rebalancing activity.

This spelled bad news for the yen, which tends to underperform when overall market sentiment is rosy. As a result, risk appetite helped propel USD/JPY to its highest since 1998! Last week, the Bank of Japan defended its ultra-loose policy despite headline inflation now slightly above target. While it offered some verbal jabs against the rapidly weakening currency, it physically did little to defend it, leaving it vulnerable to what happened in markets on Tuesday.

Japanese yen slumps as stocks rally on Tuesday

Wednesday’s Asia-Pacific trading session – focus on risk appetite

Wednesday’s Asia-Pacific economic docket is fairly light, placing the focus for traders on overall risk appetite. The rather rosy session on Wall Street could mean some follow-through for regional exchanges, perhaps opening the door for Hong Kong’s Hang Seng Index to rally alongside the Nikkei 225 and ASX 200. This may continue leaving the Japanese yen at risk. However, it remains tough to be fundamentally bullish equities for the time being.

USD/JPY technical analysis

USD/JPY shot higher above the 135.16 – 135.57 resistance zone, which was made up of the 2002 peak. This has pushed to levels last seen in 1998, exposing the 78.6% Fibonacci extension at 139.68. Confirmation of the breakout is lacking for now as negative RSI divergence persists. The latter is a sign of fading upside momentum, which can precede a turn lower. In such an instance, keep a close eye on the rising trendline from March which could reinstate an upside focus.

USD/JPY daily chart

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. This information Advice given in this article is general in nature and is not intended to influence any person’s decisions about investing or financial products.

The material on this page does not contain a record of IG’s trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.