Market update: gold prices waver ahead of FOMC

Dive into an analysis of XAU/USD's technical support, the Fed's potential policy shifts, and the broader economic indicators shaping the future of precious metals trading.

Gold's response to FOMC speculations

Gold prices saw an uptick on Monday, though the gains were restrained due to market caution in anticipation of significant upcoming events, including the Federal Open Market Committee’s (FOMC) announcement on Wednesday. XAU/USD experienced a modest increase of around 0.2% in early afternoon trading in New York, finding support near the USD 2,150 level.

The Federal Reserve is set to conduct its March meeting this week. Despite expectations for the central bank to maintain its current policy settings, led by Jerome Powell, there may be adjustments in forward guidance and economic projections, particularly due to recent disappointing inflation trends.

Disinflation dilemma: impact on Fed's strategy

Recent CPI and PPI reports have indicated a worrisome trend where disinflation progress is slowing, or potentially reversing. Consequently, the Fed might adopt a more conservative stance, delaying a shift to a more accommodative policy and narrowing the extent of anticipated easing measures. This scenario could result in only two quarter-point rate reductions in 2024, contrary to the three initially projected.

Should the policymakers signal a less accommodative approach and postpone the easing cycle, US Treasury yields and the US dollar are likely to surge, leading to a recalibration of interest rate expectations by Wall Street. Such developments could undermine the ongoing rally in precious metals, potentially causing a significant downturn in this market segment, placing gold in a precarious position shortly.

Gold's path forward

Alternatively, if the Fed maintains its previous stance and signals nearing confidence to commence cost-cutting, gold could be well-positioned for an upward trajectory. However, the current data presenting increased inflation risks may diminish the likelihood of a dovish FOMC outcome.

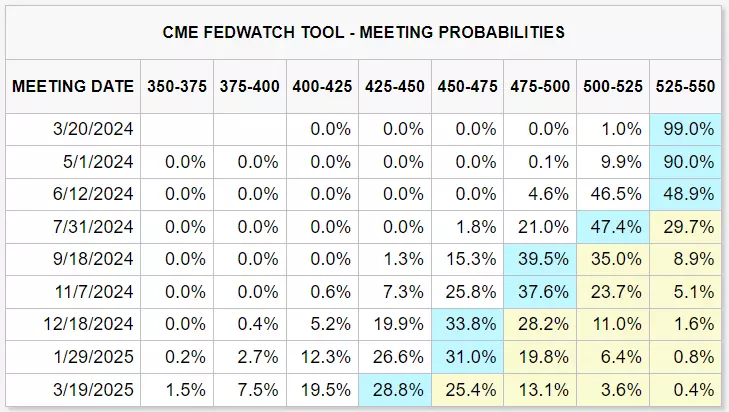

FOMC meetnig probabilities

Gold technical analysis

Gold prices, after a subdued performance last week, stabilised on Monday, rebounding from the support level at USD$2,150. If the price gains momentum in the upcoming days, resistance at USD$2,175 might impede further advances. Yet, surpassing this threshold could shift focus to the record high near USD$2,195.

On the contrary, if the market sees a bearish turn, the initial support to monitor in case of a pullback appears at USD$2,150. To prevent an intensification of selling pressure, this level must be robustly defended by bulls; failing to do so could lead to a decline towards USD$2,085, with further potential losses eyeing the USD$2,065 level.

Gold technical chart

- This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Explore the markets with our free course

Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course.

Turn knowledge into success

Practice makes perfect. Take what you’ve learned in this index strategy article, and try it out risk-free in your demo account.

Ready to trade indices?

Put the lessons in this article to use in a live account. Upgrading is quick and simple.

- Get fixed spreads from 1 point on FTSE 100 and Germany 40

- Protect your capital with risk management tools

- Trade more 24-hour markets than any other provider – 26 in total

Inspired to trade?

Put the knowledge you’ve gained from this article into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.