Microsoft's strategic wins: FY23 Q4 marked by strong cloud and consumer growth

Discover how Microsoft's strategic focus on cloud services and AI technology has propelled a significant 20% increase in net income and an 18% rise in operating income in FY23 Q4.

When will Microsoft report its latest earnings?

Microsoft Corp is scheduled to report its fiscal Q2 2024 results on Wednesday, 31 January at 5am (GMT+8), after the market closes.

Key financials

Wall Street's expectations for the upcoming results are as follows:

- Earnings per share: $2.77 vs. $2.99 in Q1

- Revenue: $61.1 billion vs. $56.52 billion in Q1

The backdrop

Investors cheered Microsoft's first-quarter results, reported in late October, as it beat Wall Street's estimates and promised future product offerings infused with AI.

"With copilots, we are making the age of AI real for people and businesses everywhere," said Satya Nadella, Chairman and Chief Executive Officer of Microsoft. "We are rapidly infusing AI across every layer of the tech stack and for every role and business process to drive productivity gains for our customers."

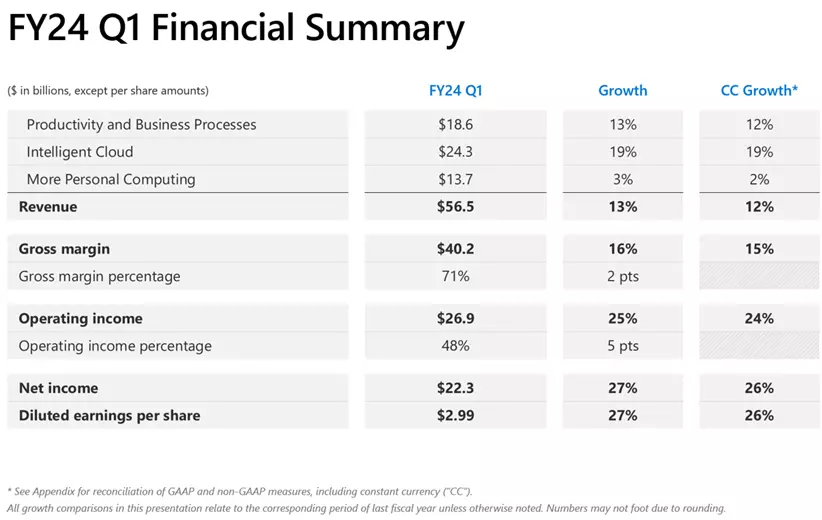

Summary of Microsoft's Q1 2024 results

Within the details, Microsoft reported the following highlights.

- Revenue from Microsoft's Intelligent Cloud segment was $24.3 billion, up 19%. Within that, Server products and cloud services revenue increased by 21%, driven by Azure and other cloud services revenue growth of 29%.

- Revenue in Productivity and Business Processes was $18.6 billion, up 13%. Within that, Office Commercial products and cloud services revenue increased by 15%, driven by Office 365 Commercial revenue growth of 18%.

- Revenue in More Personal Computing was $13.7 billion and increased 3%. Within that, Windows revenue increased 5%, with Windows OEM revenue growth of 4% and Windows Commercial products and cloud services revenue growth of 8%.

What to look for in Q2?

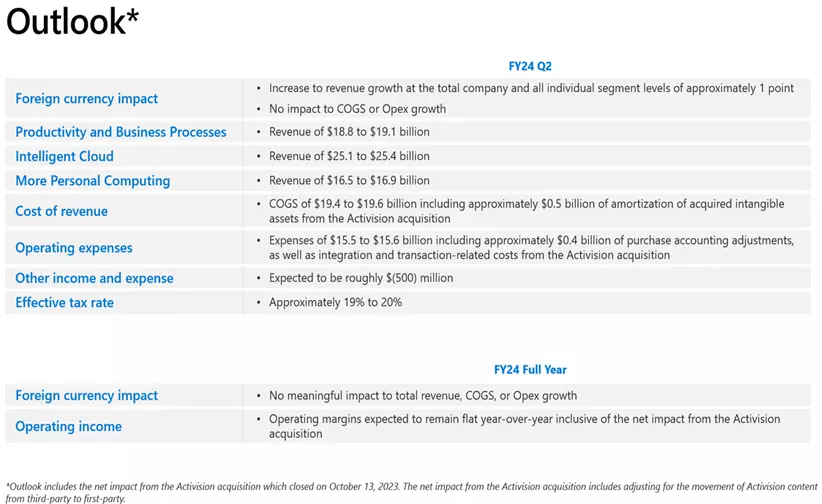

During Q1, Microsoft experienced a notable acceleration in its Azure cloud revenue growth, marking a significant shift after two years of slowing momentum. This uptick has captured the attention of analysts who anticipate a continuation of this trend in the upcoming Q2 Earnings Report. Additionally, there's a growing interest in the performance of the Microsoft 365 CoPilot AI add-on, which was launched last year and is available on a subscription basis. Despite its innovative approach, the add-on has so far received mixed reviews.

Microsoft's recent completion of the $68.7 billion acquisition of video game publisher Activision Blizzard is set to influence Q2 earnings. This acquisition, finalised in mid-October, is expected to be a topic of discussion by Microsoft executives, particularly in regards to its impact on the financial guidance for Q3.

Another point of interest is the management's perspective on the recent developments at OpenAI, along with their viewpoints on the current structure of the OpenAI board, which has been the subject of much discussion.

Microsoft FY24 outlook

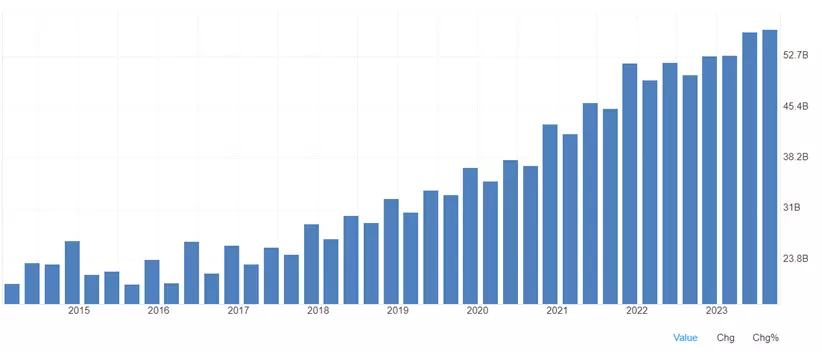

Microsoft's revenue 2015 - 2024

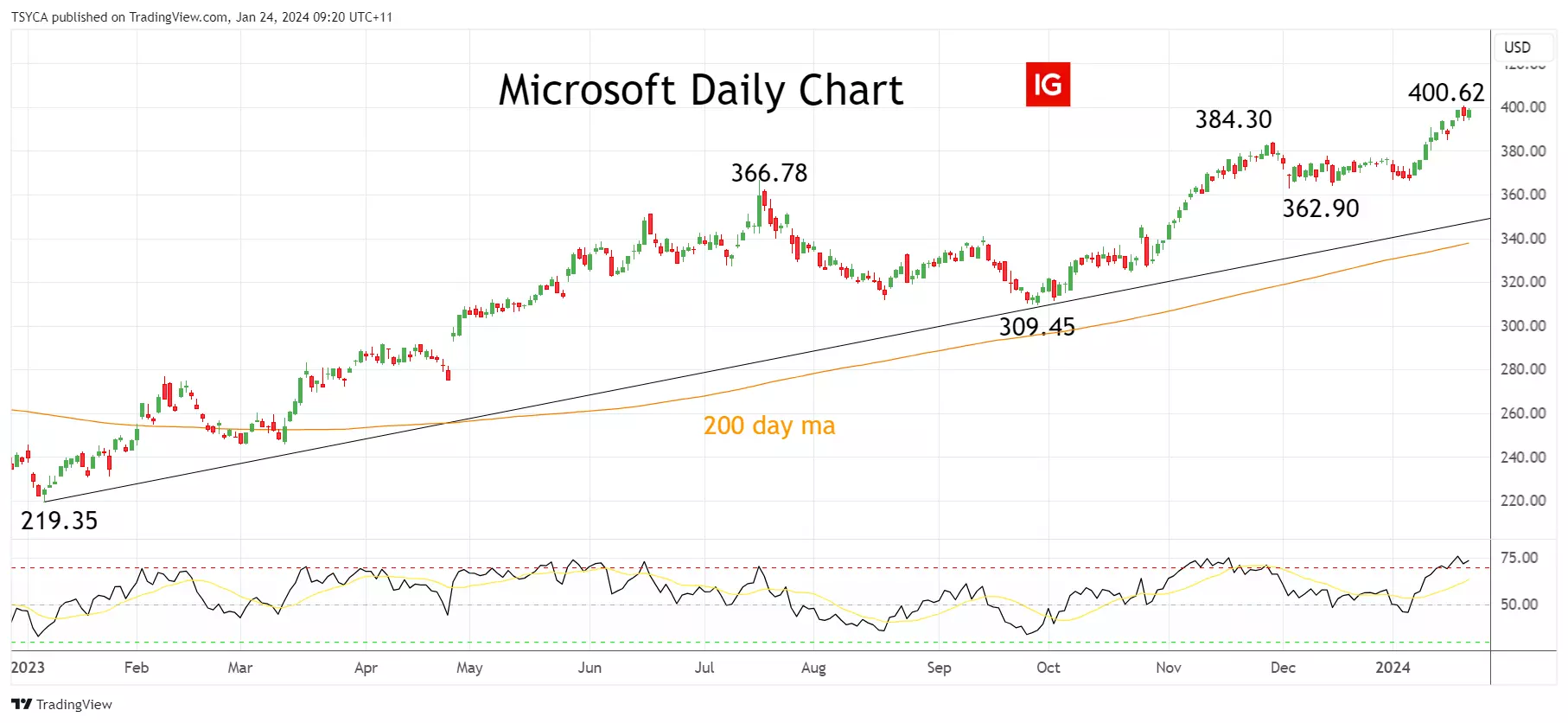

Microsoft technical analysis

Building on an almost 57% gain in 2023, Microsoft's share price has surged over 6% in the opening weeks of 2024, as investors began the new year with renewed enthusiasm for tech stocks that offer exposure to AI.

The chart of Microsoft's share price is a textbook example of a market in an uptrend, putting in place a sequence of higher highs and higher lows punctuated by corrective and orderly pullbacks. The RSI is now pushing into overbought territory, which offers hope that a pullback may not be too far away, providing an opportunity to buy Microsoft shares at better levels.

Near-term horizontal support comes in at $380/378 and below that at around $360, coming from July highs/ December lows. Medium-term support is strong in the $350/335 area, coming from the uptrend drawn from January 2023's $219.35 low and the 200-day moving average at $337.00.

To note, a sustained break below $335 would negate the uptrend and warn that a deeper pullback is underway.

Microsoft daily chart

- Source: TradingView. The figures stated are as of 24 January 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Explore the markets with our free course

Discover and learn how the range of markets you can trade on with IG Academy's online course – ‘Introducing the financial markets’.

Put learning into action

Try out what you’ve learned in this shares strategy article risk-free in your demo account.

Ready to trade shares?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Trade on over 10,000 popular global stocks

- Protect your capital with risk management tools

- React to breaking news with out-of-hours trading on 70 key US stocks

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.