Nasdaq 100: futures up after a session of limited gains

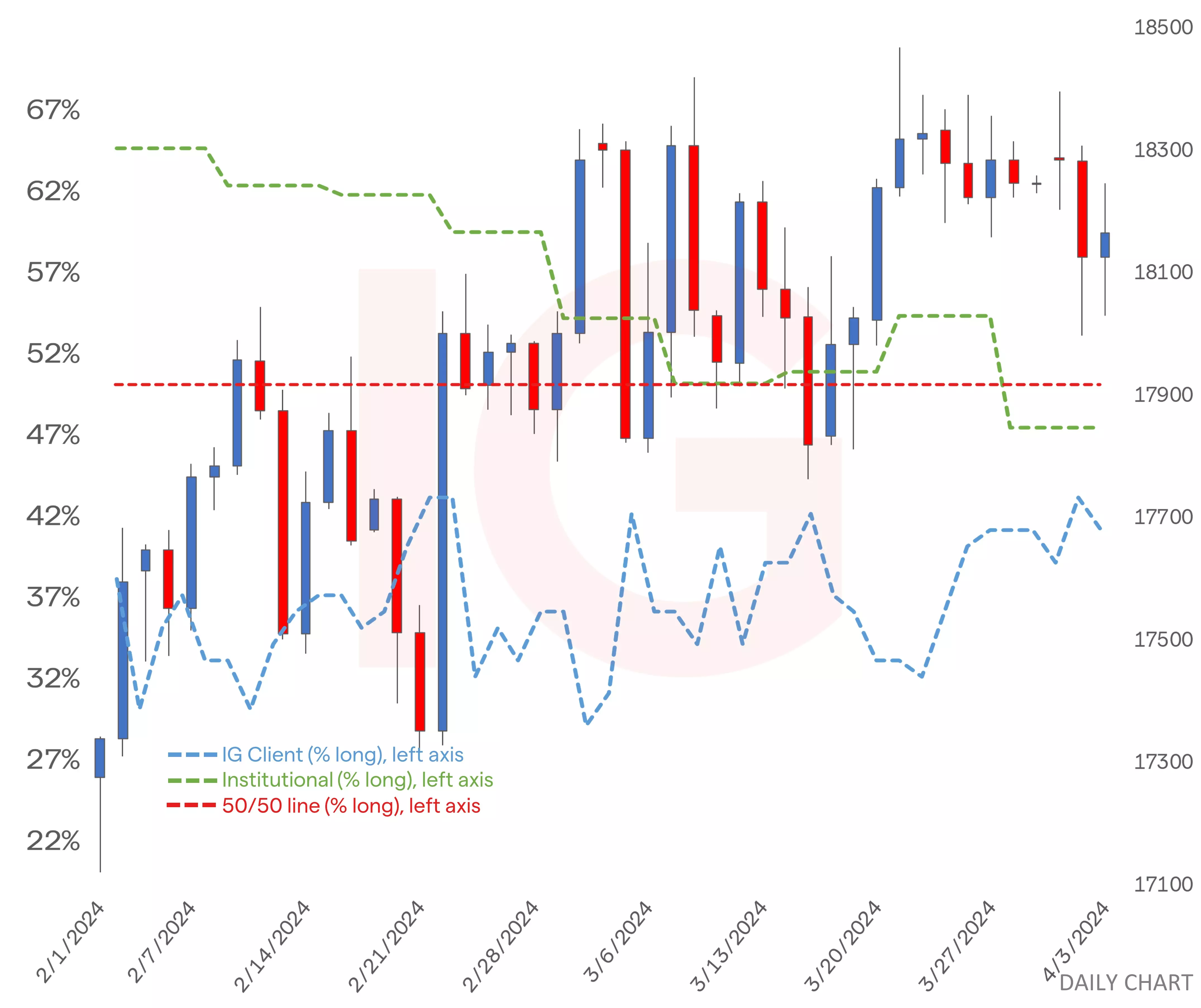

Technical overview continues to struggle on the daily time frame even as it matches the weekly’s ‘bull average’, while traders both large and small are in majority short territory.

FOMC commentary and rate cut speculations

There was plenty of FOMC (Federal Open Market Committee) members speaking. The attention was largely on Chairman Powell. He did not stick to a timeline on rate cuts, stating it's "too soon to say whether the recent readings represent more than just a bump" when referring to inflation. Bostic mentioned a potential rate cut, but only in the fourth quarter of this year. Kugler expects the disinflationary path to continue but did not specify when the first interest rate reduction in the current cycle would start. Barr commented on the resilience of the banking system.

Economic data and market reactions

Market pricing (CME's FedWatch) doesn’t need much to no longer anticipate a rate cut this June. It is pricing in fewer cuts next year, aiding the ‘higher for longer’ narrative. As for Treasury yields, they finished the session little changed but edged higher on the further end and slightly so in real terms. Breakeven inflation rates are holding at/near recent higher levels.

Economic data out of the US showed the services PMI (Purchasing Managers’ Index) for March was a miss, dropping to 51.4. It remains in expansionary territory according to ISM (Institute for Supply Management). Its employment component is still sub-50. New orders dropped to 54.4, and prices paid decreased from 58.6 to 53.4. S&P Global's survey held at 51.7.

Before this, ADP's non-farm estimate showed growth of 184K for March, besting forecasts. This comes prior to tomorrow's market-moving Non-Farm Payrolls reading, expected to be around 200K. As for today, the focus is on the weekly claims and trade data for February. More FOMC members are speaking today and tomorrow.

Wall Street: winners, losers, and surprise moves

Sector performance by the close put communication on top. There were small gains for both consumer discretionary and tech. The results were not necessarily strong but helped the tech-heavy Nasdaq 100 (US Tech 100 on IG’s trading app and platform) avoid a red finish. This contrasted with the Dow 30, and in percentage terms, Nasdaq did better than the S&P 500.

Component performance by the close put Intel at the very bottom, with foundry business losses mounting. At the top was Micron Technology, with Warner Bros Discovery and Netflix not far off. In a session where (non-component) Disney was in retreat, this occurred after Peltz's Trian Partners failed to get a seat on the company's board.

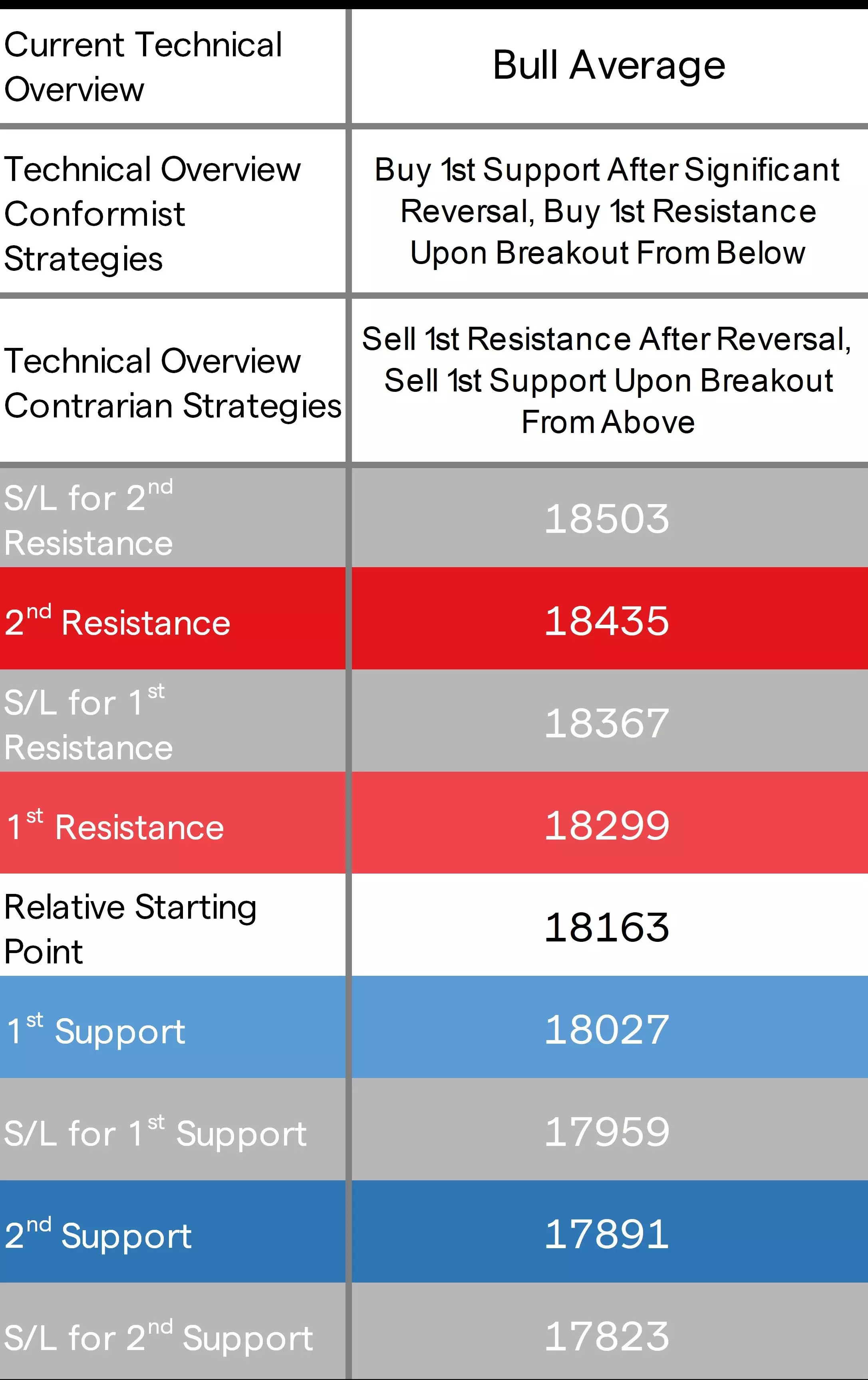

Nasdaq technical analysis, overview, strategies, and levels

When it comes to its price action, it lacked a play yesterday. The intraday highs and lows were within Wednesday’s 1st levels, keeping both conformist and contrarian strategies at bay. Key technical indicators are mostly neutral in the daily time frame. They are largely positive on the weekly. Price action within a positive channel has kept its overview ‘bull average’. Here, buying on dips comes with caution for those in the conformist camp.

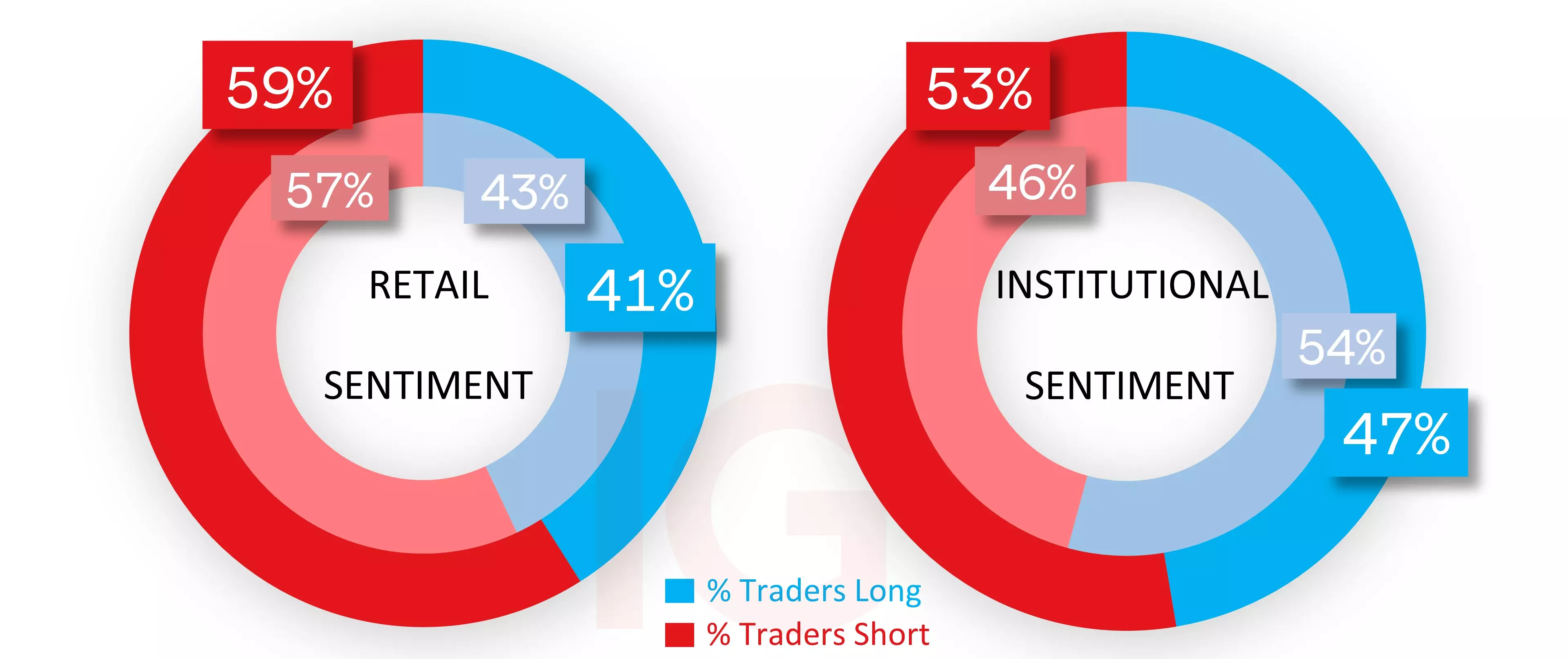

IG client and CoT sentiment for the Nasdaq

As for sentiment, slight price gains have naturally taken the retail traders' majority sell bias slightly higher, to 59% this morning from 57% yesterday. They continue to hold a significant short position in both the S&P 500 (at 68%) and the Dow 30 (at 65%).

CoT speculators recently shifted from a slight buy at 54% to a slight sell at 53%, according to last Friday’s report, where positioning is as of last Tuesday. We’ll get the latest figures tomorrow to see whether they’ve opted to remain in majority short territory.

Nasdaq chart with retail and institutional sentiment

- *The percentage of IG client accounts with positions in this market that are currently long or short. Calculated to the nearest 1%, as of today morning 6am for the outer circle. Inner circle is from the previous trading day.

- **CoT sentiment taken from the CFTC’s Commitment of Traders report, outer circle is latest report released on Friday with the positions as of last Tuesday, inner circle from the report prior.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Explore the markets with our free course

Discover and learn how the range of markets you can trade on with IG Academy's online course – ‘Introducing the financial markets’.

Put learning into action

Try out what you’ve learned in this shares strategy article risk-free in your demo account.

Ready to trade shares?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Trade on over 10,000 popular global stocks

- Protect your capital with risk management tools

- React to breaking news with out-of-hours trading on 70 key US stocks

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.