Super-sized expectations: McDonald's gears up for Q2 earnings report

As McDonald's prepares to dish out its Q2 earnings on July 27th, the fast-food giant rides high on a wave of global sales growth and digital success but struggles with inflationary pressures and supply chain issues.

McDonald's Q2 earnings report date announced

McDonald's is scheduled to report its second quarter (Q2) earnings after the market closes on Thursday, the 27th of July 2023.

The backdrop: McDonald's global presence and Q1 results

With operations spanning across more than 100 nations, McDonald's Corporation proudly hosts over 40,000 outlets as of the conclusion of 2022.

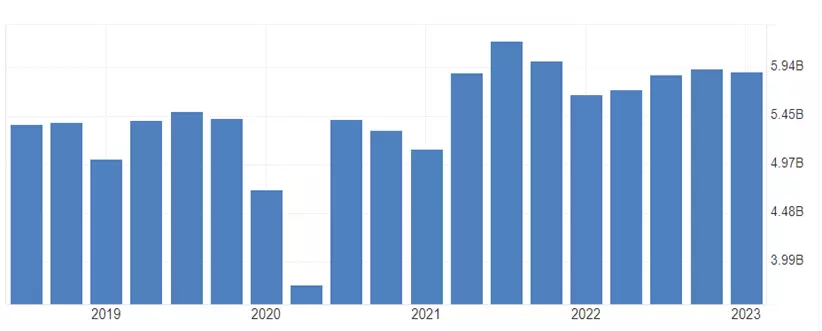

More than half the company's revenues are earned from countries outside the US. In Q1 of 2023, McDonald's reported earnings and revenues that beat analysts' expectations. Sales increased by nearly 13% globally and across each segment for the quarter.

Amidst a challenging environment and selective price rises, the appetite for McDonald's food and beverages remained robust.

"Our strong first quarter results demonstrate that our Accelerating the Arches strategy is working, as comparable sales grew 12.6% through a healthy balance of strategic menu price increases and positive traffic growth," said Chris Kempczinski, McDonald's President, and Chief Executive Officer.

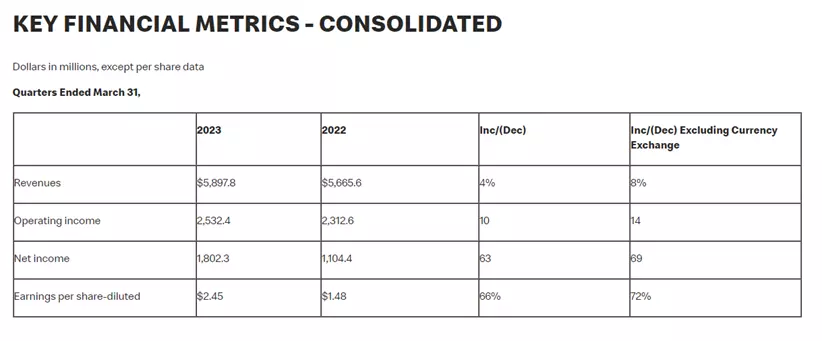

The company reported the following key numbers in its Q1 2023 earnings results.

*McDonald's earned $2.63 per share, excluding restructuring charges and other items.

McDonald's earnings expectations

McDonald’s is expected to benefit from increased US same-store sales and an increase in its share of the quick-service market in 2023, driven by the growth of digital orders and value offerings.

The company's loyalty program, of approximately 25 million active members, has the potential to drive digital sales and increase customer frequency, thereby contributing to the growth of US comparable sales.

Weaker consumer spending and McDonald’s response

Providing a potential offset to growth is weaker consumer spending due to inflation and higher interest rates. If market conditions were to deteriorate, McDonald's could introduce discounting strategies, leveraging its size advantage to capture market share through value offerings.

McDonald's expansion plans and supply chain issues

The company is expected to expand its global franchise in 2023 with another 400 planned openings in the US and 1500 globally, including 900 in China. New restaurants are expected to contribute approximately 1.5% to 2023 sales growth. However, buying power typically enables McDonald's to source products more cheaply than its rivals, but not always.

McDonald's in India's North and East divisions recently advised they would remove tomatoes from the menu due to the impact of heavy rainfall, seasonal issues on supply chains, transportation, and crop quality, which have seen the prices of tomatoes increase by five times above where they started the year.

Key financials

Wall Street's expectations for the upcoming results are as follows:

- Earnings per share: $2.76 adjusted vs. $2.63 in Q2

- Revenue: $6.24 billion vs. $5.9 billion in Q2..

McDonald's share price analysis and projections

McDonald's share price has increased by almost 11% in 2023, to be trading at fresh record highs - edging ever closer towards the psychological $300 mark. Longer-term uptrend support is viewed at $263.00.

As viewed on the daily chart below, the push to new highs has been met with bearish divergence on the RSI indicator, which suggests the uptrend is potentially running out of steam and needing a pullback.

McDonald's daily chart

If a pullback was to occur, there is good support near $280 coming from the June low and the high of November last year. Not far below that, support from the 200-day moving average comes in at $273.00.

A pullback towards the $280/$273 support zone may provide a good entry point for a retest of the $300 level before a move towards the top of the trend channel at $345, viewed in the chart above.

McDonald's weekly chart

Earnings report release and share price summary

McDonald's is scheduled to report its second quarter (Q2) earnings after the market closes on Thursday, the 27th of July 2023. Ahead of the release, the share price is trading near record highs. Dips will likely to be well supported back towards $280/$275 and again at $263.00.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.