US earnings preview: American Airlines share price overbought ahead of Q2 results

Traders should keep a close watch on the Nasdaq listed company's strategy to manage its debt, along with its ability to capitalize on robust travel demand.

When is the American Airlines earnings date?

American Airlines Group Inc. (NASDAQ: AAL) is scheduled to release results for the second fiscal quarter (Q2 2023) on the 21st of July.

American Airlines Q2 2023 earnings preview, what does ‘The Street’ expect?

American Airlines Group Inc. has recently made a positive adjustment to its earnings per share (EPS) guidance for the second quarter of 2023. The airline giant has now projected its EPS in the range of $1.45−$1.65, up from the previous forecast of $1.20−$1.40.

The improved outlook is a direct result of increasing travel demand trends and better fuel pricing.

Average ticket prices have seen a reduction, even as overall capacity has seen an expansion. This implies that while more seats are available for passengers, the revenue generated per ticket has declined. The challenge, therefore, lies in maintaining profitability while ensuring that the increased capacity is effectively utilized.

American Airlines is expected to capitalize on the resilient travel demand in the upcoming quarters. This should lead to a continued increase in total available seat miles – a key airline industry metric that refers to the total number of miles flown by all the seats available on all flights.

Is American Airlines a buy at current levels?

One of the key challenges that American Airlines faces is its high debt levels. The company's total debt of around $35bn amounts to roughly 120% of total equity. Given the prevailing high interest rates, the cost of servicing this debt is expected to remain high in the near term. This, in turn, could have an impact on the company's overall bottom-line growth.

American Airlines' revised guidance reflects a positive outlook, backed by strong demand trends and current fuel price forecast. However, the high debt level remains a concern for the company. Traders should keep a close watch on the company's strategy to manage its debt, along with its ability to capitalize on the robust travel demand, to make informed investment decisions.

After the recent run in the share price, there is the suggestion that the company currently trades around its fair value assumption at present.

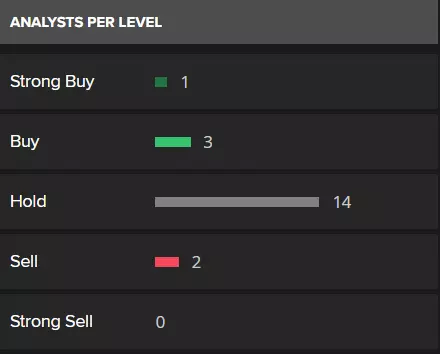

A Refinitiv poll of twenty analysts maintain a long-term average rating of hold for American Airlines (as of the 14th of July 2023.

How to trade American Airline shares

The share price of American Airlines trades firmly above the 200-day simple moving average (200MA) (blue line), although is looking overbought in the near term.

The overbought signal suggests that perhaps a short-term correction or consolidation in price might occur before the long-term uptrend is resumed.

Trend followers might prefer to find long entry on a pullback towards support at around the 17.40 to 16.80 levels before targeting further gains. That is if we see a pullback ending with a bullish candlestick / price reversal. In this scenario a close below the reversal low after a pullback might be used as a stop loss indication while in search for a move back towards the recent high and 19.65 levels.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.