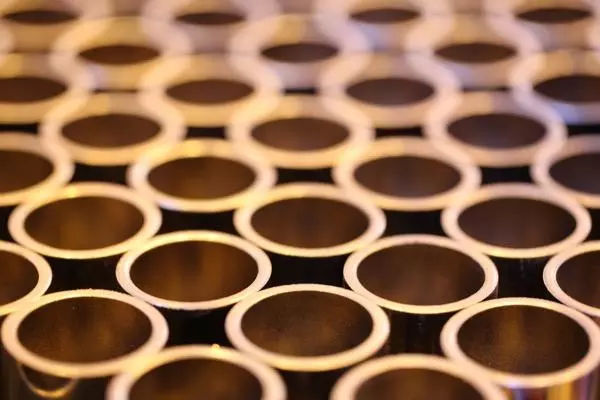

What can we expect for copper prices?

After surging close to 15% over the past weeks, can the rally for copper prices sustain?

What can we expect for copper prices?

Near term, copper prices are riding on the energy shortage crisis. While the crisis prompted metal supply cuts from China to Europe, a rebound in economic activities due to improved vaccination rates have concurrently been driving demand. The supply-demand imbalance has been reflected in the near-record low for global copper stockpiles, along with copper contracts trading in steep backwardation on the London Metal Exchange.

A look at the copper net non-commercial positioning data from the Commodity Futures Trading Commission (CFTC) indicated an increase in net-long positions from the week before. However, as copper prices near its all-time closing high, one may note that non-commercial net-long positions widely trail behind its February 2021 high. This may suggest that some market participants continue to stay on the sidelines, over concerns of softening industrial production in China and further reserve sales putting a cap on further upside.

Recent moves by China’s government to rein in coal prices ahead of winter may spur some worries that authorities are increasingly concerned on surging commodity prices, which may flow through into industrial metals. Markets caught a glimpse of this back in June, when China released some industrial metals from its national reserves to curb surging prices, fuelling some expectations that price upside may be capped by government intervention.

Copper – technical analysis

After a recent surge above its previous consolidation zone, copper prices have come off a little from its three-month high and continues to hover above the key US$10,000 per metric ton mark. A recent retest of the US$10,000 level yesterday was met with a bullish rejection, suggesting that buyers are trying to keep in control. A break below this level may potentially bring further downside to the US$9,476 level next, where a previous resistance will now serve as support.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Trade on commodities

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.1

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

1In the case of all DFBs, there is a fixed expiry at some point in the future.

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.