What's next for GameStop shares following after-hours price surge?

The GameStop share price surge continues to defy short-sellers’ predictions as it topped $209 in after-hours trading. The question is now: how long will the pump last, and what influence does this really have on the stock markets?

GameStop share price up over 90%

- Will the surge continue throughout 2021?

- Are we in a new era of social media led price pumps?

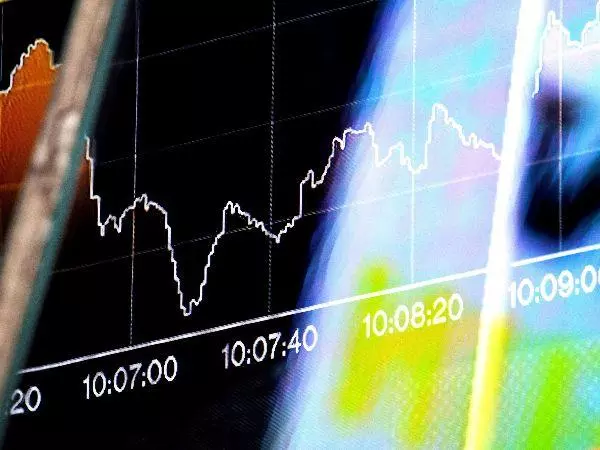

Shares in GameStop (GME.N) have surged this week, with prices up by over 90%. The unprecedented surge was helped during after-hours trading on Tuesday 26 January, when a tweet from Elon Musk sent GameStop shares into overdrive.

Elon Musk pushes GameStop shares higher

The after-hours pump pushed up the GameStop share price by 41% to $209, following its $147 close on 26 January. While long-term holders are enjoying the ride, the question analysts are asking now is how long can it last? We’ve seen social media-inspired pumps before, particularly where Musk is concerned. However, is the latest rush a flash-in-the-pan, or the dawn of a new era in trading?

After heightened activity and reactive buzz surrounding GameStop stocks, the company saw their shares skyrocket, a stark contrast to the steadily declining prices they’ve been seeing over the last few years.

Since reaching $68 a share, GameStop had failed to gain a significant amount of traction. Shares did rally in 2014 and remained moderately high until 2017. However, from that point onwards, it was downhill.

By mid-2020 GameStop shares were trading at less than $4. In this respect, the current surge looks unsustainable. However, it’s important not to ignore the upward trend witnessed at the end of 2020. Although the price chart looked nothing like it does now, shares were bullish. By November, shares were above $11 and, at the close of the year, they’d surpassed the $20 mark.

Is the popularity of after-hours trading here to stay?

After the recent surge, it’s hard for many investors to interpret whether this spike in activity will be a one-off, or regular occurrence. Moreover, whether the increase in after-hours activity is itself an aspect of the market that is here to stay.

GameStop was a rising entity heading into 2021. Even though retail sales were hit by COVID-19 restrictions, online sales were up. This shift was fuelling the bull run and, while it may not have led to recent events, it’s a sign the company was moving in the right direction. So, is the activity surrounding this relatively small company a marker of big changes to come? Moreover, will after-hours trading continue to be utilised for more major outlets?

What does the future hold for GameStop?

Indeed, even now we could see shares in AMC Entertainment (AMC.N) enjoying a similar rush thanks to online communities. The feeling among many analysts is that GameStop’s current bull run will end when the hype falls away. However, the impact this last trading week has had can’t be forgotten.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

No representation or warranty is given as to the accuracy or completeness of this information. Consequently, any person acting on it does so entirely at their own risk. Please see important Research Disclaimer.

Please also note that the information does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Any views and opinions expressed may be changed without an update.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices

See more forex live prices

See more shares live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.

See more indices live prices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 20 mins.