How to buy, sell and short Trainline shares

Trainline is an online train ticket vendor and journey planner. Discover how to buy, sell and short Trainline shares, and learn how to analyse the Trainline share price.

How to buy or invest in Trainline shares

Investing in Trainline shares means that you’ll own them outright. Buying Trainline (TRNT) shares means that you’re speculating on the Trainline share price increasing with CFDs.

Investing in the shares gives you ownership of them. You’ll become a shareholder in Trainline, meaning you’ll be eligible to receive dividends if the company pays them and you could be granted voting rights in company decisions.

Buying shares by speculating on their price with CFDs means you’ll be opening positions on leverage. You won’t need to pay the full value of the shares upfront. Instead, you’ll open a position with margin – giving you full market exposure for an initial deposit.

To buy or invest in Trainline shares, follow the steps below:

Investing in Trainline shares

- Create or log in to your share dealing account and go to our trading platform

- Search for ‘Trainline’

- Select ‘buy’ in the deal ticket to open your investment position

- Choose the number of shares you want to buy

- Confirm your purchase and monitor your investment

Trading Trainline shares

- Create or log in to your trading account and go to our trading platform

- Decide whether you want to trade CFDs

- Search for ‘Trainline’

- Choose your position size

- Select buy and monitor your trade

You might prefer to speculate on the Trainline share price with CFDs. You’ll be able to:

- Get full exposure with a 20%-25% deposit on almost all of our tier-one shares1

Open an account now to get started

How to sell and short Trainline shares

Selling Trainline shares means that you’ll be exiting your investment position. You’d do this to realise your profits or cut your losses – depending on how the share price has moved.

For example, if the Trainline share price increased above the price at which you bought the shares, you’d make a profit. But, if the price fell below the price at which you bought the shares and you decided to sell your investment position, you’d incur a loss.

Shorting Trainline shares is different to selling. It’s made possible through financial derivatives like CFDs. You’d short Trainline with these products if you felt that – based on your analysis – the price was going to fall. In doing so, you’d make a profit on a falling market, providing the Trainline share price decreased as you’d predicted.

To short Trainline shares, follow the steps below:

Shorting Trainline shares

- Create or log in to your trading account and go to our trading platform

- Search for ‘Trainline’

- Choose your position size

- Choose ‘sell’ in the deal ticket to go short and speculate on the price falling

- Confirm and monitor your short position

Trainline shares: the basics

Trainline shares are listed on the London Stock Exchange (LSE) under the TRN ticker. The company is a constituent of the FTSE 250. Trainline completed its initial public offering (IPO) in June 2019 – which put a £1.68 billion valuation on the company after its first day of trading.

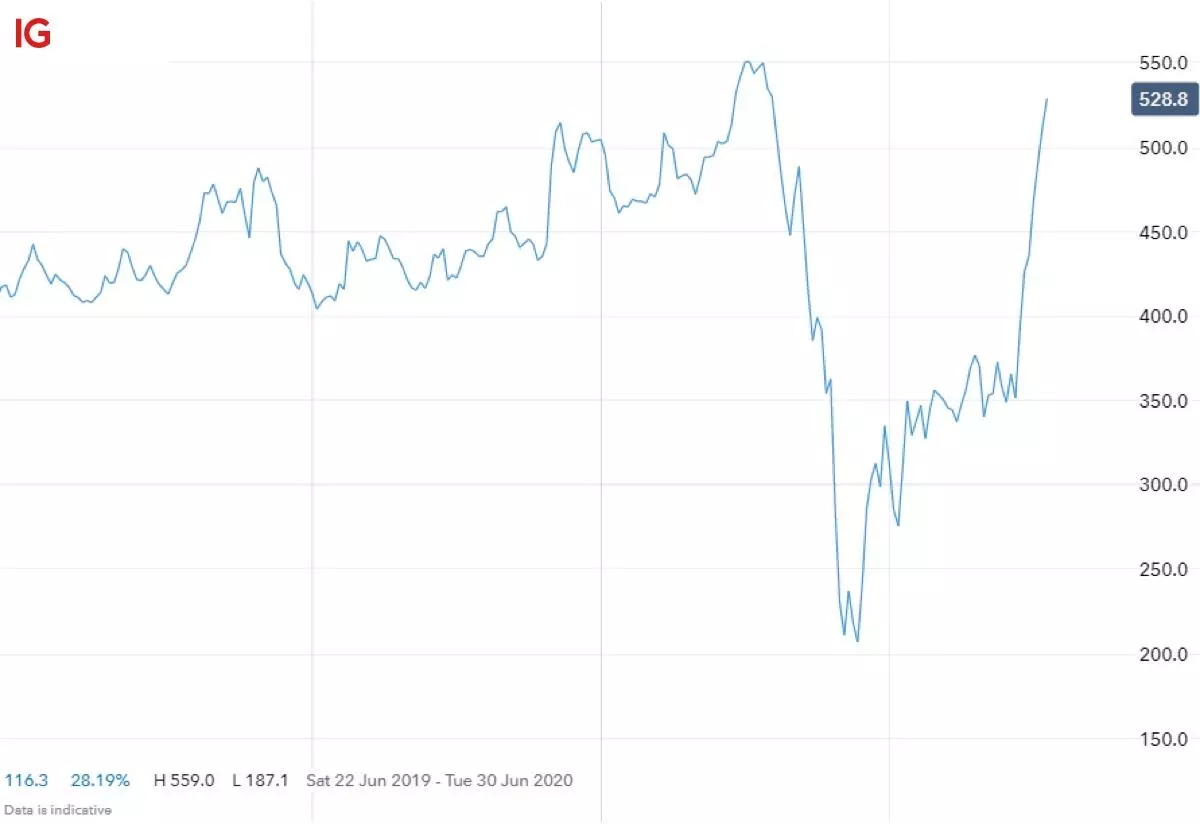

You can see a screengrab from our trading platform of the Trainline share performance from 22 June 2019 to 22 May 2020 below.

Trainline: a brief history

Trainline began life as thetrainline.com in 1997. This was the company’s name until 2015, when private equity firm KKR bought the company and rebranded it as Trainline. KKR kept a stake in Trainline until November 2019, when it cashed out its holdings – a total stake of 68 million shares – for upwards of £279 million in profit.

The sale came five months after Trainline’s IPO in June 2019, which was what enabled KKR to cash out at a tidy profit. Since then, Trainline’s revenues, profits and share price have all been hit by the coronavirus pandemic in the early and middle stages of 2020.

National lockdowns in the UK and Europe – where Trainline runs the majority of its operations – meant that customers were less inclined and less able to take journeys via rail. That said, at the time of writing (26 May 2020), the share price was recovering as lockdowns began to be lifted and governments attempted to achieve a partial return to normality.

Trainline key personnel

There are nine people on the senior leadership team at Trainline:

| Clare Gilmartin | Chief executive officer (CEO) |

| Shaun McCabe | Chief finance officer (CFO) |

| Mark Holt | Chief technology officer |

| Victoria Biggs | VP brand and communications |

| Bill Hopkins | Executive director operations and TOC solutions |

| Neil Murrin | General counsel and director regulatory affairs |

| Robin Hancock | Chief people officer |

| Pete Wade | VP growth |

| Alidad Moghaddam | General manager international |

Trainline business model

As a ticket purchasing and journey planning company, Trainline is paid commission by rail and coach operators for ticket sales. It also generates revenue through booking fees, travel insurance, advertising and through white label products developed for rail companies.

The company is looking to expand its operations in the coming years, particularly in Europe. It is also looking to expand the number of rail carriers and journey providers that it works with.

Trainline share price analysis: how to analyse the Trainline share price

You can use both technical and fundamental analysis to analyse the Trainline share price.

Technical analysis can help you to attempt to determine a future price movements of Trainline shares based on chart patterns and price action. Popular technical indicators include moving averages, the parabolic SAR, the Williams %R and the stochastic oscillator.

Fundamental analysis will look at factors like news reports, government announcements or company leadership changes. These could be good or bad news for the Trainline share price, depending on the circumstances. For example, when governments announced national lockdowns the share price fell, but when lockdowns were slowly lifted the share price increased.

Footnotes

1Deposits on leveraged trades are 20%-25% for 99.14% of tier-one shares (correct as of 1 June 2020). For more information, view our share trading margin rates.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

Please see important Research Disclaimer.

Explore the markets with our free course

Discover and learn how the range of markets you can trade on with IG Academy's online course – ‘Introducing the financial markets’.

Put learning into action

Try out what you’ve learned in this shares strategy article risk-free in your demo account.

Ready to trade shares?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Trade on over 10,000 popular global stocks

- Protect your capital with risk management tools

- React to breaking news with out-of-hours trading on 70 key US stocks

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.