IG clients seek opportunity as they trade through the economic downturn

Recession and inflation are now the main concerns for IG clients, with over 60% worried that they could impact the performance of their investments over the next six months, while half are concerned about wars and conflicts amid the backdrop of Russia’s invasion of Ukraine and rising tensions between the US and China.

New Covid-19 variants, the second-biggest concern to clients a year ago, are now a concern for just 10% of clients.

Overall, around a quarter of clients expect a year to pass before gross domestic product (GDP) growth resumes. Around 15% expect a two-year period when growth remains negative. Only a small number expect a rebound in the short-term.

Despite these economic worries, around a third of IG clients expect stock markets to post a healthy recovery next year, in line with some of the better years of the past decade, with another group expecting a modest rebound. Conversely, a fifth of those surveyed think that markets will fall next year, although even then expectations are limited for the most part to a fall of no more than 10%. Around ten percent expect a much tougher year, a reflection of concerns that 2023 will see the beginning of an extended recession around the globe.

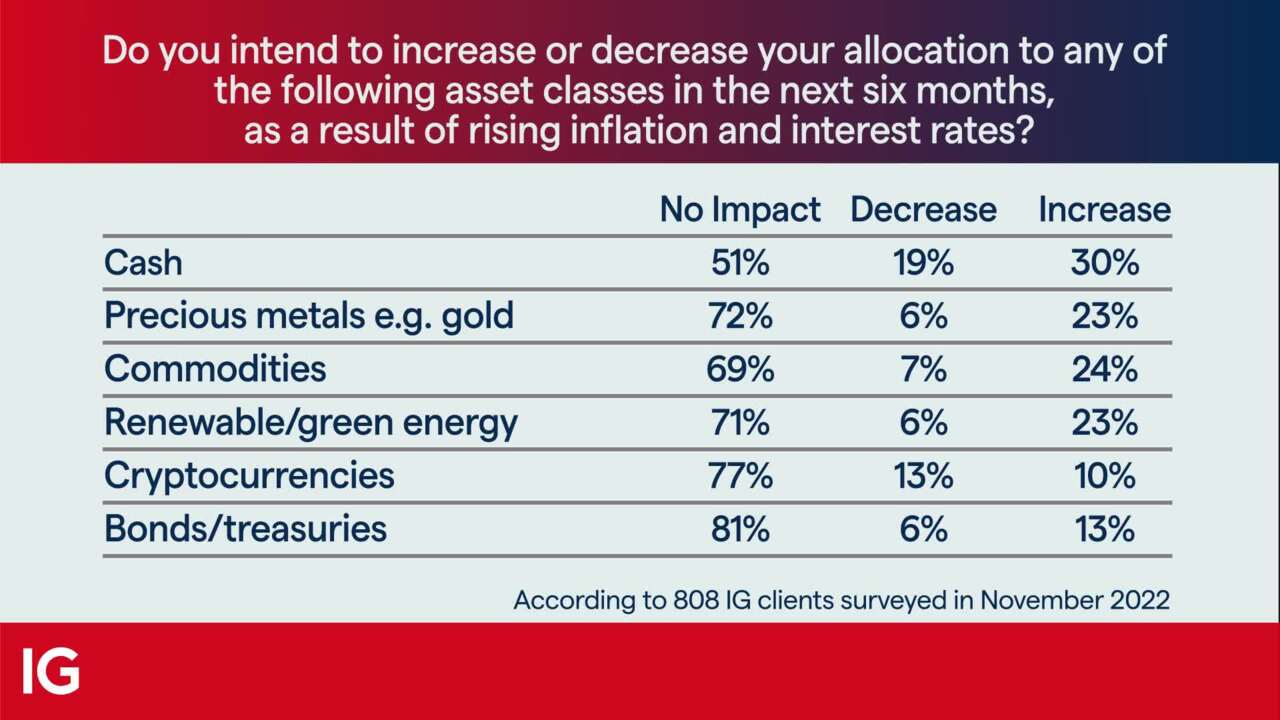

The market falls in 2022 have meant that around a third of IG clients have increased their asset allocation to cash, to protect against further declines. In addition, where they have increased exposure to stocks, it has primarily been in value stocks, whereas over 25% of those asked have cut back their exposure to growth stocks in sectors like Big Tech and Healthcare.

Despite the declines, a majority of clients want to boost investments in a variety of assets, ranging from commodities to growth stocks and real estate. Cryptocurrencies remain popular too, while geographically emerging markets are favoured over US ones.

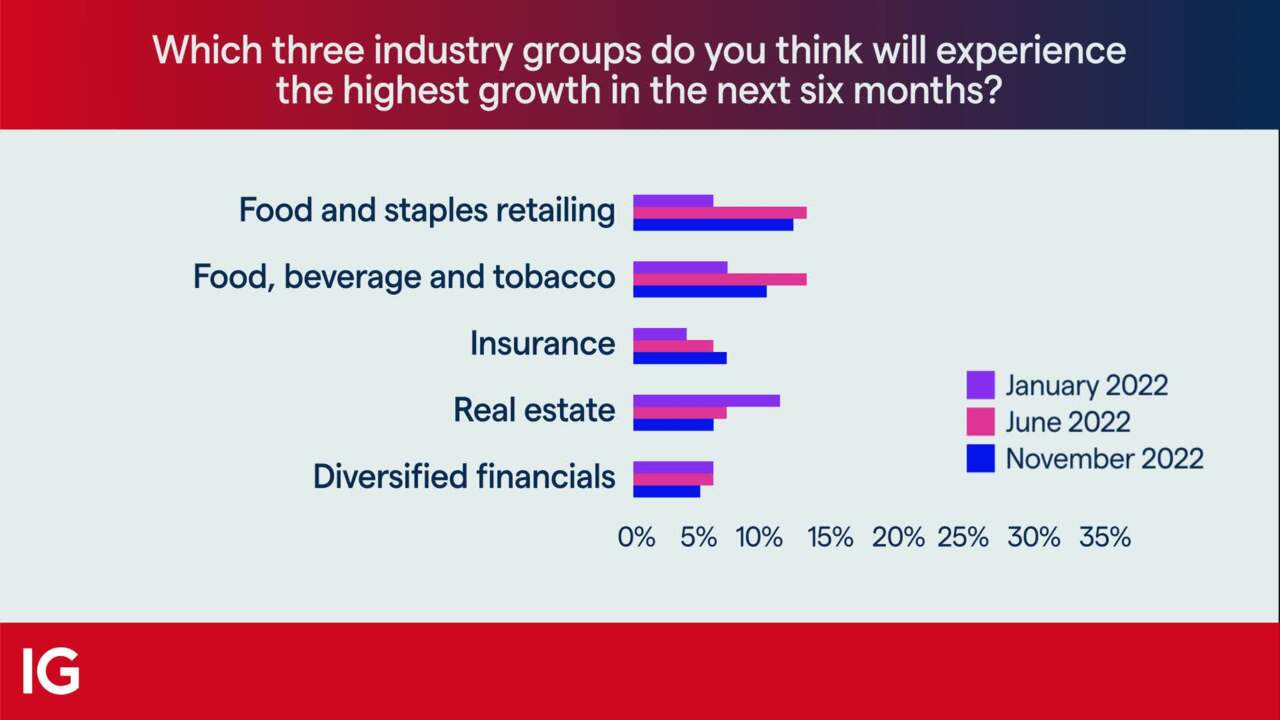

Clients expect the energy sector to see the highest growth in the next six months, as recent strong oil and gas prices following Russia’s invasion of Ukraine pushes up earnings in the sector. Banks are also expected to see strong growth, thanks to rising interest rates boosting profit margins. By contrast, real estate and retail are forecast to suffer, thanks to rising inflation and higher borrowing costs hitting consumers' ability to borrow and also crimping their spending.

Earnings season, with its potential for news-driven market volatility, is likely to be a busy time for IG clients. Almost two-thirds of those surveyed think that they will be on the lookout for more trading opportunities when the next earnings season rolls around towards the end of January 2023.

IGA, may distribute information/research produced by its respective foreign affiliates within the IG Group of companies pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, IGA accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact IGA at 6390 5118 for matters arising from, or in connection with the information distributed.

The information/research herein is prepared by IG Asia Pte Ltd (IGA) and its foreign affiliated companies (collectively known as the IG Group) and is intended for general circulation only. It does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

Please see important Research Disclaimer.

React to global volatility

Market volatility continues as coronavirus concerns amplify. Trade with IG and take advantage of:

- Tight spreads – from just 1 point on major indices, and 2.8 on US crude

- Guaranteed stops – they’re free to use, and only incur a fee when triggered

- Round-the-clock assistance – our highly skilled team are available when you need support