When will my funds be available to withdraw after I sell shares?

Understanding the settlement period

When you sell shares, there is a required 'settlement period' before your funds become available for withdrawal:

| Share Type | Settlement Period | Example |

| US Shares | T+1 (1 working day) | Sell on Monday → Available Tuesday |

| All Other Shares | T+2 (2 working days) | Sell on Monday → Available Wednesday |

Note: 'T' stands for the transaction date (the day you sell your shares). This settlement period is necessary for the exchange, clearance, and settlement of your trade, and it is determined by the underlying market regulations that we must adhere to. |

| More Information: What is Settlement? How does settlement affect my share dealing position? When will my funds be available to withdraw after I sell shares? |

| You Can | You Cannot |

| ✅ Reinvest these funds in a different stock on the same account | ❌ Transfer funds to another IG account: you cannot make inter-account transfers |

| ❌ Withdraw these funds |

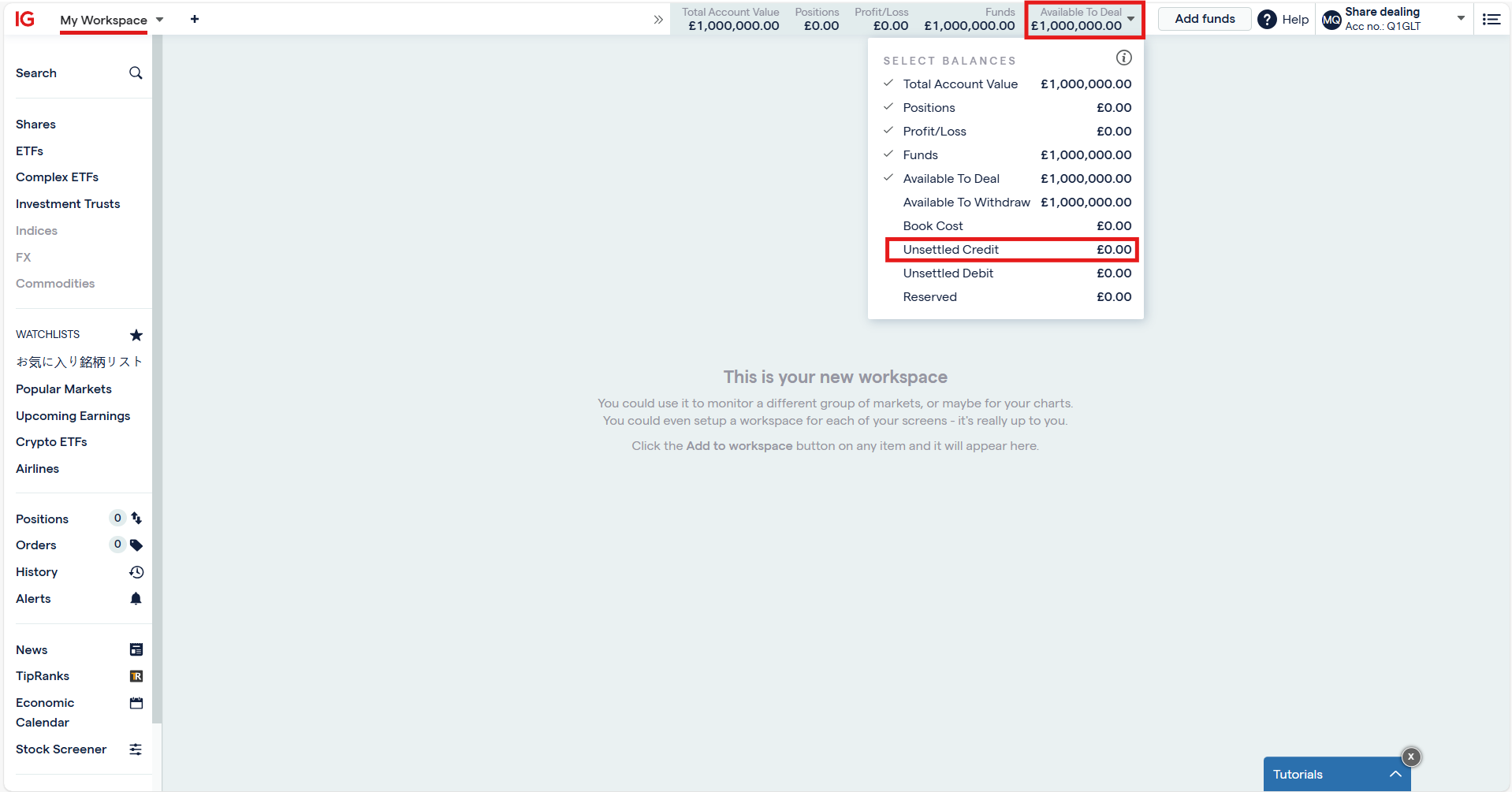

On desktop:

On Mobile:

After the settlement period, you can request a withdrawal. The following withdrawal processing times will apply:

Card/ApplePay: Withdrawals requested Monday to Friday (before 8pm) are processed the same day, however it can take up to 5 working days to receive the funds depending on your bank.

- Bank transfer:

- Bank withdrawals requested before 12 o'clock (UK time) on a working day should be processed the same day.

- Domestic withdrawals less than 100 GBP are processed as BACS which can take up to 3 working days.

- Domestic withdrawals greater than 100 GBP are processed as Faster Payments and should arrive the same day.

- Currency and international withdrawals may take up to 3 working days or longer, depending on the receiving bank.

On desktop:

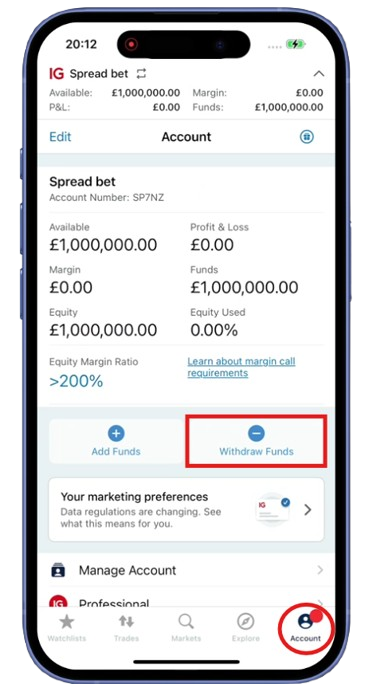

On mobile app:

Go to: Bottom right corner Accounts > Withdraw funds.

Please Note:

|