Find out more or choose another breakaway

In collaboration with Dr Robert Hancké of the London School of Economics, Australia’s No. 1 retail FX provider,1 IG, has considered...

Breakaway region London

Parent country UK

Old currency British Pound (GBP)

New currency London Pound

London dominates the British economy, and contributes a disproportionate share of the country’s tax revenue. Would the benefits of going it alone be worth the political fallout?

Monetary secession would immediately give the London region an ultra-high income and wealth status, commensurate with Switzerland and Monaco

The new currency is very likely to appreciate significantly against the pound and other major currencies

Export competitiveness could fall, but that may not pose much of a problem for relatively cost-insensitive, high-end, international industries like finance, consulting, law and the creative sector

The rest of the UK could have a more balanced economy – one that is less dependent on the City

A relative fall in the value of the pound could make exports significantly more competitive and lead to a revival of manufacturing, stabilised incomes, and reduced inequality. Over time, a rising GDP could increasingly make the region more self-sufficient

But without London, the rest of the UK could remain a relatively small economy, and struggle to reboot its economic model given global competition

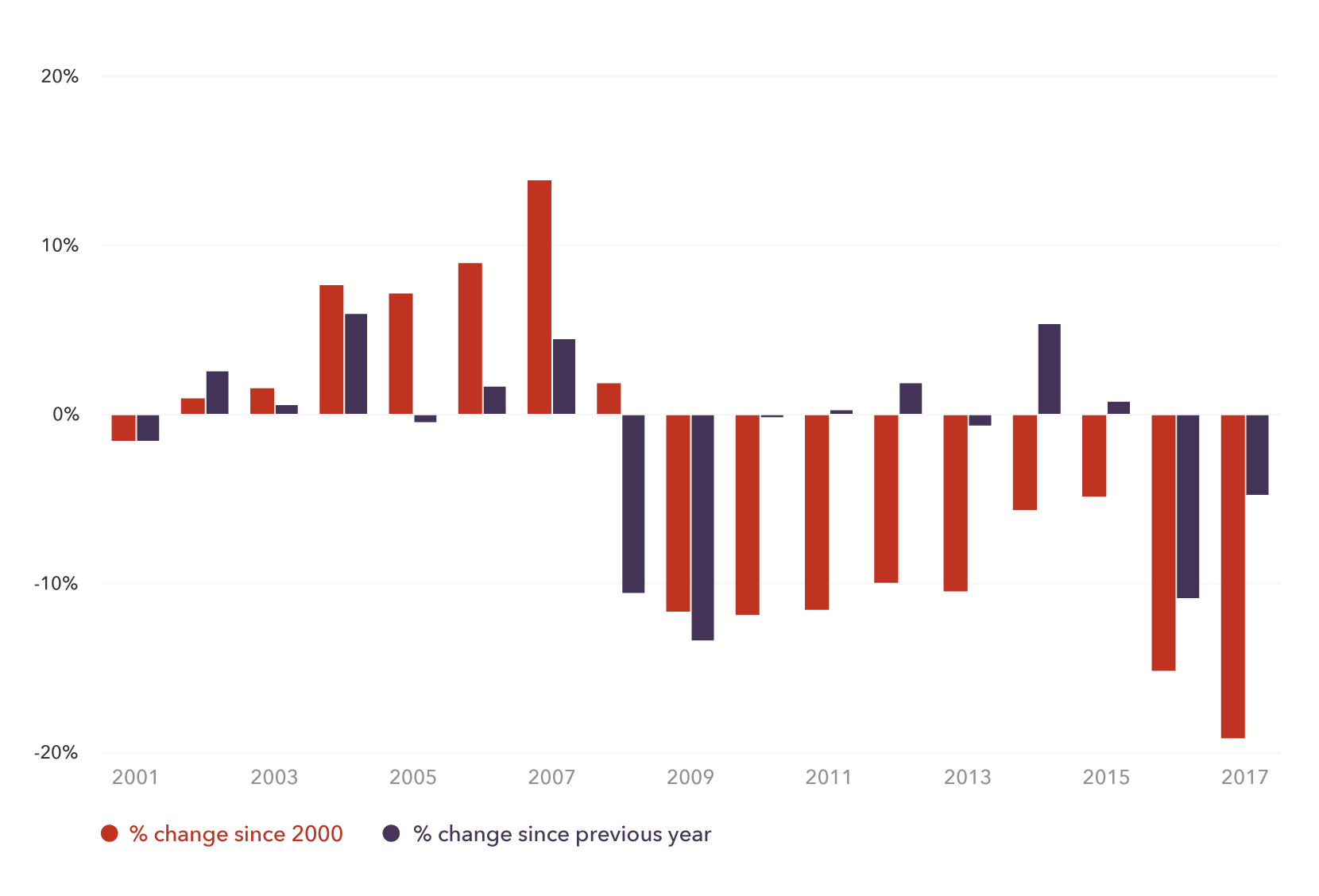

Change in value of British pound (GBP) since 2000, based on SDRs per currency unit source

Dr Robert Hancké

“Unless monetary secession ultimately leads to political secession, and the city-state London applies for EU membership within the next few years (so that it can remain the EU’s financial centre), moving towards an independent currency is likely to involve more costs than benefits.”

Monetary independence for London would likely throw the entire UK political economy into turmoil

The Bank of England would likely no longer supervise, regulate and support the largest part of the UK economy

Any new central bank of London would immediately need a sophisticated political mandate and dedicated resources to take over those functions

Assuming the rest of the UK remains a single unit – which is not guaranteed, given calls for Scottish independence – it could suddenly face a budget deficit of 15-20%

The benefits of monetary independence for London are unclear

As it stands, the British pound is more tailored to the economic needs of London and the south-east of England than cities like Liverpool or Newcastle

Despite the uniqueness of London in the UK political economy, secession is currently not even debated

It is also unclear how a new currency could practically be introduced under current constitutional arrangements in the UK