Find out more or choose another breakaway

In collaboration with Dr Robert Hancké of the London School of Economics, Australia’s No. 1 retail FX provider,1 IG, has considered...

Breakaway region Sicily

Parent country Italy

Old currency Euro (EUR)

New currency New Sicilian Lira

Economically weak regions can potentially make themselves more competitive by creating their own currency. But does Sicily have what it takes to make the most of financial independence?

A weaker currency, with a lower exchange rate, could instantly improve Sicily’s export competitiveness

Since much of Sicily’s economy is in low-productivity sectors such as construction, agriculture, and public services, an independent currency is likely to lead to a significant drop in living standards

It’s unlikely that Sicily’s example will be followed by other Italian regions; Sicilian independence would probably not cause the country to break up

But Italy itself might follow Sicily’s example and leave the eurozone if the exchange rate depreciation bears fruit

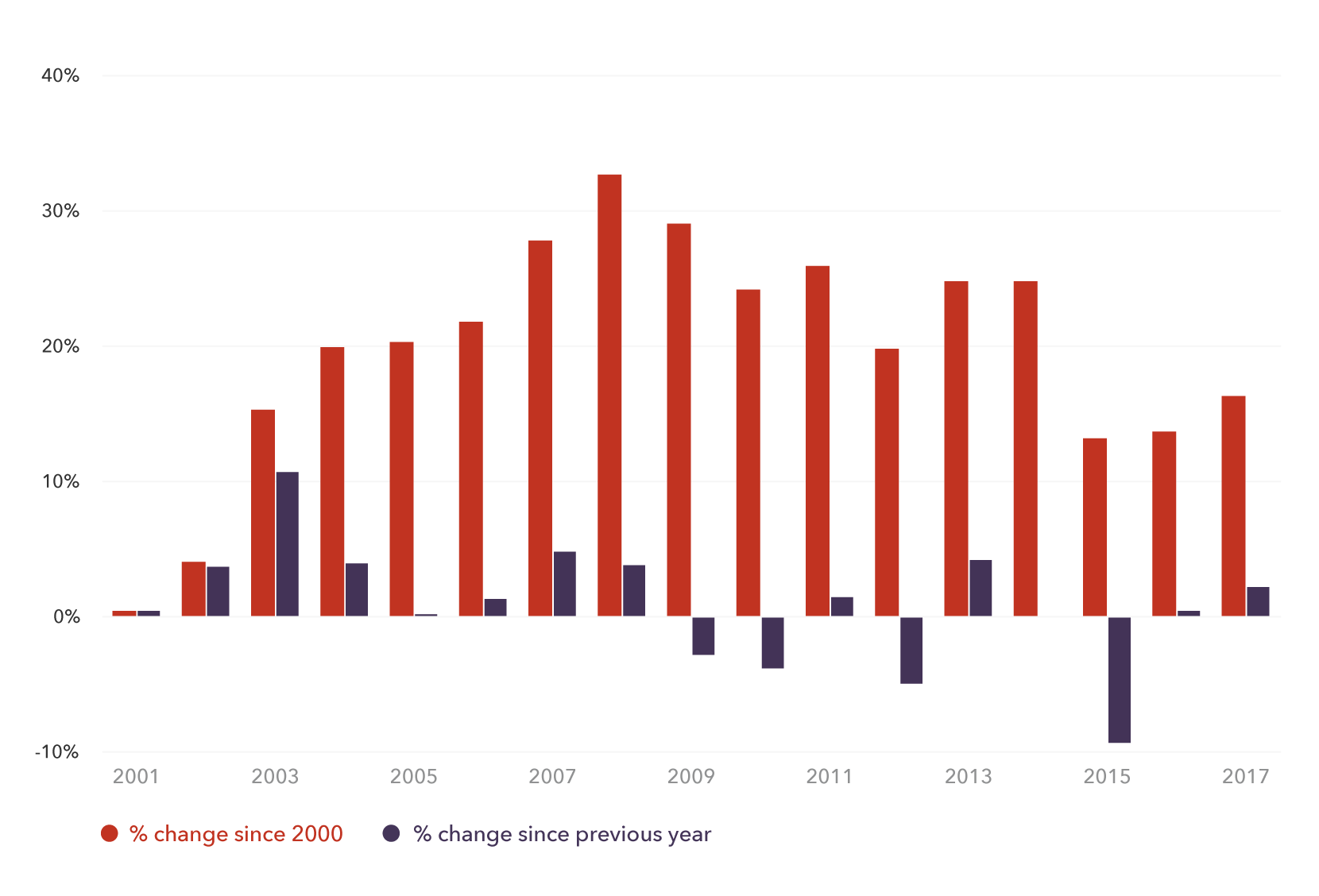

Change in value of euro (EUR) since 2000, based on SDRs per currency unit source

Dr Robert Hancké

“The region has relatively few potential growth industries of the kind for which a softer currency would be more appropriate.”

A break-up of the rest of the country is unlikely, not least because Sicily is an island and therefore has no land borders with the rest of Italy

It might trigger similar reactions from other weak regions in Europe that feel trapped in their current currency regime

The Sicilian economy may be structurally too weak to benefit from an autonomous currency

Problems of resource diversion through corruption are likely to remain a significant issue