The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication.

The recent wobble in global stock markets has some of its foundation rooted in rising bond yields. The ten-year US Treasury is fast approaching a yield of 3%, a number that some say may act as a tipping point, at which stage investors in the equity markets may start looking at bonds as a more reliable return than the stock markets.

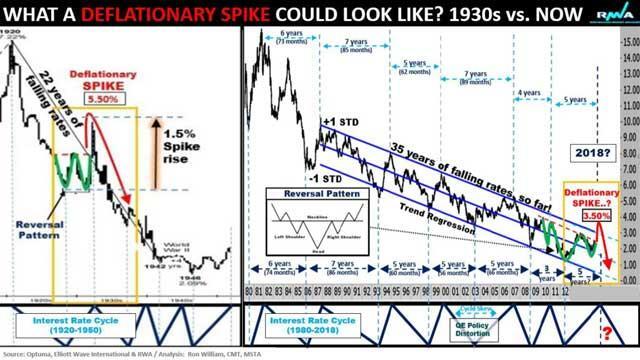

Spike risk to 4%

Ron William MSTA CMTA, founder and technical analyst at RW Advisory, explains his case for rising bond market yields. He says that the ten-year US Treasury yield is expected to pass 3%, with the possibility of a ‘spike risk’ to a level closer to 4%. That would be a level not seen since 2010, when the markets were in the heat of the financial crisis.

William explains that the recent market turbulence has highlighted the fear that the equity market is feeling at the recent elevated levels. He reminds us that, while markets track the Volatility Index (VIX), the rising bond yield is an equally important measurement of ‘fear’.

Debt default worries as rates climb

Under normal conditions, a yield of 3% would not necessarily stir too much fear. However, the issue that many economies face is that this period of low rates, represented by the record low bond yields, has encouraged many to take on debts that may become unserviceable. As yields rise, so too will interest payments on anything other than agreements with a period of fixed payments.

The big question is, how will the authorities respond? With record levels of debt built up on excessive low interest rates and quantitative easing (QE), markets have been lulled into a false environment. Will governments feel a responsibility to those that face a painful fiscal squeeze? If not, could we be facing an even worse time than the markets faced in 2008-2009?