Market update: Federal Reserve March announcement: rate outlook & market reactions

In the upcoming March announcement from the Federal Reserve, all eyes are on interest rate decisions and forward guidance, with potential market impacts at stake.

The Federal Reserve will release its March monetary policy announcement on Wednesday. Consensus estimates overwhelmingly suggest that the institution led by Jerome Powell will hold its benchmark rate unchanged within its current range of 5.25% to 5.50%, effectively maintaining the status quo for the fifth consecutive meeting. Moreover, analysts widely anticipate that the central bank will keep its quantitative tightening program intact for now, continuing to reduce its bond holdings gradually.

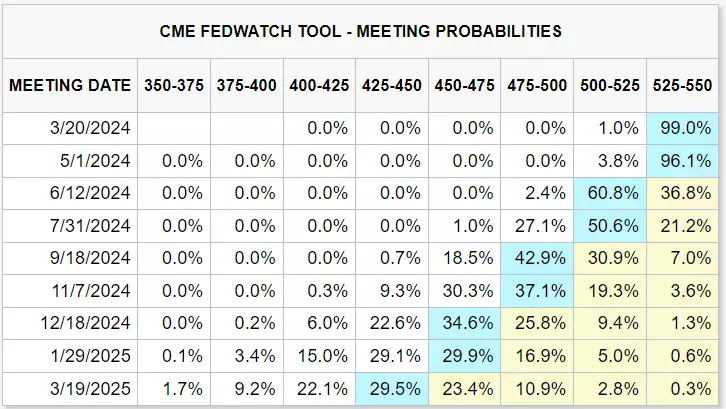

While the decision on interest rates themselves may not deliver dramatic surprises, markets will be laser-focused on the forward guidance. With that in mind, the FOMC may repeat that it does not expect it will be appropriate to reduce borrowing costs until it has gained greater confidence that inflation is converging sustainably toward two percent – a move that would indicate more evidence on disinflation is needed before pulling the trigger. Current FOMC meeting probabilities are shown below.

FOMC meeting probabilities

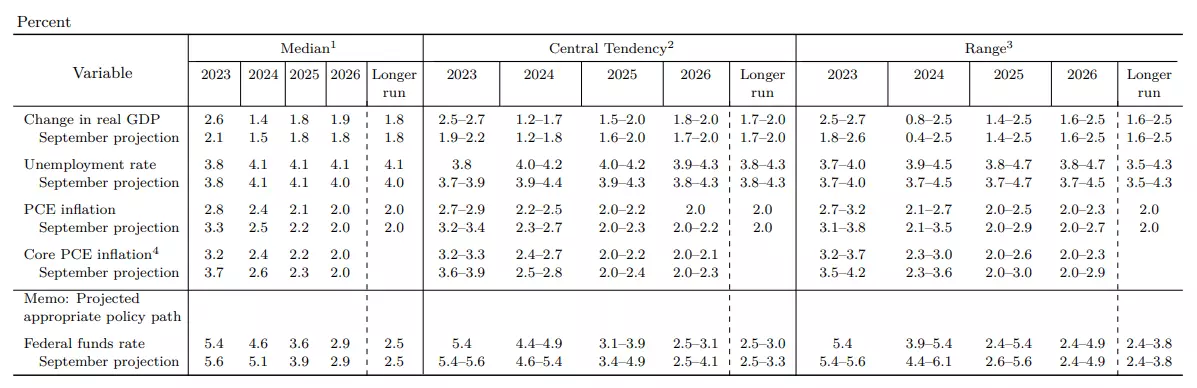

In terms of macroeconomic projections, the Fed is likely to mark up its gross domestic product and core PCE deflator forecasts for the year, reflecting economic resilience and sticky price pressures evidenced by the last two CPI and PPI reports. The revised outlook could compel policymakers to signal less monetary policy easing over the medium term, potentially scaling back the three rate cuts initially envisioned for 2024 to only two.

Market reaction: Fed's signal impact on yields, dollar, stocks & gold

If the Federal Reserve signals a greater inclination to exercise patience before removing policy restraint; and shows less willingness to deliver multiple rate cuts, we could see US Treasury yields and the US dollar charge upwards in the near term, extending their recent rebound. Meanwhile, stocks and gold, which have rallied strongly recently on the assumption that the central bank was on the cusp of pivoting to a looser stance, could be in for a rude awakening (bearish correction).

Chart on the projections from the December FOMC meeting

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG Bank S.A. accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer.

Explore the markets with our free course

Learn how shares work – and discover the wide range of markets you can trade CDFs on – with IG Academy's free ’introducing the financial markets’ course.

Put learning into action

Try out what you’ve learned in this shares strategy article risk-free in your demo account.

Ready to trade shares?

Put the lessons in this article to use in a live account – upgrading is quick and easy.

- Trade over 12 000 popular global stocks

- Protect your capital with risk management tools

- React to breaking news with out-of-hours trading on 70 key US stocks

Inspired to trade?

Put your new knowledge into practice. Log in to your account now.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.