Earnings season

Trade when it matters this US earnings season, by taking your position the moment announcements happen with our exclusive out-of-hours markets.

Why trade earnings season with us?

Take your position on all session US shares

Capitalise on announcements with 70+ out-of-hours US stocks

Pricing and execution

We aim to offer you the best price and faster execution

Keep your finger on the pulse

React to breaking news with custom alerts sent by text, email or push notification

Go long or short on a huge range of global stocks

Take advantage of rising and falling prices with CFDs

Stay up to date with expert analysis

Inform your trades with regular insights from our in-house team

Open your position on the move

Download our award-winning mobile app to trade wherever, whenever1

Unique out-of-hours opportunities

Most company earnings are released outside of the main market session, which means the majority of traders have to wait to take their position. With us, you can trade 70+ key US stocks out-of-hours to capitalise on earnings as soon as they’re announced.

CFD on All Session US shares

10am to 2am Monday to Thursday, and 10am to 11pm Friday (Geneva time)

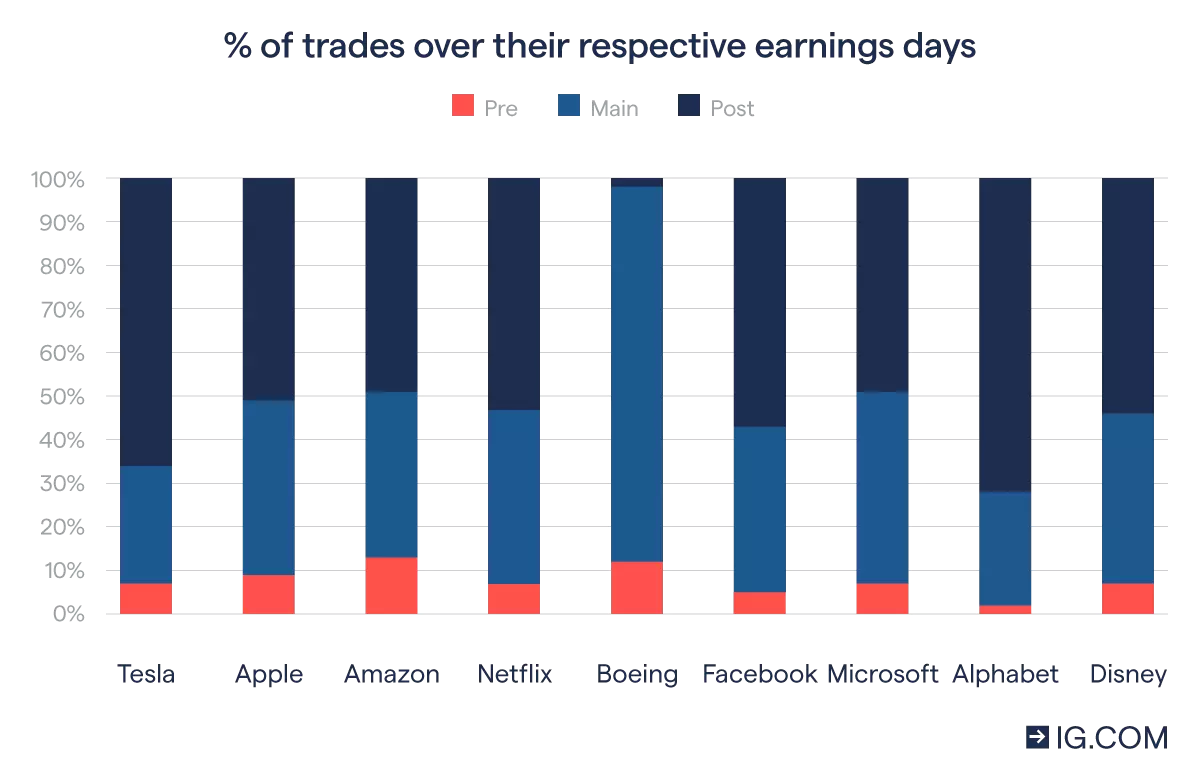

Earnings announcement days: when do trades take place?

A vast number of our clients trade pre- and post-market to take advantage of earnings volatility – as you can see in this chart.

For example, 60% of our clients traded on Netflix’s Q1 earnings outside of the main session. While the volume of trades on Alphabet’s Q1 out of hours was even higher at 74%.

Data relates to Q1 earnings announcements. Source: IG.com, 2020

What to watch this earnings season

The earnings season that starts in July 2020 marks the first time companies will report how the Covid-19 pandemic has impacted them. It’ll be important to look at both companies that are expected to have been positively affected by the lockdown measures, and those that have suffered.

- Stay-at-home stocks

- Remote working stocks

- Coronavirus vaccine stocks

- Travel stocks

- Bank stocks

- 5G stocks

Investors rallied around these shares in the expectation that they would gain in value, as consumers sought out ways to cope with life in lockdown. As a result, many entertainment companies, home delivery firms and exercise equipment makers saw an uptick in sales and their share prices.

As the economy reopens, these stocks could become less popular. It will be interesting to see what effect their time in the spotlight has had on their bottom lines this earnings season.

US stocks to watch: Netflix, Disney, Peloton and Amazon

These prices are indicative, and subject to our website terms and conditions.

These prices are indicative, and subject to our website terms and conditions.

Pharmaceutical, biopharmaceutical and life sciences companies are all racing to find a vaccine against Covid-19, as well as diagnosis tests to help combat the virus.

Some are further ahead in trials than others. It’s likely that the first company to release a successful vaccination will see a massive impact on its share price – this makes it important to understand where each company is at in terms of their research and progression.

US stocks to watch: Inovio Pharmaceuticals, Moderna, Pfizer and Novavax

Swiss stocks to watch: Novartis and Roche Holding

These prices are indicative, and subject to our website terms and conditions.

Travel companies were among the first to be impacted by lockdown measures – causing falling demand for flights, hotels and entertainment venues such as casinos. The mass cancellations of holidays could result in enormous losses and difficulties paying off any fixed costs.

As lockdown measures ease, there is the potential for these stocks to see gains again. But until travel between countries is back up and running, demand will be limited.

US stocks to watch: Boeing, American Airlines Group, Penn National Gaming and Eldorado Resorts

These prices are indicative, and subject to our website terms and conditions.

Low interest rates could impact bank stocks significantly this earnings season, as well as the decline in demand for services such as asset management and foreign exchange.

Many analysts are expecting a slow. The associated unemployment and loan losses could then play out on the banks’ profits.

US stocks to watch: Wells Fargo, JPMorgan Chase, Citigroup and Goldman Sachs

Swiss stocks to watch: Credit Suisse and UBS

These prices are indicative, and subject to our website terms and conditions.

Many smartphone stocks took a beating in the coronavirus slowdown, but proponents of the 5G wireless market believe it could boost earnings again. The introduction of this tech has also been slowed by the pandemic, but some major providers have started introducing coverage.

It’s worth keeping an eye on the whole supply chain, from chip makers to providers.

US stocks to watch: Analog Devices, Verizon and Sprint

These prices are indicative, and subject to our website terms and conditions.

Keep up to date on earnings reports

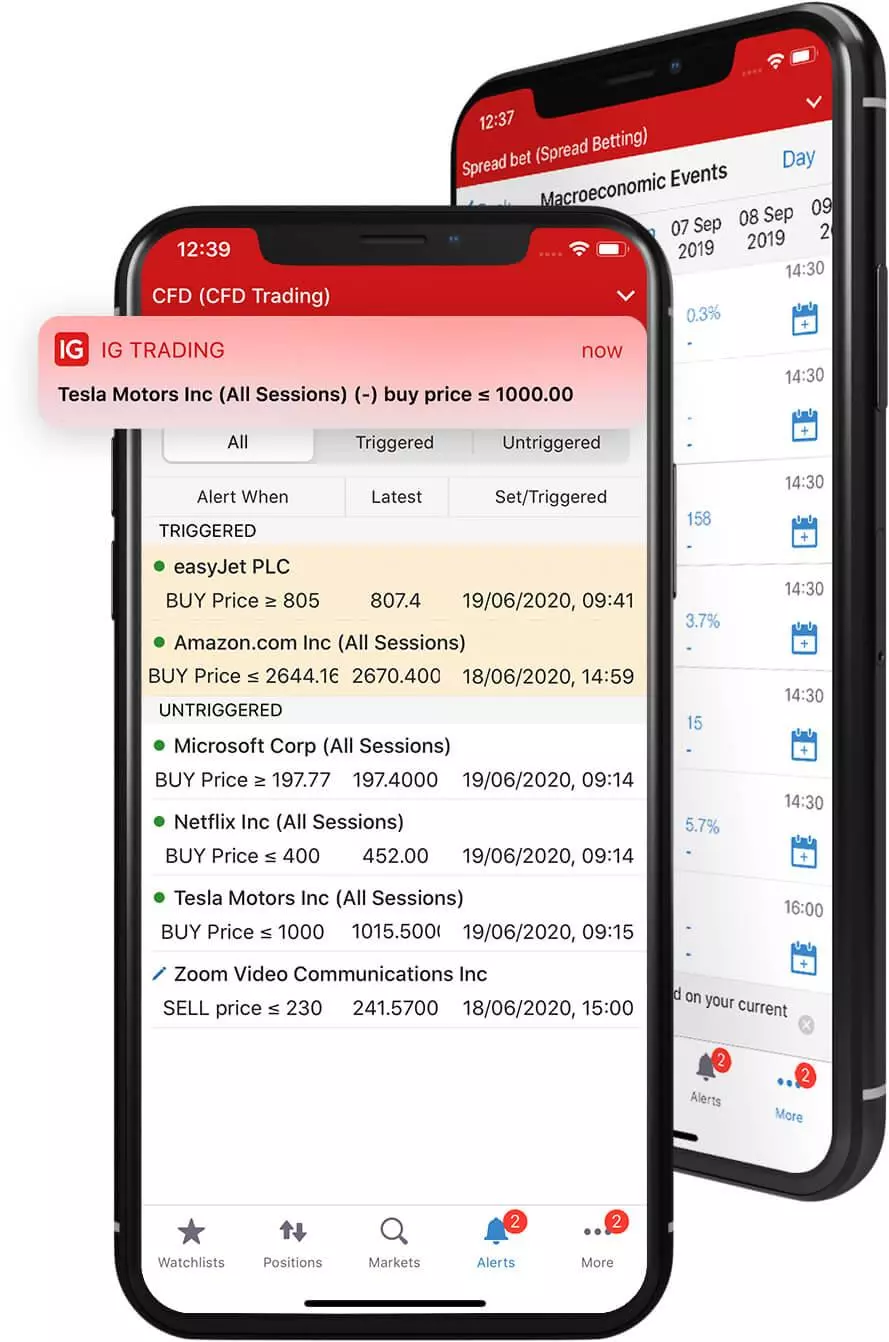

Set trading alerts

Never miss out on earnings announcements with our free automated trading alerts. Choose from:

- Price alerts. Get notified when a market moves by a certain percentage or amount in points

- Technical indicator alerts. Use popular indicators to signal your ideal market conditions

- Economic alerts. Just select your chosen event in our economic calendar to receive an alert

Breaking news and analysis

Get updates before and after company earnings from our in-house market experts.

-

Australia 200 outlook: how US-China tariff exemptions affect local investors

2025-04-15T00:29:26+0100

Shares costs

Have a look to the average cost of share trading with our CFD account

- Tesla Motors Inc.

- Apple Inc.

Tesla Motors Inc.

Buy 17 shares at $750 with a FX rate of 1.305 (GBP/USD)

| CFD trading | |

| Action | Buy 17 shares |

| Capital required to open | $2550 |

| Charge to open | $15.00 (commission) |

| Round trip FX conversion fee | * |

| Overnight funding | $1.48 |

| Charge to close | $15.00 (commission) |

| Total fees | £24.24 |

This information is correct as of 10/01/2020 and with the corresponding FX conversion rates.

* A 0.5% FX conversion is applied to any profits or losses from CFD positions.

Apple Inc.

Buy 42 shares at $308 with a FX rate of 1.305 (GBP/USD)

| CFD trading | |

| Action | Buy 42 shares |

| Capital required to open | $2587.20 |

| Charge to open | $15.00 (commission) |

| Round trip FX conversion fee | * |

| Overnight funding | $1.50 |

| Charge to close | $15.00 (commission) |

| Total fees | £24.26 |

This information is correct as of 10/01/2020 and with the corresponding FX conversion rates.

* A 0.5% FX conversion is applied to any profits or losses from CFD positions.

HTML CSS DO NOT REMOVE OR EDIT

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 17 000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app1

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 17 000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app1

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a truly market-leading service

1Awarded ‘best finance app’ and ‘best multi-platform provider’ at the ADVFN International Financial Awards 2020.