PDF (921KB)

Standard margin rate and guaranteed stop premiums

Trade

Share trading

Ready to get into shares? Use leveraged trading to explore different ways to access the shares market and find your perfect approach.

2025

Value for money

Boring Money Awards

2024

Best Finance App

ADVFN International Financial Awards

How to trade on shares

Share lists

Browse shares by country, get Reuters ticker codes, and see guaranteed stop premiums.

Which shares can you short? Which shares can you go long?

Popular share categories

Share Category |

Commission per side |

Min. charge (online) |

Min. margin requirement - retail |

Min. margin requirement professional2 |

UK |

0.10% |

£10 |

20% |

4.5% |

US |

2 cents per share |

$15 |

20% |

4.5% |

Euro |

0.10% |

€10 |

20% |

4.5% |

See all shares categories and our spread bet and CFD product details

Subject to risk reviews, the margin rates may differ for individual clients

Our shares services

Extended hours

The US stock market opens from 2.30pm to 9pm UK time, which means many UK-based trading companies only allow you to trade up until 9pm.

We've made sure our clients can trade CFDs on dozens of key US stocks at the most important times – up until 1am Monday to Thursday and 10pm on Fridays (UK time).

This includes major stocks such as Apple, IBM, McDonald's, Microsoft, Facebook and Alibaba during US earnings season.

Learn more about funding and margin requirements for extended hours shares.

Direct Market Access (DMA)

DMA allows you to trade CFDs on prices sourced directly from the order books of major equity exchanges, as well as the ability to view pricing from global exchanges and MTFs.

It can be traded using our iOS and Android apps (to request DMA access on your app please give us a call) as well as on L2 Dealer, our dedicated DMA platform.

We recommend direct market access only for advanced traders. It is suitable for those looking to trade market depth with algorithms, and traders looking to participate in the pre-market and post-market auctions.

Find out more about how to trade DMA and its costs.

How to trade share CFDs

Traders can choose from over 11,000 international shares that we offer on our platform. We’ve compiled a quick step-by-step guide to help you get started, from opening a trading account to closing a position.

Learn all about CFDs and share trading

CFD trading involves speculating on the underlying price of a financial asset by going long if you think the price will rise, or short if you think it’ll fall. You need to learn how to trade CFDs before you get exposure to different assets. Trading shares is different from investing in them and owning a stake in a company.

Open and fund your live CFD trading account

We offer 11,000+ shares to trade, plus out-of-hours trading, all on the UK’s award-winning platform.2 You can open an account by filling in an online form , and you can deposit funds into your account whenever you’re ready. You can use any bank card, or bank account that’s registered in your name. With us, there’s no minimum deposit for a bank transfer, however, you’d need at least £250 using credit, or debit card.

Choose the stock you want to trade

Get exposure to some of the most popular stocks to watch this year, from UK shares like Lloyds Banking Group and Vodafone Group to top performing US stocks such as Tesla and Uber.

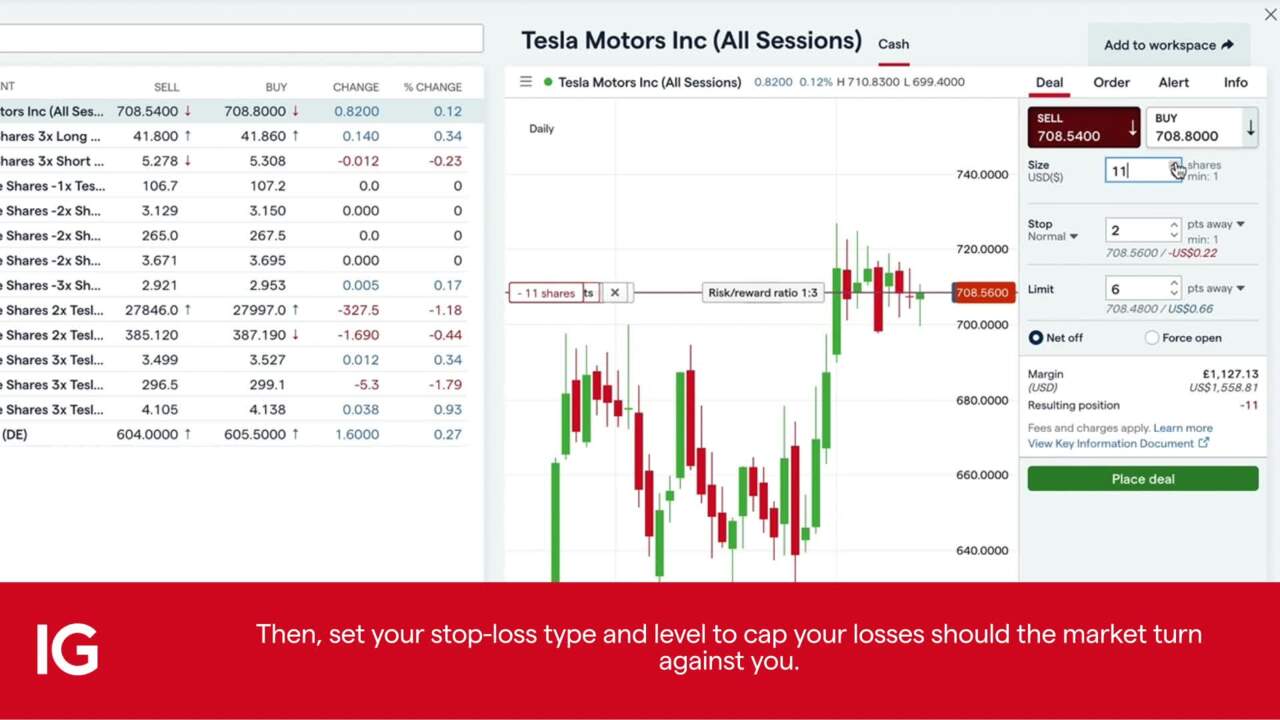

Open your first shares trade

Open your position either by going long or short, based on your trading strategy and risk appetite. You should assess the merits of your trade based on the necessary technical analysis and fundamental analysis before you open your position.

On our platform, you can track trading signals and set up alerts to notify you when there’s market movement in order to reconsider your strategy. It’s important to remember that it’s your responsibility to track your positions and you shouldn’t only rely on alerts.

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the Republic of Ireland.

2 Professional clients are exempt from regulatory limits on leverage in place for retail clients, and are able to trade on lower margins as a result. You can find out more, and check your eligibility, on our professional trading page.