What is forex and how do you trade it?

Take a closer look at everything you’ll need to know about forex, including what it is, how you trade it and how leverage in forex works. Interested in forex trading with us?

What is forex trading?

Forex trading, also known as foreign exchange or FX trading, is the conversion of one currency into another. FX is one of the most actively traded markets in the world, with individuals, companies and banks carrying out around €6.6 trillion worth of forex transactions every single day.

While a lot of foreign exchange is done for practical purposes, the vast majority of currency conversion is undertaken by forex traders to earn a profit. The amount of currency converted every day can make price movements of some currencies extremely volatile – which is something to be aware of before you start forex trading.

With us, you’ll have a wide range of major, minor and exotic currency pairs to go long or short on.

Ready to start trading forex? Open an account to get started

Beginners’ guide to forex: learn currency trading in 6 steps

Forex trading essentials for beginners

- What is a forex pair?

- What are the base and quote currencies?

- What is a pip in forex?

- What is a lot in forex trading?

What is a forex pair?

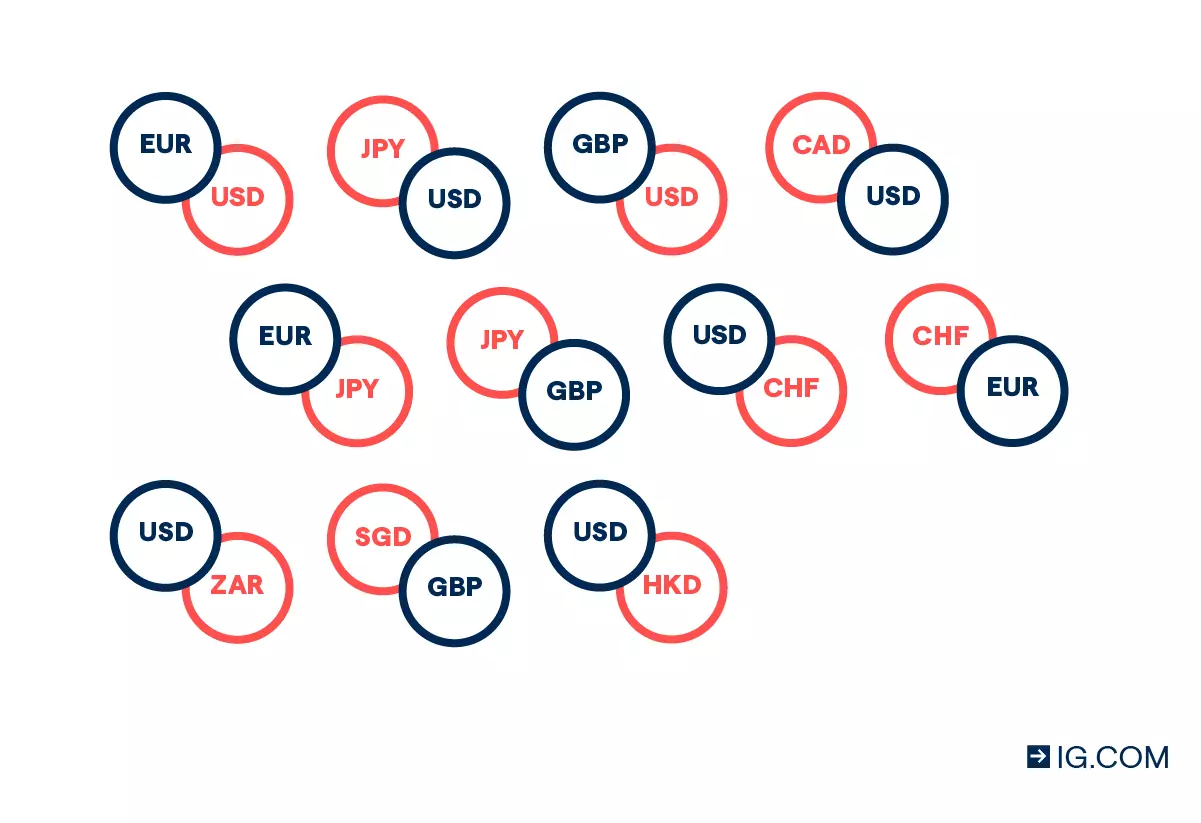

A forex pair is a combination of two currencies that are traded against each other. There are hundreds of different combinations to choose from, but some of the most popular include the euro against the US dollar (EUR/USD), the US dollar against the Japanese yen (USD/JPY) and the British pound against the US dollar (GBP/USD).

What are the base and quote currencies?

The base currency is always on the left of a currency pair, and the quote is always on the right. The base currency is always equal to one, and the quote currency is equal to the current quote price of the pair – which shows how many of the quote currency it’ll cost to buy one of the base. So, when you’re trading currency, you’re always selling one to buy another.

What is a pip in forex?

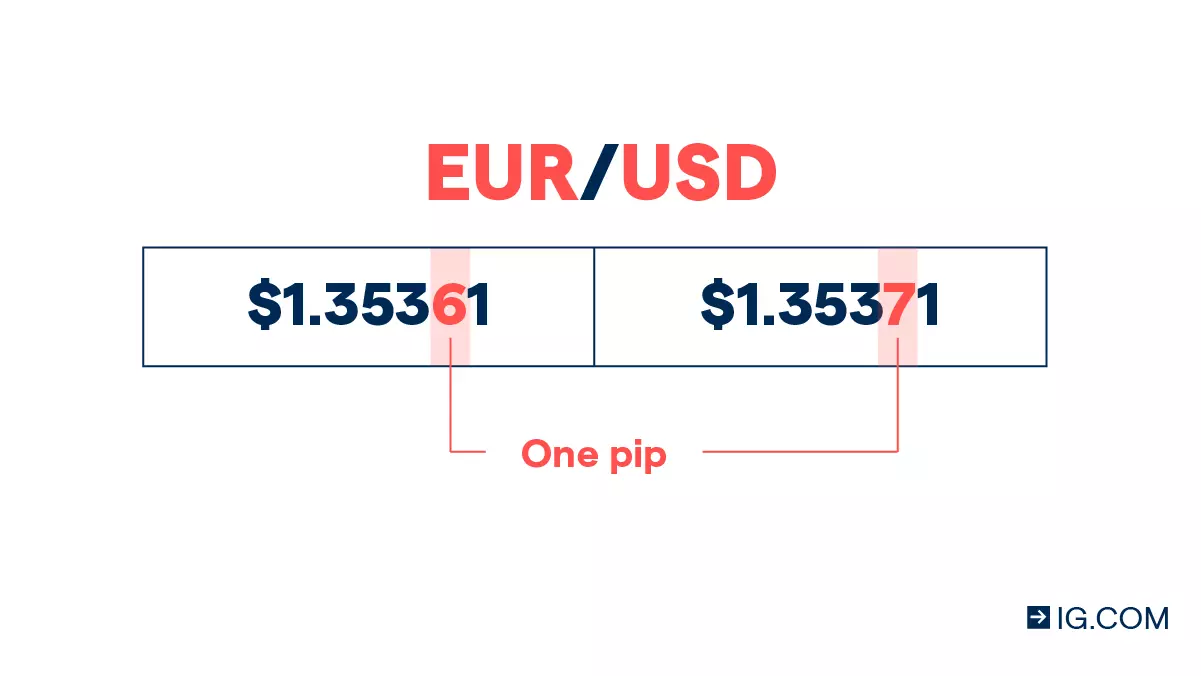

A pip in forex is usually a one-digit movement in the fourth decimal place of a currency pair. So, if EUR/USD moves from €).35361 to €1.35371, then it has moved a single pip. But, if you’re trading JPY ‘crosses’ – ie currencies crossed or paired with the yen – a pip is a change at the second decimal place. A price movement at the fifth decimal place in forex trading is known as a pipette.

What is a lot in forex trading?

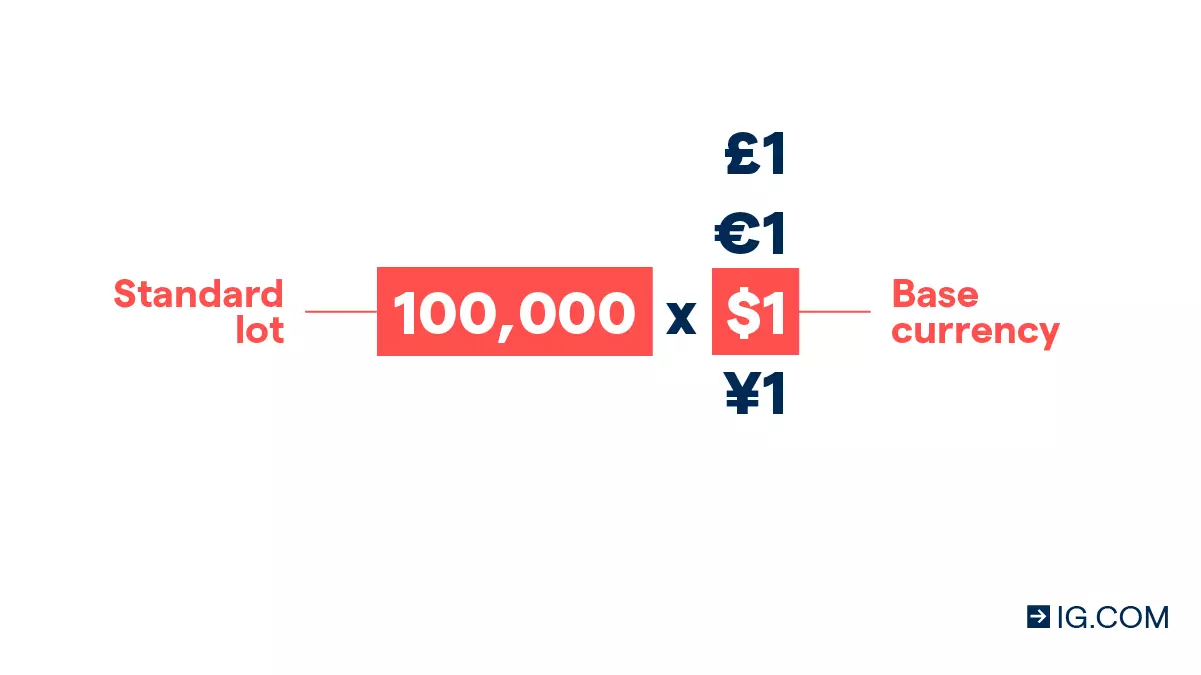

Currencies are traded in lots, which are batches of currency used to standardise forex trades. As forex price movements are usually small, lots tend to be very large. For example, a standard lot is 100,000 units of the base currency.

How does forex trading work?

Forex trading works like any other transaction where you are buying one asset using a currency. In the case of forex, the market price tells a trader how much of one currency is required to purchase another. For example, the current market price of the EUR/USD currency pair shows how many US dollars it would take to buy one euro.

Each currency has its own code – which lets you quickly identify it as part of a pair. We’ve included codes for some of the most popular currencies below.

What does it mean to buy or sell a currency pair?

To buy a currency pair means that you expect the price to rise, indicating that the base currency is strengthening relative to the quote currency. To sell a currency pair means that you expect the price to fall, which would happen if the base currency weakened against the quote.

For example, you’d ‘buy’ the EUR/USD pair if you think that the euro will strengthen against the dollar – meaning you’ll need more dollars to buy a single euro. Or, you’d ‘sell’ this pair if you think that the euro will weaken against the dollar – meaning you’ll need fewer dollars to buy a single pound.What is the spread in forex trading?

The spread in forex trading is the difference between the buy and sell prices. For example, the buy price might be 1.3428 and the sell price might be 1.3424. For your position to be profitable, you’ll need the market price to either rise above the buy price or fall below the sell price – depending on whether you’ve gone long or short.

What are margin and leverage in FX trading?

Margin refers to the initial deposit you need to commit in order to open and maintain a leveraged position. So, a trade on EUR/USD might only require a 3.33% margin in order for it to be opened. As a result, instead of needing €100,000 to open a position, you’d only need to deposit €3330.

Why do people trade forex?

Speculating on currencies strengthening or weakening

Traders speculate on forex pairs to profit from one currency strengthening or weakening against another. When the price of a pair is rising, it means that the base is strengthening against the quote and when it’s falling, the base is weakening against the quote.

That’s because a rising price means that more of the quote are needed to buy a single unit of the base, and a falling price means that fewer of the quote are needed to buy one of the base. So, traders would likely go long if the base is strengthening relative to the quote currency, or short if the base is weakening.

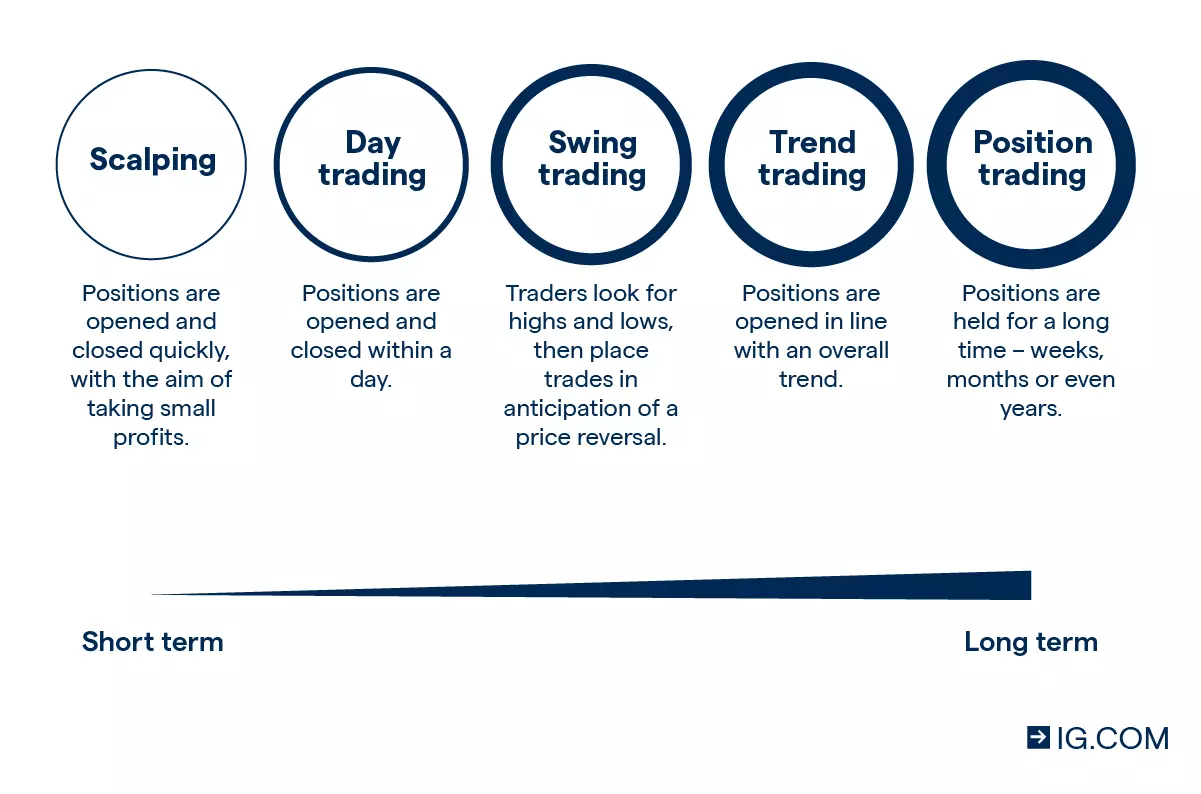

Some of the most popular forex trading styles are scalping, day trading, swing trading and position trading. You might choose a different style depending on whether you have a short- or long-term outlook.

Hedging with forex

Hedging is a way to mitigate your exposure to risk. It’s achieved by opening positions that will stand to profit if some of your other positions decline in value – with the gains hopefully offsetting at least a portion of the losses.

Currency correlations are effective ways to hedge forex exposure. An example would be EUR/USD and GBP/USD, which are positively correlated because they tend to move in the same direction. So, you could go short on GBP/USD if you had a long EUR/USD position to hedge against potential market declines.

Seize opportunity 24 hours a day

The forex market is open 24 hours a day thanks to the global network of banks and market makers that are constantly exchanging currency. The main sessions are the US, Europe and Asia, and it’s the time differences between these locations that enables the forex market to be open 24 hours a day.

The forex trading market hours are incredibly attractive, offering you the ability to seize opportunity around the clock. We are also the only provider to offer weekend trading on certain currency pairs, including weekend GBP/USD, EUR/USD and USD/JPY. That means you can trade these combinations when others can’t.

Learn how currency markets work

What moves the forex market?

The forex market is made up of currencies from all over the world, which can make exchange rate predictions difficult as there are many forces that can contribute to price movements. That said, the following factors can all have an effect on the forex market.

Central banks

A currency’s supply is controlled by central banks, who can announce measures that will have a significant effect on that currency’s price. Quantitative easing, for example, involves injecting more money into an economy, and can cause a currency’s price to fall in line with an increased supply.

News reports

Commercial banks and other investors tend to want to put their capital into economies that have a strong outlook. So, if a positive piece of news hits the markets about a certain region, it will encourage investment and increase demand for that region’s currency. If negative news hits, then demand might be expected to fall. This is why currencies tend to reflect the reported economic health of the region they represent.

Market sentiment

Market sentiment, which often reacts to the news, can also play a major role in driving currency prices. If traders believe that a currency is headed in a certain direction, they will trade accordingly and may convince others to follow suit, increasing or decreasing demand.

Discover how to trade forex

Traditionally, a forex broker would buy and sell currencies on behalf of their clients. But, if you have access to a trading platform such as ours, you can take a position on currency markets yourself by using financial derivatives like spread bets, CFDs, vanilla options and barriers.

When trading with the these instruments, you never take ownership of actual forex. Instead, you’ll use the derivatives to speculate on price movements. This means you can take a position on a pair without ever holding either of the currencies.

Here's how to trade forex with us:

Select a currency pair

We offer more than 80 currency pairs – from majors like EUR/USD, to exotics like HUF/EUR. Before choosing an FX pair to trade, you should carry out fundamental analysis and technical analysis on the two currencies.

Decide whether to ‘buy’ or ‘sell’

Once you’ve chosen an FX pair to trade, you need to decide whether you want to ‘buy’ (go long) or ‘sell’ (go short), based on your analysis.

You’d go long on the pair if you expected the base currency to rise in value against the quote currency. Or, you would go short if you expected it to do the opposite.

Choose how to trade

You can take a position using spread bets, CFDs, vanilla options or barriers.

- Spread bets

- CFDs

- Vanilla options

- Barriers

Spread bets are derivatives you can use to speculate on financial markets without taking ownership of the underlying asset. Instead, you’d be placing a bet (amount per point of movement) on whether you think the price will rise or fall.

Spread betting is leveraged, so you’ll use a small deposit (called margin) to open a larger position. This means both losses and profits could outweigh your initial deposit as both are calculated on the full position size. One of the benefits of spread betting is that it’s tax-free.1

When you trade CFDs, you’re agreeing to exchange the difference in the price of a position from the point at which it is opened up until it’s closed. To open a trade, you’ll pay a small margin upfront to gain exposure to the larger position. However, this means your losses as well as profits can far outweigh your deposit amount. CFD prices are displayed in the same way as a regular forex pair’s quote price – for example 1.31425.

Plus, you’ll be able to speculate on prices rising by going long, as well as falling by going short. Standard forex CFDs are worth 100,000 units of the first named currency in the pair, while mini forex CFDs are worth just 10,000 units of the same.

Options give you the right, but not the obligation, to buy or sell an FX pair at a specified price on a set expiry date.

Our forex vanilla options are structured like traditional options, and you can buy and sell calls and puts with the option to exit your position on or before the expiry date.

Vanilla options are sophisticated instruments and generally better suited to experienced traders. While purchasing options incurs limited risk, selling a put means your risk for loss is potentially unlimited.

Barriers will move one-for-one with the quote price of its underlying currency pair. To limit risk, barriers also come with automatic ‘knock-out’ levels.

These ensure that if a market moves against your position beyond a certain limit, they are automatically terminated. Please bear in mind, however, that markets can be volatile, which means that losses can accrue quickly.

To go long on a currency pair using barriers, you’d buy a barrier call option. To go short, you’d buy a barrier put option.

Open your first trade

If you want to trade on the value of forex pairs rising or falling, why not open an account with us? Once you’ve done that, you can follow the steps outlined on this page to take a position. Our trading platform is award winning,7 and there’s no obligation to add funds until you want to place a trade.

Alternatively, you’ll also be able to download and use our MT4 offering, which includes a variety of free indicators and add-ons.

Before trading, however, always remember that leveraged derivatives are complex financial instruments and come with a high risk of losing money rapidly – especially in volatile markets, like forex.

Learn more about leverage and how you can manage your risk.

Monitor your position

Once you’ve opened your position, you can monitor your FX trade in the ‘open positions’ section of our dealing platform. You can also set price alerts to receive email, SMS or push notifications when a predefined level is reached.

But, even with these alerts set, it’s still important to keep up to date with the latest news and political events that could move the market.

Close your trade and take your profit or loss

Once you’ve decided it’s time to close your position, simply navigate to the ‘positions’ tab, select your position and click on ‘close’ for spread bets, CFDs, vanilla options and barriers. Alternatively, just use the deal ticket to make the opposite trade to the one you opened.

Once you’ve built your confidence and feel like you’re ready to trade the live forex markets, you can create a live account with us in five minutes or less. You’ll get access to award-winning platforms,8 expert support around the clock and spreads from just 0.6 points.

FAQs

What does forex (FX) trading mean?

Forex trading means exchanging one currency for another. Forex is always traded in pairs which means that you’re selling one to buy another.

Is there a difference between forex trading and currency trading?

There is no difference between forex trading and currency trading, as both mean that you’re exchanging one currency for another. When forex trading or currency trading, you’re attempting to earn a profit by speculating on whether the price of a currency pair will rise or fall.

Can anyone trade forex?

Anyone can trade forex if they develop their trading knowledge, build a forex trading strategy and gain experience trading the market. But, the volatility of the forex market is a unique environment that takes time to understand.

How can I make money from forex trading?

You can make money from forex trading by correctly predicting a currency pair’s price movements and opening a position that stands to profit. For example, if you think that a pair will decline in value, you could go short and profit from a market falling.

Alternatively, if you think a pair will increase in value, you can go long and profit from an increasing market.

However, forex markets are known for their volatility – which means that they’re high risk environments. Your exposure to this risk is only amplified when trading with leveraged derivatives. It’s important to understand the instruments and the effects of leverage on your trading before using them to take a position.

How can I get started trading FX?

You can get started trading FX by opening an account with us. You’ll also need to be familiar with what moves the forex market – like central bank announcements, news reports and market sentiment – and take steps to manage your risk accordingly.

What costs and fees do you have to pay when currency trading?

The costs and fees you pay when trading currency will vary from broker to broker. But, you should bear in mind that you’ll often be trading currency with leverage, which will reduce the initial amount of money that you’ll need to open a position. Be aware, though, that leverage can magnify both your profits and your losses.

What currency pairs move the most?

The forex market is extremely volatile, so a currency pair that moves up one week might go down the next. But, the majority of forex trading volume is concentrated in a handful of forex pairs like EUR/USD, USD/JPY, GBP/USD, AUD/USD and USD/CHF.

That’s because these pairs represent some of the most widely-circulated currencies, so they attract the most traders. This results in a greater amount of price movement as the balance between buyers and sellers constantly shifts.

Once you’ve built your confidence and feel like you’re ready to trade the live forex markets, you can create a live account with us in five minutes or less. You’ll get access to award-winning platforms,7 expert support around the clock and low spreads.

What are gaps in forex trading?

Gaps are points in a market when there is a sharp movement up or down with little or no trading in between, resulting in a ‘gap’ in the normal price pattern. Gaps do occur in the forex market, but they are significantly less common than in other markets because it is traded 24 hours a day, five days a week.

However, gapping can occur when economic data is released that comes as a surprise to markets, or when trading resumes after the weekend or a holiday. Although the forex market is closed to speculative trading over the weekend, the market is still open to central banks and related organisations. So, it is possible that the opening price on a Sunday evening will be different from the closing price on the previous Friday night – resulting in a gap.

How is the forex market regulated?

Despite the enormous size of the forex market, there is very little regulation because there is no governing body to police it 24/7. Instead, there are several national trading bodies around the world who supervise domestic forex trading, as well as other markets, to ensure that all forex providers adhere to certain standards.

When it comes to the EU member states, forex is regulated under the Markets in Financial Instruments Directive (MiFID II).

Try these next

Trade over 80 FX pairs, with spreads starting from 0.6pts on EUR/USD

See how our technology can help you trade efficiently

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

Spread bets

See an example of going long with spread bets

See an example of going short with spread bets

CFDs

See an example of buying a forex CFD

See an example of selling a forex CFD

Options

See an example of buying a call option

See an example of buying a put option

Barriers

See an example of buying a forex barrier call

See an example of buying a forex barrier put