Foreign exchange (forex, or FX for short) is the marketplace for trading all the world’s currencies and is the largest financial market in the world. There are many benefits of trading forex, which include convenient market hours, high liquidity and the ability to trade on margin. Learn more about eight of the biggest advantages of forex trading below. Interested in forex trading with us?

Why trade forex?

When traders choose which market to trade, they are looking for optimal trading conditions and the best chance of taking a profit. There are many reasons why millions of traders across the world think that the forex market fits these criteria, but we are going to focus on the top nine benefits of forex trading:

Ability to go long or go short

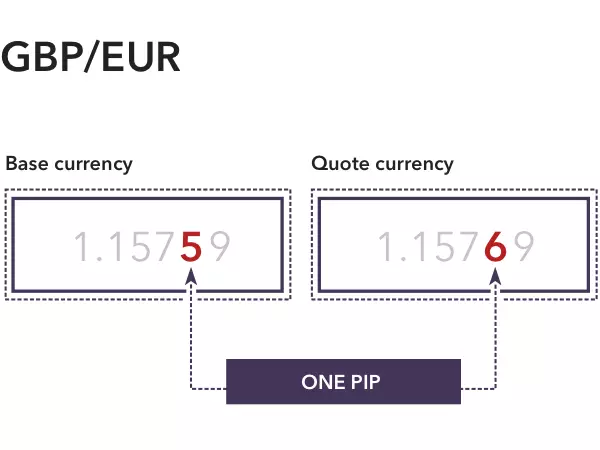

While you can go short on other markets by using derivative products, such as CFDs, short selling is an inherent part of trading forex. This is because you are always selling one currency (the quote currency) to buy another (the base currency). The price of a forex pair is how much one unit of the base currency is worth in the quote currency.

For example, in the forex pair GBP/EUR, GBP is the base currency and EUR is the quote currency. If GBP/EUR is trading at 1.12156, then one pound is worth 1.12156 euros. If you think that the pound is going to increase against the euro, you would buy the pair (going long). If you think that the pound will decrease in value against the euro, you would sell the pair (going short). Your profit or loss will depend on the extent to which you get your prediction right, meaning it is possible to profit whichever way the market moves.

Forex market hours

The foreign exchange market is open 24 hours a day, five days a week – forex can be traded from 9pm Sunday to 10pm Friday (UK time). These long hours are because forex transactions are completed between parties directly, over the counter (OTC), rather than through a central exchange. And because forex is a truly global market, you can always take advantage of different active session’s forex trading hours.

It is important to remember that the forex market’s opening hours will vary in March, April, October and November, as countries shift to daylight savings on different days.

Does forex trade on weekends?

The forex market closes on Friday night at 10pm (UK time) and does not open again until 9pm (UK time) on Sunday evening. However, because the market is only closed to retail traders (not central banks and related organisations), forex trading actually does take place over the weekend. This means that there can be a difference in price between Friday close and Sunday open – known as a gap.

Traders need to be highly aware of the weekend forex trading hours and alter their positions accordingly. If you do not want to expose your position to the risk of gapping, you may want to consider closing your position on Friday evening or placing stops and limits to manage this risk.

High liquidity in forex

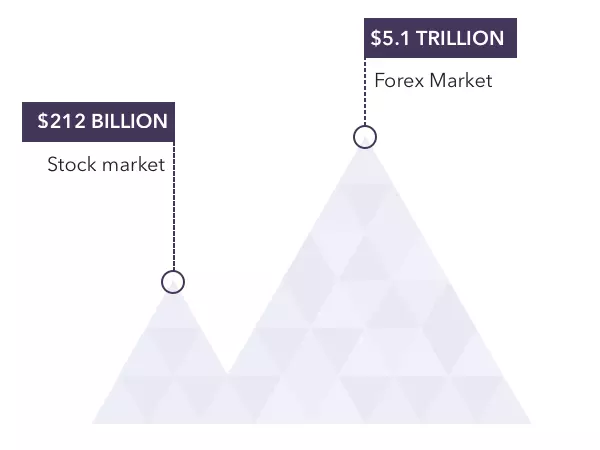

The FX market is the most liquid market in the world, meaning there are a large number of buyers and sellers looking to make a trade at any given time. Each day, over $5 trillion dollars of currency is converted by individuals, companies and banks – and the vast majority of this activity is intended to generate a profit.

The high liquidity in forex means that transactions can be completed quickly and easily, so the transaction costs – or spreads – are often very low. This creates opportunities for traders to speculate on price movements of just a few pips.

Average global daily trading volume

Source:

Forex: Bank for International Settlements Triennial Central Bank Survey (2016)

Stocks: calculated using data from the World Bank (2017)

Forex volatility

The high volume of currency trades each day translates to billions of dollars every minute, which makes the price movements of some currencies extremely volatile. You can potentially reap large profits by speculating on price movements in either direction. However, volatility is a double-edged sword – the market can quickly turn against you, so it’s important to limit your exposure with risk-management tools.

Leverage can make your money go further

IG offersone way to trade foreign exchange pairs: CFDs. This option is leveraged, which can make your money go further. Leverage in forex enables you to open a position on the currency market by paying just a small proportion of the full value of the position up front.

The profit or loss you make will reflect the full value of the position at the point it is closed, so trading on margin offers an opportunity to make large profits from a relatively small investment. However, it can also amplify any losses, meaning losses could exceed your initial deposit. For this reason, it’s important to consider the total value of the leveraged forex position before trading CFDs.

To help you manage your risk, IG offers a range of risk-management tools including stop losses, guaranteed stops, price alerts and running balances.

Trade a wide range of currency pairs

Forex trading gives you the opportunity to trade a wide variety of currency pairs, speculating on global events and the relative strength of major and minor economies.

With IG, for example, you can choose from over 90 currency pairs, including:

- Major currency pairs, eg GBP/USD, EUR/USD, and USD/JPY

- Minor pairs, eg USD/ZAR, SGB/JPY, CAD/CHF

- Emerging currency pairs, eg USD/CNH, EUR/RUB and AUD/CNH

- Exotic pairs, eg EUR/CZK, TRY/JPY, USD/MXN

These pairs are all available to trade from the same account via a single login.

Hedge with forex

Hedging is a technique that can be used to reduce the risk of unwanted moves in the forex market, by opening multiple strategic positions. Although volatility is part of what makes forex so exciting, hedging can be a good way of mitigating loss or limiting it to a known amount.

There are a variety of strategies you can use to hedge forex, but one of the most common is hedging with multiple currency pairs. By choosing forex pairs that are positively correlated, such as GBP/USD and EUR/USD, but taking positions in opposite directions, you can limit your downside risk. For example, a loss on a short EUR/USD position could be mitigated by a long position on GBP/USD.

Alternatively, you could use forex to hedge against loss in other markets, such as commodities. For example, because the USD/CAD generally has an inverse relationship with crude oil, it is commonly used as a hedge against falling oil prices.

Access tools to help you trade

IG offers a range of trading platforms on web, mobile and tablet, as well as specialist platforms for those looking to take their trading to the next level. You can get access to a range of features designed to help improve your trading, including risk management tools – like stops and limits – as well as interactive charts and integrated news feeds.

- We also offer a number of products designed to help you improve your forex trading: IG Academy is loaded with clear and engaging forex trading courses designed with the beginner in mind

- Our free demo account gives you completely risk-free access to $200,000 in virtual funds, so you can try forex trading and our technology without committing any capital

Risk of Forex Trading

Although there are multiple benefits of forex trading, the volatility of the market and the leveraged trading instruments do come with increased risk. It is important to understand that even though you only put up a relatively small amount of capital to open a position, your position or loss is based on the full value of position. Therefore, the amount you gain or lose could be relatively large compared to your intial outlay.

However, there are a variety of ways that you can manage your currency risk, such as attaching stops and limits to your position, setting price alerts and using a trading style that matches your attitude to risk.

Why trade forex instead of stocks?

Your decision about whether to trade forex or stocks on leverage should be based on which asset you are interested in trading – currencies or shares. However, there are a few reasons why some traders prefer to trade forex than stocks:

- Market opening hours: the stock market is limited to an exchange’s opening hours, whereas the forex market is open 24-hours a day. However, it is worth noting that certain stock indices are available for weekend trading

- Higher liquidity: the forex market sees an average daily turnover of $5 trillion, whereas the stock market sees comparatively fewer traders per day

- Greater volatility: the stock market tends to have more stable prices that change over a longer period of time. Although this is a great thing for some trading styles, the volatility of the forex market can create an exciting range of opportunities for shorter-term traders

When you are deciding whether forex or the stock market is better for you, you should consider your attitude to risk and your financial goals.

FAQs

What is the easiest forex pair to trade for beginners?

The easiest forex pair to trade will vary from trader to trader, depending on their interests and attitude to risk. A good place for beginners to start would be the major forex pairs that have a larger trading volume, which makes them far more liquid and potentially less volatile.

What are the most traded currency pairs?

The most traded currency pairs are the major crosses, including EUR/USD, USD/JPY, GBP/USD and USD/CHF. For those just starting to trade the forex market, it is important to understand that the majority of forex trading is concentrated across these combinations, which can make them easier to trade as they have higher liquidity.

Develop your forex knowledge with IG

Find out more about forex trading and test yourself with IG Academy’s range of online courses.

You might be interested in…

Trade over 90 FX pairs, with spreads starting from 0.6pts on EUR/USD

Learn the mechanics of a forex trade: including pairs, pips and leverage

See how our technology can help you trade efficiently