Why take a position on IPOs with us?

Take your position from day one

Trade in the company’s shares on the secondary market as soon as it’s fully listed

Make use of our best execution

Your orders will be filled in 0.013 seconds from submission, in line with our best execution policy

Predict on price movements

Trade on rising and falling prices with contracts for difference (CFDs)1

Make use of our best execution

Your orders will be filled in 0.013 seconds from submission, in line with our best execution policy

Pay no additional charges

Deal at zero commission on all primary market IPO subscriptions2

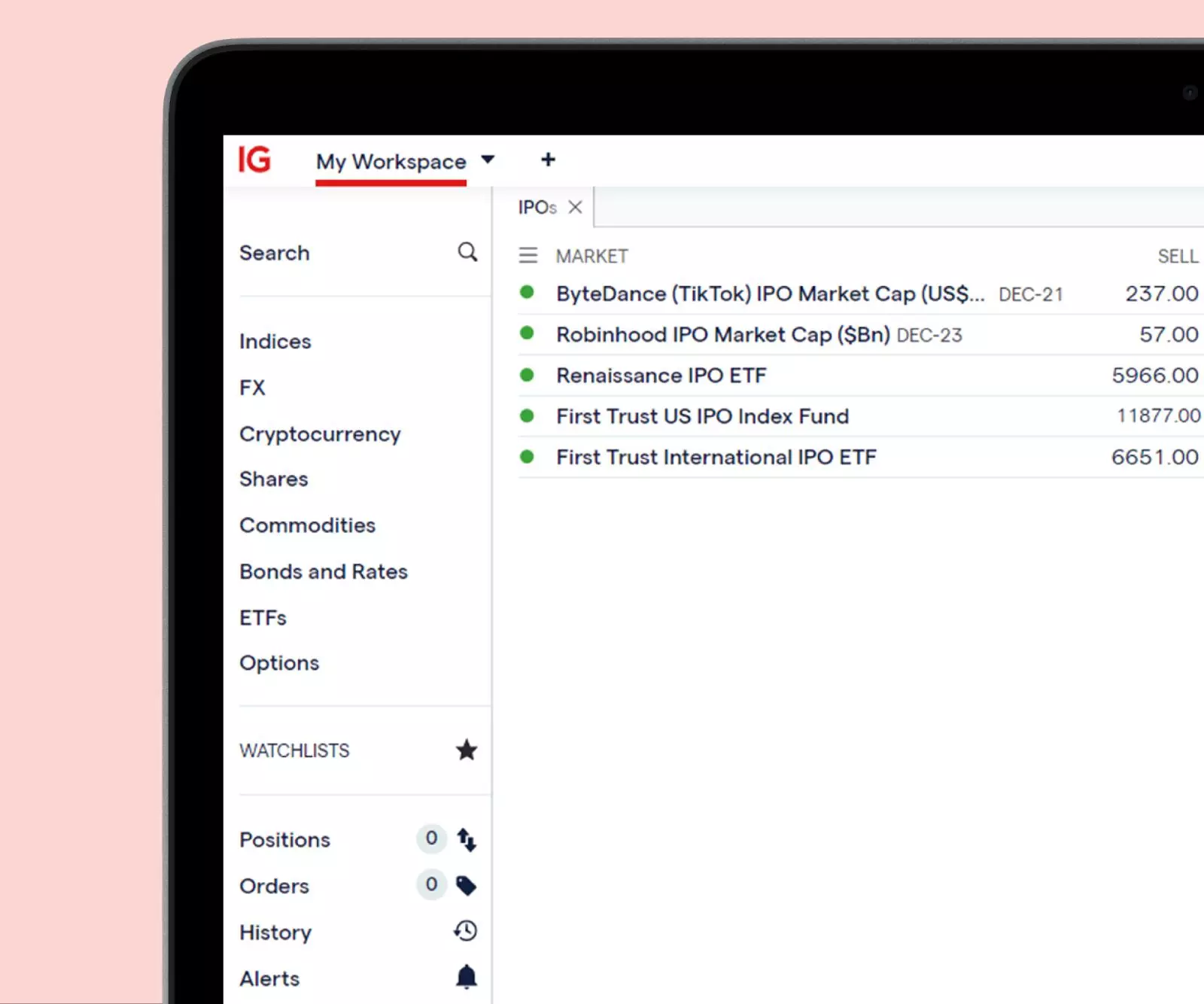

Keep up to date on the latest IPOs

Read news and analysis on upcoming IPOs from our in-house team of experts

How can you get exposure to an IPO?

With us, you’ll be able to take a position once the stock has listed on the secondary market, using CFDs.

Secondary market

The secondary market is where stocks are freely exchanged. There is one way for you to take a position on the secondary market following an IPO. You can:

- Trade on the company’s share price with CFDs

Open a CFD trading account in minutes

Open a CFD trading account in minutes

Fast execution on a huge range of markets

Enjoy flexible access to more than 13,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 13,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app

Feel secure with a trusted provider

With 45 years of experience, we’re proud to offer a truly market-leading service

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Call +65 6390 5133 between 9am and 6pm (SGT) on weekdays or email accountopening@ig.com.sg for account opening enquiries.

Call +65 6390 5133 between 9am and 6pm (SGT) on weekdays or email accountopening@ig.com.sg for account opening enquiries.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

How to take your IPO position

1. Learn how IPOs work

Discover everything you need to know in our guide to IPOs.

2. Choose an IPO

Explore upcoming IPOs with news and analysis from our in-house experts.

3. Understand CFD trading

Learn about the benefits and risks of CFD trading, including how leverage works.

4. Open an account

Create a live trading account or practise on a demo

5. Build your IPO strategy

Make sure you know when you plan to take profits and cut losses.

6. Open your first position

What is an IPO?

An IPO is the traditional way for a company to go public. IPOs can increase sales revenues and profit because listing on a stock exchange helps to increase a company’s exposure.

An IPO can be a great way to trade on the price movements of a newly listed stock.

With us, you’ll be able to trade the stock once it’s fully listed.

What is an IPO?

An IPO is the traditional way for a company to go public. IPOs can increase sales revenues and profit because listing on a stock exchange helps to increase a company’s exposure.

An IPO can be a great way to trade on the price movements of a newly listed stock.

With us, you’ll be able to trade the stock once it’s fully listed.

FAQs

Can I make a profit trading initial public offerings (IPOs)?

Yes, you can make a profit trading initial public offerings if you correctly predict share price movements. However, if your prediction is incorrect, you’d incur a loss.

You’ll use CFDs to take a position on share price movements after the stock has listed. When utilising these financial derivatives to trade with us, you’d use leverage. While this means that you only need a small deposit – called margin – to open your position, your potential profits and possible losses will also be magnified to the full value of the position. Making it vital to manage your risk properly.

Learn more about how leverage impacts your trading

What are the risks of trading in an IPO?

While there are risks involved in any trading activity, IPOs have additional risks. These include:

- Not being adequately informed with important company information that might affect share prices, e.g. ongoing legal cases and intellectual property that isn’t patent protected

- A short to no trading history to inform trading decisions

- Market expectations not being met due to inflated estimations

- Companies not meeting their target market cap

It’s important that you have all the relevant information before you commit to any trade. When trading IPOs, some useful documents include company prospectuses and admission documents. Staying informed helps you avoid risks that might affect your position.

Try these next

Learn how to buy and sell shares online using CFDs

Find out more about trading shares with us

Discover how to trade exchange traded funds

1 CFDs are leveraged products. CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please ensure that you fully understand the risks involved.

cta.addEventListener('click', () => { if(window.Intercom){ Intercom('show') }});