What are interest rate derivatives and how do you trade them?

Interest rates play a significant role in influencing the performance of the financial markets and provide an indication of the economic outlook. Learn how to trade on interest rate derivatives with Singapore’s No. 1 CFD/FX Broker1.

What are interest rate derivatives?

Interest rate derivatives are products (typically futures) used to trade on interest rate fluctuations. With us, you’ll use CFDs to trade interest rate futures. With derivatives, you don’t own any assets outright and as a result, you can trade both rising and falling interest rates. Because interest rate derivatives are leveraged, you can open larger positions with a smaller upfront amount.

The outcome of your prediction will determine whether you make a profit or a loss. Just remember – leveraged trades are opened with a small deposit, called margin, to take a larger position.

With leveraged trades, it’s important to remember that there’s a high risk that your profits or losses will outweigh your initial margin amount, so always ensure you’re trading within your means and managing your risk.

Ways to trade interest rate derivatives

- CFD trading on interest rate futures

Enter into a contract to agree to exchange the difference between your interest rate position’s opening price and its closing price – for profit or loss. This also attracts no commission charges

- Trading interest rate swaps

Exchange interest rates or two different types of interest – usually in the form of futures – with a broker. Usually, the two parties involved are institutions rather than individuals, as many retail traders prefer the comparatively simpler process of trading interest rates with CFDs. Note that we don’t offer interest rate swaps

How do interest rate derivatives work?

Interest rate derivatives mean that you’re agreeing to predict on the future price of a specific interest rate, for example, the 3-Month Sterling Overnight Interbank Average (SONIA). Also, interest rate derivatives’ pricing is determined by underlying futures markets.

When trading interest rate derivatives via CFDs, there are two different contract sizes: standard and mini. A mini contract is worth 20% of a main contract’s size. For example, one main contract of the 3-Month SONIA is worth £25, while the mini is worth £5 per contract.

With CFDs, your profit or loss is determined by the difference between the Short Sterling’s price when you opened your position and when you closed it, multiplied by the contract value (main or mini) as well as by the amount of contracts you bought or sold.

Interest rate trading example: CFDs

Let’s say that you believe the Bank of England is about to raise interest rates, so you decide to open a position. We price interest rates at 100 minus the interest rate. So, if interest rates are currently at 4%, then the price will be 96 (which is 9600.00 on our platform).

You believe the Bank of England might lower the interest rate, which means a higher underlying price, so you go long on 25 CFDs when the buy price is 9949.50. Each contract is worth £5. If the interest rate does indeed fall and the underlying price reaches 9957.50, you’ll make a profit of £1000 ([9957.50 – 9949.50] x £5 x 25 contracts). If the interest rate rises instead and the underlying price falls to 9939.50, you’ll make a loss of £1250 ([9939.50 – 9949.50] x £5 x 25 contracts).

Remember, these are leveraged trades. As you can see, there’s a risk that your losses or profits can substantially outweigh your initial margin amount.

How to trade interest rate futures

Interest rate futures are used to predict interest rate changes that may be coming up in the next few months. You can trade interest rate futures in five steps:

Learn why people trade interest rates

- You can go long or short depending on what the interest rate is doing

- Interest rate trading can be used to diversify your portfolio

- Interest rates are tied to the global economy. This can take some guesswork out of trading, as it’s often well-known when a new hawkish or dovish cycle will start

- Because interest rates are often inverse to other asset classes (for instance, when interest rates rise, stocks often underperform), they can be safe havens in times of volatility

- Interest rate derivatives are often used to hedge open positions, for instance hedging mortgages – by banks and institutional investors, but also by clued up individual traders

Choose an interest rate market to trade

You can take a position on some of the biggest and most influential interest rates in the world with us. Here’s what we offer:

- The 3-Month SONIA enables you to predict on the Bank of England base rate in the UK

- The 3-month Euribor is the interbank interest rate between various Eurozone banks

- The 3-month Secured Overnight Financing Rate (SOFR) is the benchmarket interest rate for dollar-denominated derivatives and loans, which is calculated by the Federal Reserve

Open a trading account

You can trade on interest rate futures using CFDs.

First, you’ll choose your account type. Then, you’ll create a live account. We require that you fill out a short form before we verify your identity. Lastly, you’ll fund your account to start trading.

Not ready to trade just yet? You can also open a demo account to practise your rates futures trading before starting with real money. Our demo account gives you access to a risk-free platform and $10,000 in virtual funds to hone your interest rates trading strategy.

Learn what moves rate prices

Interest rates are set at a national level by the central banks, often with a lot of discussion between countries. In the UK, for example, the Bank of England’s Monetary Policy Committee determines the bank rate.

This rate is determined by a host of factors. These include inflation levels (keeping the interest rate consistent with Consumer Price Index (CPI)), what state the economy is in (lowering interest rates in tough times hopes to encourage spending and saving) and conditions between banks, such as liquidity in interbank markets.

The interest rate set by the central bank (called the bank rate in the UK) will then inform the interest rates set by banks and other lenders to their clients.

Place your trade

How to trade interest rate futures

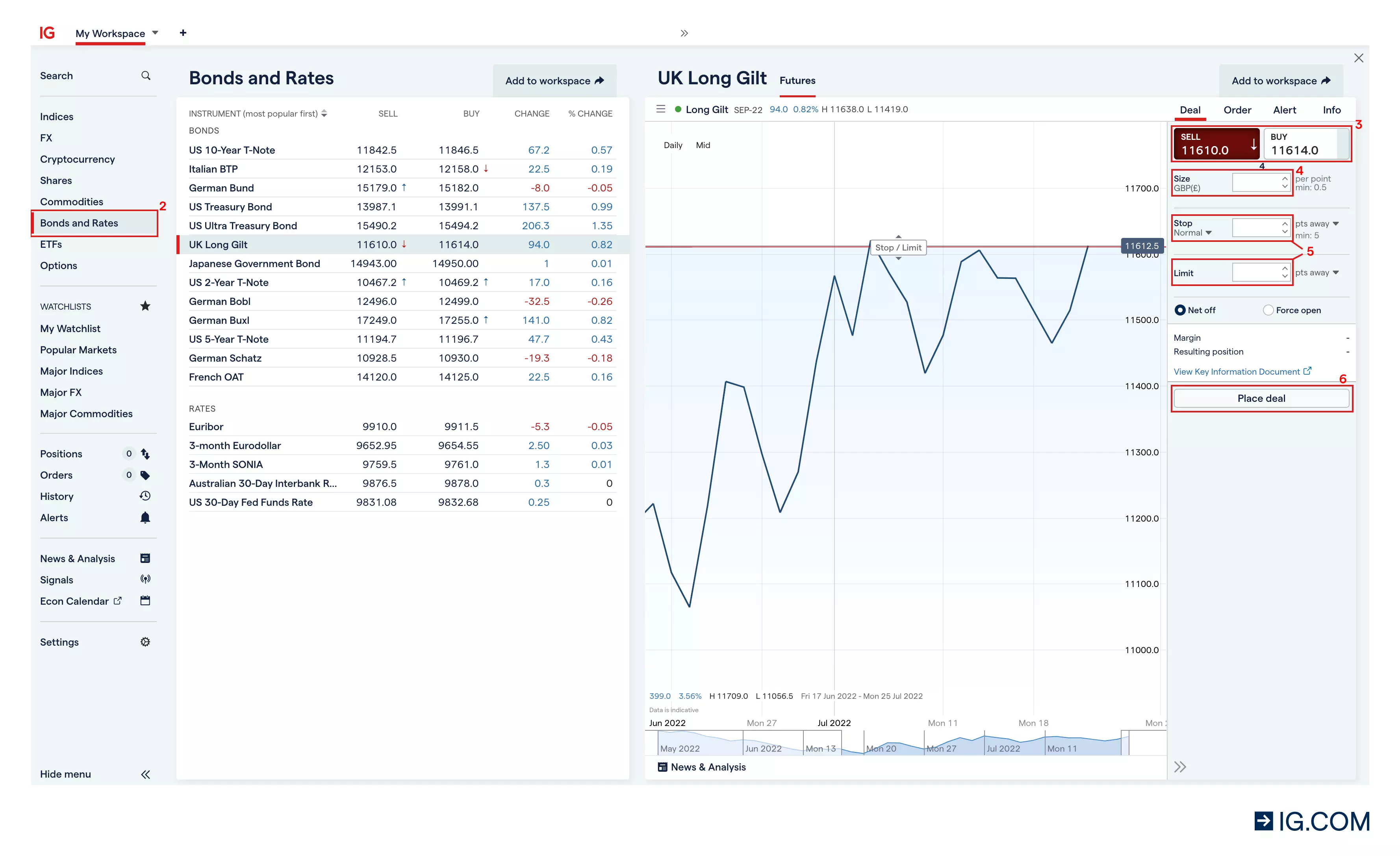

- Log in to our web platform or mobile app

- Go to 'Bonds and rates' or search for the rate you want to trade

- Select 'buy' if you want to go long or 'sell' if you want to go short

- Choose your position size

- Set your stops and limits

- Open your position

Techniques for trading interest rate futures

There are different ways to trade interest rate futures, but there are some common techniques that you can use to get you started.

- Predicting on rising interest rates

- Predicting on falling interest rates

- Hedging against interest rate risk

- Hedging against inflation

As trading on interest rate futures work like any other futures contracts, you can go long or short. On our platform, there is an inverse relationship between interest rate futures and interest rates.

So, for rising interest rates, you’d adopt a ‘short’ position on the futures contract, within your chosen date range. When going short, you’re ‘selling’ a derivative contract to open your trade, and your profit or a loss will depend on whether your prediction is correct.

To close your trade once (to lock in possible profits or limit any losses, you’d ‘buy’ the interest rate derivative to effectively buy the derivative back.

It’s important to remember that short-selling is a high risk trading method because bond prices could keep rising – in theory, without limit. This means that, if you open a short position, you’re at risk of incurring unlimited losses. That’s because there’s no limit to how much interest rates can rise, so always trade wisely with a risk management strategy in place.

If you think the interest rate is likely to be lowered soon, and that the market is about to enter a dovish cycle, you can also trade on interest rate derivatives by ‘going long’. When you go long, you’re ‘buying’ your interest rate derivative within your chosen date range.

To close your long position, you’d reverse the trade by clicking ‘sell’. You’d earn a profit if you sold for a higher amount than you bought at, and take a loss if the reverse were true.

You can even hedge interest rate derivatives against other markets, for example the mortgage rate. For example, if the mortgage rate were about to go up, you could hedge this by shorting interest rate derivatives.

This is because interest rates have a closely symbiotic relationship with some asset classes and an inverse relationship with others, such as mortgages. This makes hedging a popular technique for trading interest rates.

Consumer spending and borrowing tends to go up when interest rates go down, as does company spending. This means stocks often perform well in low interest rate environments, across a number of sectors – especially consumer retailers selling to the man in the street.

But what about when interest rates rise? Some popular hedging strategies include opening a position on mortgage payments – which go up in hawkish environments – and bonds, which often decrease in price when interest rates increase. Another strategy is to buy or go long on shares in banks and other lenders, which tend to also do well when interest rates are hiked.

One of the key duties of any central bank is to monitor and steer the rate of inflation in a country, in line with the general economic climate. One main method of doing this is for central banks to influence the short term interest rate, which means interest rates and inflation often have an inverse relationship.

This makes interest rate derivatives and futures a useful hedge against inflation. During an interest rate hike, consumer spending and borrowing drops as belts are tightened. This causes inflation to lessen, with the economy contracting. When the interest rate is dropped and spending and lending increases once more, inflation rises as more money is circulating.

In this instance, you would go short on interest rates and long on inflation derivatives or inflation-linked stocks.

FAQs

What does interest rate derivative mean?

Interest rate derivative’ means using a derivative product to trade on changes in the interest rate of a country. In other words, it’s a type of financial product that enables you to trade on the short-term interest rate and predict on whether it will rise or fall.

What are the types of interest rate derivatives?

One of the most popular types of interest rate derivatives is trading futures with CFDs. This enables you to predict on the future changes in interest rates. Interest rate caps are another form of interest rate derivative, as are interest rate swaps – although we don’t offer caps or swaps on our platform.

Are there other ways to trade on interest rate changes?

Although interest rate derivatives are the most direct way to trade on rates, there are other ways to trade on them.

One alternative way to trade on interest rates is by trading bonds, which often do well when interest rates decrease and drop in value when interest rates rise.

Another way to trade more indirectly on interest rates is to buy or sell stocks, commodities and other asset classes in accordance with what the rate is doing, as interest rates have a symbiotic relationship with almost all markets. Retail stocks are often a popular when interest rates drop, while shares in financial institutions like banks tend to appreciate when interest rate rise.

1 By total number of client relationships. Investment Trends 2022 Singapore Leverage Trading Report.