How to trade artificial intelligence (AI)

Artificial intelligence (AI) is getting set to change the future. Discover how to trade AI with us, Singapore’s No.1 CFD/FX broker1.

If you’re ready to trade on artificial intelligence, follow these steps:

1. Make a decision to trade

Trading allows you to predict whether prices will rise or fall. With us you can trade derivatives via CFDs.

2. Identify a stock or ETF through your own analysis

Carry out your own technical and fundamental analysis to identify a stock or ETF that you’d like to take a position on.

3. Open an account and place your AI trade

Open a trading account to take a postion on prices with CFDs.

Get direct exposure to the top artificial intelligence stocks with our Artificial Intelligence Index

Explore a unique trading opportunity with our AI Index, where you can access a curated selection of leading AI stocks conveniently. Diversify your portfolio with exposure to prominent US corporations spearheading innovation. You can trade the index using CFDs. You can:

Go long or short

Take advantage of market fluctuations by going long or short on the AI industry, enabling you to capitalise on both rising and falling prices. However, it’s important to remember that you can make a loss if the market moves against you.

Trade with leverage

Unlock the power of leverage by depositing only a fraction of the full trade value to open positions, which enables you to amplify potential profits based on the entire value of the trade. However, it’s crucial to know the associated risks, as leverage magnifies both gains and losses. This means your potential loss can exceed your deposit amount.

The index is calculated and managed by BITA GmbH.

Or, if you want to get a greater understanding of the AI sector before you take a position, here’s our full guide:

5 steps to trading in artificial intelligence (AI)

Learn about the AI industry

The AI industry is focused on researching, developing and manufacturing the latest and greatest machines that can make our everyday lives easier. The sector is centred around machines that’ve been programmed to carry out tasks and ‘think’ when solving problems.

AI is already being used to help in a range of different sectors, including healthcare, finance, car manufacturing, robotics, automation, education and agriculture.

Discover why people trade or invest in AI

People trade or invest in AI because it is a growing sector that is likely to become a greater part of our daily lives in the coming years. Previously the stuff of science-fiction, artificial intelligence has already made our world vastly different to what it was 50 years ago. Who’s to say what the world will look like in 10 years’ time, let alone 50.

So, people are looking to trade or invest in AI to ride the wave of technological advancement that’s expected to take the twenty-first century by force. And, the companies that are leading the charge could be set to experience rapid growth – assuming that AI becomes everything that people currently think it will be.

AI is one of several thematic trading opportunities that’ve gained popularity in recent years – and people are interested to see exactly what this industry has in store. Other thematic opportunities include water, electric vehicles and 5G.

Remember with us you can only trade derivatives via CFDs.

CFDs are leveraged products. This means you open a position with a deposit, called margin, which is just a fraction of the total poisition size. Please note that this means you may gain or lose money faster than you'd expect.

Decide which AI asset you want to take a position on

With us, you’ll be able to trade on artificial intelligence stocks or ETFs.

- Stocks give you exposure to the market performance of different companies that are directly involved in the artificial intelligence sector like Alibaba, IBM and Microsoft

- ETFs are a basket of securities – usually the shares of multiple companies and certain indices like the Nasdaq 100 – that will give you diversified exposure to the artificial intelligence sector

- AI Index – this index reflects the performance of notable US companies and is a great way to gain exposure to the AI market

- Stocks

- ETFs

- Indices

| Trading |

| Take a position on stock prices rising or falling with CFDs. |

| Trading |

| Take a position on ETF prices rising or falling with CFDs. |

| Trading |

| Take a position on prices rising or falling with CFDs. |

- Artificial intelligence stocks live market prices

- Artificial intelligence ETFS live market prices

Prices above are subject to our website terms and conditions and are indicative only. All shares prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and conditions and are indicative only. All shares prices are delayed by at least 15 minutes.

Trade in artificial intelligence via CFDs

| Trading with CFDs | |

| Markets | Artificial intelligence shares and ETFs |

| Method | Our CFD account |

| Time frame | Short to medium term |

| Initial capital required | Deposit (margin) |

| Returns | Profit from long and short positions |

| Commission | From $10 for Singapore-listed shares and ETFs, and $10 USD for those listed in the US |

| Risk | Leverage can magnify both your profits and losses as they’ll be based on the full exposure of the trade, not just the margin required to open it. This means profits and losses could far outweigh your margin, so always ensure you’re trading within your means. |

| Style | Day trading, swing trading, trend trading and position trading |

Trading vs investing in detail

We like to be clear about the differences between trading and investing.

‘Trading’ allows you to predict whether the price of a stock or other financial asset will rise or fall using derivatives like CFDs. If you want to take a position on AI stocks or ETFs without owning them directly, then CFD trading might be for you.

Bear in mind that these are leveraged products, which means they enable you to get full market exposure for an initial deposit – known as margin. But, while leverage can increase your profits, it can also increase your losses.

‘Investing’ means that you’re buying and owning shares or ETFs to benefit from prices rising. You’ll be able to invest in the shares of individual companies that are involved in the artificial intelligence sector, or in ETFs to get broad exposure to AI.

Leverage isn’t available when you’re investing, so you’ll need to commit the full cost of your position upfront. While this could increase your initial outlay, it also caps your maximum risk at the amount of money you paid to open your position.

Remember, with us you can only trade derivatives via CFDs.

Identify an opportunity through your own analysis

Analysis is a crucial part of trading – and competent analysis can be the difference between making a profit or incurring a loss. It’s important that you carry out both fundamental and technical analysis before opening your artificial intelligence position.

- Technical analysis looks at chart patterns, technical indicators and historical price action

- Fundamental analysis is based on the fundamentals of a company, including its net revenue and profit and loss statements

Interested in analysis? Find out more at IG Academy

Pick your platform and place your AI trade

We’ve got an award-winning trading platform2 – available on desktop or on-the-go with our mobile app. You’ll benefit from in-platform news and analysis from our in-house team of experts and Reuters newsfeeds – as well as a range of technical indicators that you can use to analyse charts and historical price action.

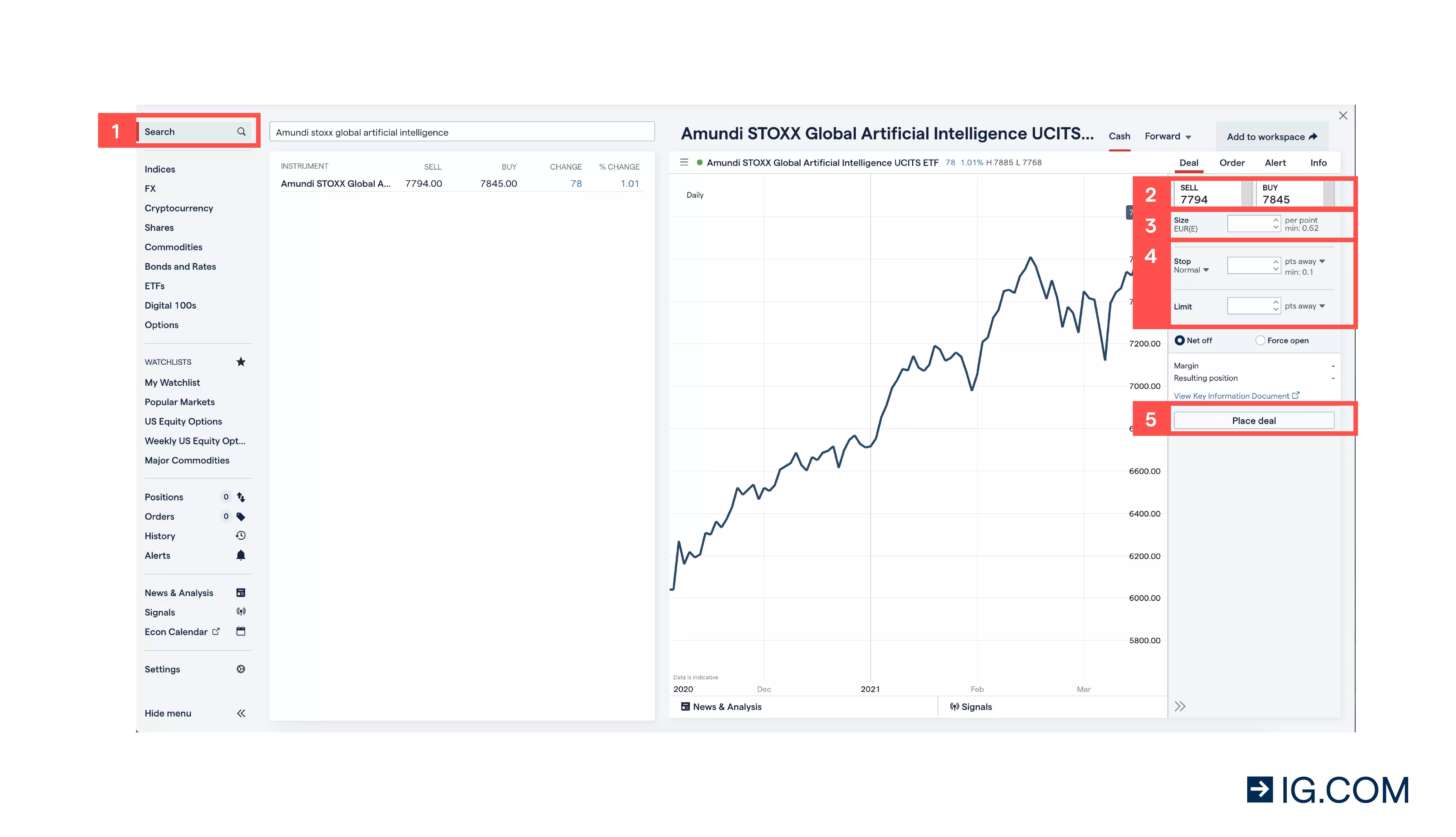

Step-by-step guide to making an AI stocks or ETFs trade

Here’s a screenshot of our trading platform, with some steps that take you through how to open a position for CFDs.

- Search for and select your opportunity

- Choose ‘buy’ to go long or ‘sell’ to go short

- Put in your position size

- Set your stops or limits to help manage your risk

- Place your deal and monitor your position

Before you open a position on artificial intelligence stocks or ETFs, it’s important to take steps to manage your risk. For example, CFDs are leveraged products, meaning that you should familiarise yourself with the impact of leverage on your trading.

We’ve also got free educational courses at IG Academy to help you get the most out of your time on the markets. If you’re not ready to trade with a live account, maybe you’ll want to try our demo – which gives you $20,000 in virtual funds to help build your confidence in a risk-free environment.

1 By total number of client relationships. Investment Trends 2022-2024 Singapore Leverage Trading Report.

2 Winner for Mobile Platform / App based on the Investment Trends 2018 Singapore CFD & FX Report based on a survey of over 4,500 traders and investors. Awarded the Best Online Trading Platform by Influential Brands in 2019 and 2022. Winner of FX Markets Asia FX Awards 2021 - Best Retail FX Platform. Winner for Best Trading App based on the Investors Chronicle and Financial Times Investment and Wealth Management Awards 2018, and the Professional Trader Awards 2019.