Oil, gold and silver prices stabilize ahead of US CPI print

Outlook on Brent crude oil, gold and silver ahead of this week’s US CPI and PPI data releases.

Brent crude oil holds decline despite US stockpiles rise

Brent crude oil prices again fell on Wednesday amid higher-than-expected US stockpiles but lingering tensions in the Middle East led to a minor bounce.

Technically the situation hasn’t changed in that the oil price continues to sideways trade within a triangle formation, the break out of which may well determine the ensuing medium-term trend.

Support is seen along the December-to-January uptrend line at 75.74, at Monday’s 75.21 low and last week’s 74.81 low. Were it to be fallen through, the 7 December low at 73.69 would represent the next downside target ahead of the 72.50 December low.

Resistance remains to be seen along the October-to-January downtrend line at 78.74 ahead of last week’s 79.35 high. Were it to be overcome, a bullish reversal towards the late-December high and the 200-day simple moving average (SMA) at 81.44 to 81.74 would likely be on the cards.

Gold price side-lined ahead of US CPI print

Spot gold’s drop from its $2,088 per troy ounce late-December peak amid an appreciating US dollar has led to Monday’s $2,017 low being reached, above which the precious metal has been range trading ever since.

Slightly further down support can be found along the 55-day SMA at $2,015 and, more importantly, between the October and late-November highs at $2,009 to $2,007.

Resistance above Wednesday’s $2,040 high can be seen along the December-to-January downtrend channel resistance line at $2,044 and also at Friday’s $2,064 peak. While remaining below it, downside pressure should retain the upper hand.

Silver price still hovers above support

Spot silver’s descent from its late-December per troy ounce high at $24.60 on the back of an appreciating US dollar took it to last week’s $22.84 low, above which it has been sideways trading in a low volatility range since. Slightly below $22.84 sits the $22.51 December low which should act as support, were it to be revisited. Further down lies the November low at $21.89.

Minor resistance above Tuesday’s $23.37 intraday high can be found between Friday’s high and the 55- and 200-day SMA at $23.62 to $23.64. While this resistance area caps, downside pressure should dominate.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

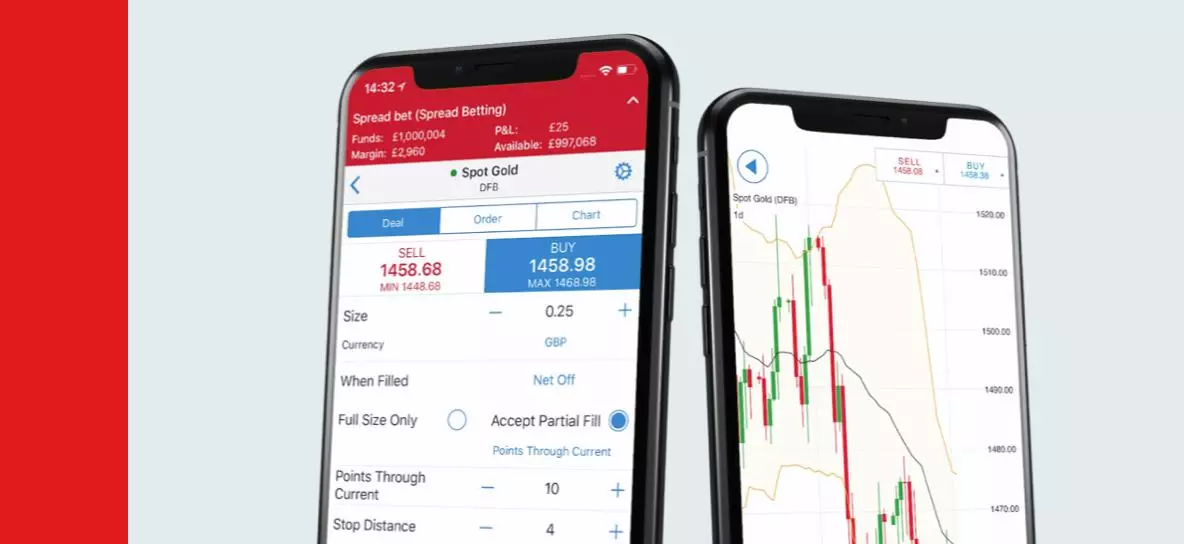

See your opportunity?

Seize it now. Trade over 17,000+ markets on our award-winning platform, with low spreads on indices, shares, commodities and more.

Live prices on most popular markets

- Equities

- Indices

- Forex

- Commodities

Prices above are subject to our website terms and agreements. Prices are indicative only. All share prices are delayed by at least 15 minutes.

Prices above are subject to our website terms and agreements. Prices are indicative only. All shares prices are delayed by at least 15 mins.