How to trade or invest in the space stocks and ETFs to watch

Space company listings have taken off in recent years. Learn how you can get exposure to space stocks and ETFs with us, the world’s No.1 trading provider.1

Call 0800 195 3100 or email newaccounts.uk@ig.com to talk about opening an account.

Contact us 08001953100

Get info fast via our instant help and support portal. Available for account queries, ProRealTime, product info and more.

Visit help and support for more information.

Get info fast via our instant help and support portal. Available for account queries, ProRealTime, product info and more.

Visit help and support for more information.

Call 0800 409 6789 or email helpdesk.uk@ig.com if you have any questions about trading or investing. We're available 24/7 between 8am Saturday and 10pm Friday.

Contact us 0800 409 6789

Call 0800 195 3100 or email newaccounts.uk@ig.com to talk about opening an account.

Contact us 08001953100

Get info fast via our instant help and support portal. Available for account queries, ProRealTime, product info and more.

Visit help and support for more information.

Get info fast via our instant help and support portal. Available for account queries, ProRealTime, product info and more.

Visit help and support for more information.

Call 0800 409 6789 or email helpdesk.uk@ig.com if you have any questions about trading or investing. We're available 24/7 between 8am Saturday and 10pm Friday.

Contact us 0800 409 6789

Learn about the space industry

Private space companies have revolutionised the industry. With over 10,000 space-focused companies globally (and counting), the industry is valued at around $4 trillion. Space tech companies in particular make up the majority of this sector.

For example, certain companies manufacture and supply materials for spacecraft construction, as well as parts for the build and repair of the spaceflights and launch infrastructure. Other companies develop frontier technologies, like software, artificial intelligence (AI) and robotics. They also manufacture satellites, as well as navigation and mapping systems, that enable the success of the space industry.

While you might not afford a $450,000 spaceflight ticket with Virgin Galactic, there are other ways you can get exposure in the industry. There are a growing number of space stocks, EFTs and investment trusts in the space sector – and you can trade or invest in a number of these on our platform.

Discover why people trade or invest in space stocks and ETFs

People trade or invest in space stocks and ETFs because they believe that the industry offers lots of growth opportunities, especially for tech companies in the supply chain. It’s believed that the global space industry will generate well over $1trillion in revenue by 2040.

Space stocks are one of several thematic opportunities that’ve gained popularity in recent years. You’ve probably observed the mounting interest in the possibilities that frontier technologies may offer in the near future. Other themes that you can trade or invest in with us include AI, electric vehicles and 5G

The global space economy

Research the best space shares and ETFs

Are these the best space shares to watch?

Space stocks live market prices

Virgin Galactic

The space tourism pioneer, Virgin Galactic, operates spaceflights – making space travel a reality. Founded by Richard Branson, it had its initial public offering (IPO) in 2019, listing on the New York Stock Exchange.

Despite the stock’s popularity, the share price has been volatile over the with some sharp decreases experienced as the market reacted to news that the space company had postponed the launch of its commercial spaceflight from Q1 to Q4 of 2022.

Garmin

A global leader in satellite navigation, Garmin (with the help of its subsidiaries) designs, manufactures, and sells tech devices and apps. Over a five-year period, from 2017 to 2021, the share price saw a steady three-fold incline.

Lockheed Martin

Lockheed Martin is an American-based company that is centred around aerospace, technology, military and information security. It was founded in March 1995 when Lockheed Corporation merged with construction company Martin Marietta.

Over a five-year period (from 2017 to 2021) Lockheed Martin stock experienced a 25% increase in the share price, due to

Astra Space

A small American start-up, Astra Space manufactures launch vehicles for commercial and military use. In 2021, the company made an unsuccessful attempt to launch a vehicle into space due to engine issues. In Q1 of 2021 the Astra Space share price stood at $19 per share but fell to $9 per share in Q4 of 2021.

Iridium Communications

Iridium Communications is a global satellite comms company that provides worldwide access to voice and data services. The stock experienced a five-fold increase in the share price over a three-year period (2019 to 2021).

Iridium reported 7% annual increase in its total revenue of $162.2 million in Q3 of 2021. This consisted of $127.8 million of service revenue and $34.4 million of income generated from equipment sales and engineering as well as support projects.

While only five space stocks are mentioned above, the industry keeps increasing at a high rate and more companies are expected to make their IPOs. IPOs you should expect in the future include the likes of Virgin Orbit, Starlink, maybe even SpaceX.

Are these the best space ETFs and investment trusts to watch?

Space ETFs live market prices

You can trade these space ETFs on our platform:

Seraphim Space Investment Trust

The world's first listed Space Tech Fund and Seraphim Space's first significant investment since its IPO in July 2021. It’s a venture trust that invests in space start-ups from inception to exit. So, with the Seraphim Space Investment Trust, you’d be investing in a basket of stocks that support space entrepreneurial ventures.

Procure Space UCITS ETF

Procure Space UCITS ETF was Europe’s first space exchange traded fund, launched on the London Stock Exchange in June 2021. This basket is part of the Space Index, which gives you exposure to space stocks in 80 countries, increasing your exposure to high-growth companies within the space tech megatrend.

In the UK, all Undertaking for Collective Investment in Transferable Securities (UCITS) ETFs are eligible for individual savings account (ISA) investment.

Choose the asset you want to trade and identify an opportunity

With us, can trade or invest in space stocks or ETFs.

- Stocks

- ETFs

Stocks give you exposure to the market performance of different companies that are directly involved in the space industry, like Garmin Ltd, Virgin Galactic and Iridium Communications

Trading

Speculate on stock prices rising or falling with spread bets or CFDs

Investing

Buy the stocks outright and benefit from any upward movement in their price

Trading

Speculate on ETF prices rising or falling with spread bets or CFDs

Investing

Buy shares in an ETF outright and benefit from any upward movement in the ETF’s price

Remember that trading on leverage is high risk, and you can lose more than your initial deposit. Make sure to take the appropriate risk management steps before opening a position and never trade using more capital than you can afford to lose. Investing also poses certain risks, though you can’t lose more than your initial outlay. Take control of your investment using our risk management tool and ensure you’re well-informed with our range of educational resources.

Trading and investing in detail

‘Trading’ lets you speculate on the price movements of a stock or other financial asset using derivatives like spread bets or CFDs. If you want to take a position on space stocks or ETFs without owning them directly, then spread bets or CFDs might be for you.

‘Investing’ means that you’re taking direct ownership of something to benefit from prices rising. You’ll be able to invest in the shares of individual companies that are involved in the space sector, or in ETFs to get broad exposure to space companies.

‘Investing’ means that you’re taking direct ownership of something to benefit from prices rising. You’ll be able to invest in the shares of individual companies that are involved in the space sector, or in ETFs to get broad exposure to space companies.

Leverage isn’t available when you’re investing, so you’ll need to commit the full cost of your position upfront. While this could increase your initial outlay, it also caps your maximum risk at the amount of money you paid to open your position

Trading space opportunities

- Create or log in to your trading account for spread bets or CFDs

- Go to our platform

- Search for your space opportunity

- 4. Decide whether to go long or short, choose your position size and take steps to manage your risk

- 5. Open and monitor your trade

Investing in space opportunities

- Create or log in to your share dealing account.

- Go to our platform

- Search for your space opportunity

- Decide your position size

- Open and monitor your investment

Here are our best share dealing commission rates compared to those of our competitors

| IG | Hargreaves Lansdown | AJ Bell | |

| Best commission rate on US shares | Free | £5.95 | £4.95 |

| Standard commission rate on US shares | £10 | £11.95` | £9.95 |

| FX conversion fee | 0.5% | 1% - 0.25% | 0.75%- 0.25% |

| Best commission rate on UK shares | £3 | £5.95 | £4.95 |

| Standard commission rate on UK shares | £8 | £11.95 | £9.95 |

| How to qualify for the best rates | Open 3+ or positions in the previous month | 20 or more trades in the previous month | n/a |

The costs for spread bets and CFDs work differently. The cost of placing a spread bet is incorporated into the difference between the buy and sell price – also known as the spread. This means that the fee to deal will be reflected in your net profit or loss, and won’t be listed separately.

When you place a spread bet, it’ll be denominated in a particular currency and, if this is not your base currency, you may need to pay the associated conversion fee. Other costs you need to consider are the overnight funding charges and extra charges for guaranteed stop orders to control risk in the event of slippage.

When you trade on leverage, there’s one direct charge you’ll need to consider – the spread, or a commission in the case of share CFDs. We charge a spread on every market except for share CFDs, on which you’ll pay a commission.

Also, look out for potential charges like overnight funding, which is a charge you pay to keep your position open after trading hours, and guaranteed stop fees that could influence your trading costs. We work to keep these charges among the lowest in the business.

Identify an opportunity through your own analysis

Analysis is a crucial part of trading and investing – and competent analysis can be the difference between making a profit or incurring a loss. It’s important that you carry out both fundamental and technical analysis before opening your space stock or ETF position.

- Technical analysis looks at chart patterns, technical indicators and historical price action

- Fundamental analysis is based on the fundamentals of a company, including its net revenue and profit and loss statements

Interested in analysis? Find out more at IG Academy

Pick your platform and place your space trade or investment

We’ve got an award-winning trading platform1 – available on desktop or on-the-go with our mobile app. You’ll get access to in-platform news and analysis from our in-house team of experts and Reuters newsfeeds – as well as a range of technical indicators that you can use to analyse charts and historical price action.

- Step-by-step guide to making space stock or ETF trade

- Step-by-step guide to making a space stock or ETF investment

- Search for and select your opportunity

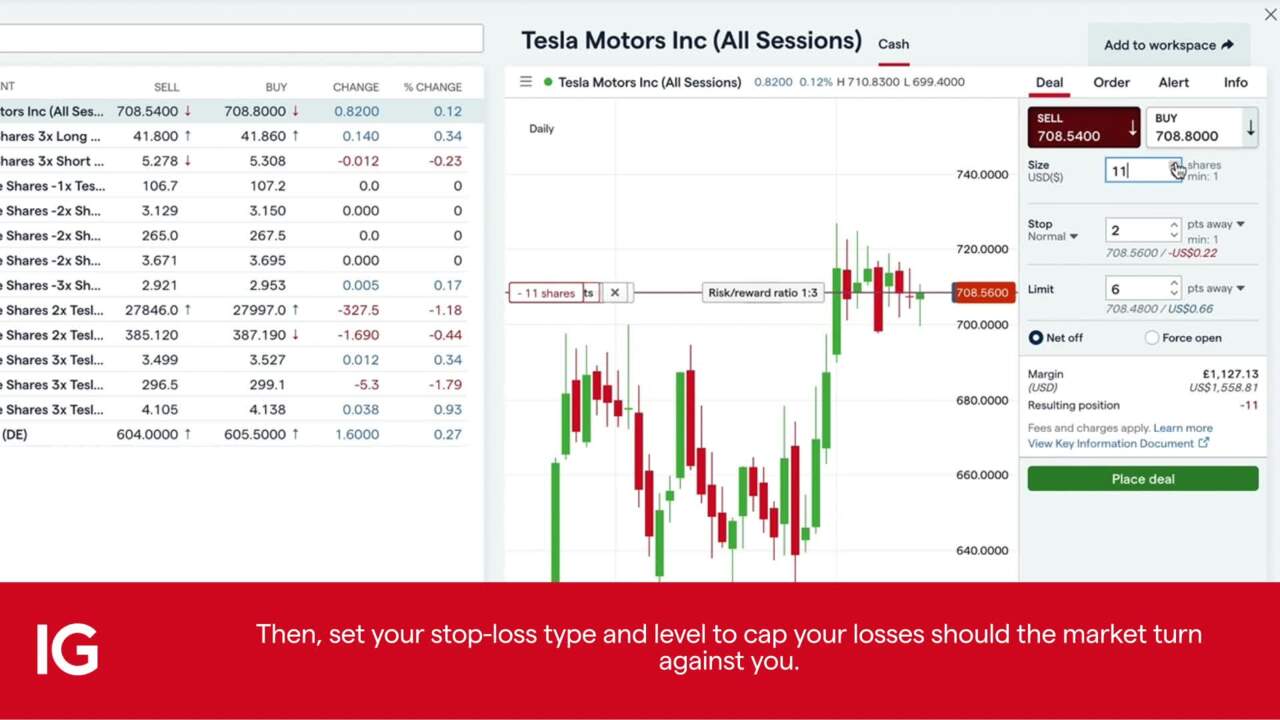

- Choose ‘buy’ to go long or ‘sell’ to go short

- Put in your position size

- Set your stops or limits to help manage your risk

- Place your deal and monitor your position

Here’s a screenshot of our investment platform, with some steps that take you through how to open an investment position.

- Search for and select your opportunity

- Choose ‘buy’ to open your investment

- Put in your position size

- Set your order type

- Place your deal and monitor your position

1 Best trading platform as awarded at the ADVFN International Financial Awards and Professional Trader Awards 2019. Best trading app as awarded at the ADVFN International Financial Awards 2020.

2 Negative balance protection is a regulatory requirement of all providers in the UK, which ensures you can never lose more than is in your account. Negative balance protection applies to trading-related debt only, and is not available to professional traders.