How to trade out-of-hours: pre-market and post-market

Discover how our pre-market, post-market and weekend trading offerings can enable you to make the most of price movements outside of regular market hours.

Start trading today. Call 0800 195 3100 or email newaccountenquiries.uk@ig.com. We’re available from 8am to 6pm (UK time), Monday to Friday.

Contact us: 0800 195 3100

Start trading today. Call 0800 195 3100 or email newaccountenquiries.uk@ig.com. We’re available from 8am to 6pm (UK time), Monday to Friday.

Contact us: 0800 195 3100

Written by Anzél Killian, Senior Financial Writer. Reviewed by Axel Rudolph, Senior Market Analyst

What is out-of-hours trading?

Out-of-hours trading is any trading activity that takes place outside of a market’s standard trading window. A range of our markets are available for out-of-hours trading, including shares, indices, forex pairs and options.

Out-of-hours trading can be separated into:

- Pre-market trading, which takes place before the main trading session opens

- Post-market trading, which takes place after the main trading session closes

- Weekend trading, which enables you to trade selected markets on Saturday and Sunday

Why trade out-of-hours?

When you trade during pre-market, post-market or weekend sessions, you can:

- React to breaking news and company earnings reports as they happen

- Open, edit or close a position outside of the main market session

- Hedge your exposure if breaking news is likely to affect an existing position

Discover more about trading online

What out-of-hours sessions are available?

What is pre-market trading?

Pre-market trading enables you to trade a market before the main session opens. For example, while most UK traders can only access US stock markets from 2.30pm to 9pm (UK time), pre-market trading could enable you to access these markets hours before they open. We offer exclusive extended and pre-market hours on All Sessions stocks, indices, forex pairs and options.

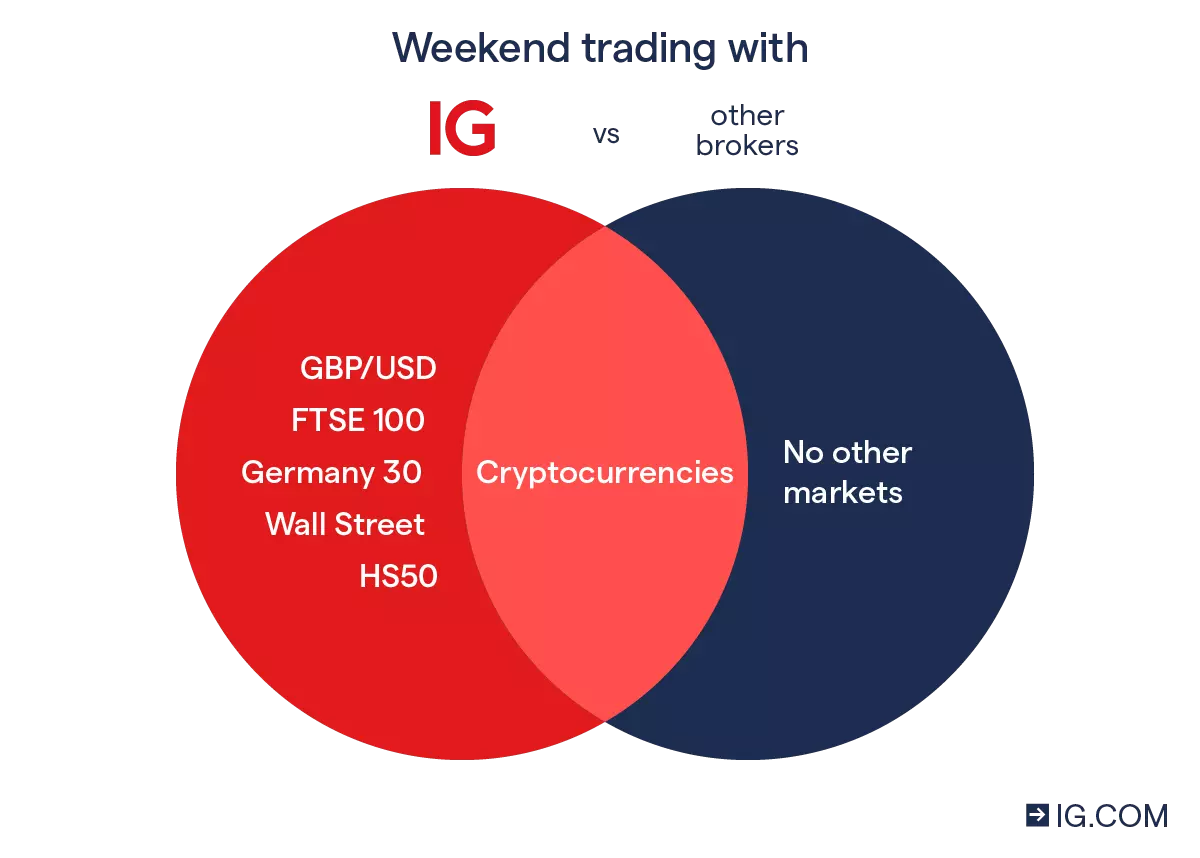

We also provide weekend trading before the Monday open on selected global indices and the GBP/USD forex pair – which you won’t get with any other provider.

What is post-market trading?

Post-market trading enables you to trade after the main session closes. For example, while most UK traders can only access US stock markets from 2.30pm to 9pm (UK time), post-market trading could grant you access to these markets for hours after they close. Our exclusive extended hours on All Sessions stocks, indices, forex pairs and options enable you to trade post market.

You’ll also be able to access our weekend trading offering after the Friday close on selected global indices and the GBP/USD forex pair – only available when you trade with us.

What is weekend trading?

Weekend trading enables you to take a position on a Saturday or Sunday. Much of our weekend trading offering is exclusive, as we’re the only provider to offer global indices and the GBP/USD forex pair. We also offer EUR/USD and USD/JPY.

You can use weekend trading to react to breaking news on a Saturday and Sunday, or to hedge your weekday positions with a weekend one on the same market. That’s because our weekend markets are separate to their weekday counterparts.

How to trade pre-market and post-market

Learn what moves pre-market and post-market prices

A range of factors can influence pre-market and post-market prices, including earnings releases, monetary policy meetings, macroeconomic events, and any unexpected news.

For example, companies often report results in the pre- or post-market sessions – before the main trading session starts. This can include US firms such as Apple, Alphabet, Netflix, Facebook, Amazon and Tesla, which are available as part of our All Sessions stock offering.

Prices tend to move rapidly when news breaks outside of the main session, as a result of lower trading volumes and liquidity. So, traders who don’t have access to pre- or post-market trading can find that they miss the opportunity to take full advantage of the price moves associated with these reports.

Choose a pre-market or post-market strategy

Pre-market and post-market trading sessions can form an important part of a trader’s strategy. There are two main ways to take advantage of price movements during these sessions:

Trading breakouts

Breakouts typically follow a period of consolidation – when an asset’s price is relatively static after a strong price move in either direction. Consolidation often precedes an announcement, as traders and investors are waiting to see how they should act.

Breakout traders will look for consolidation in the market, then open positions on the back of relevant news announcement. Their aim is to take full advantage of the resulting price move.

Technical indicators that can help you assess when breakouts could occur include Average True Range and Bollinger Bands.

Hedging gap risk

Gapping occurs when the price at the start of the main session is substantially higher or lower than the end of the previous day’s post-market session.

You can minimise gap risk by hedging with our out-of-hours markets. For example, if you were concerned that a Tesla shareholding could fall in value before the main session opens, you could take a short position on Tesla during our post-market session.

If the market falls as expected, the profit from your short position would help offset the loss to your shareholding. But, if it rises instead, the increase in the value of your shareholding would help offset the loss on your short position.

Open your position

Whether you choose to trade pre-market, post-market or at the weekend, the steps to open your position are always the same. Open an account then learn how to place your first out-of-hours trade.

How to trade at the weekend

Learn what moves prices at the weekend

Major price movements on our weekend markets most often result from breaking news or macroeconomic events.

Forex pairs and indices are strongly influenced by events including G7, G20 and EU summits, as well as trade negotiations, referendums and elections.

Choose a weekend trading strategy

Our weekend trading offering gives you an exclusive opportunity to trade markets not readily available elsewhere. There are two main ways to take advantage of price movements during these sessions:

Trading macro events

Macro events often result in an announcement, such as an interest rate decision or the conclusion of trade talks.

The expected outcome of such an announcement will often be priced in to the markets before it actually happens, so prices can move quickly if there is a difference between expectations and reality.

You can take a position early, provided you have an appropriate risk management strategy in place, or wait to see if something unexpected happens before opening a trade.

Hedging at the weekend

If you’re concerned that weekend news could affect an existing position, you’ll be able to use our weekend markets to hedge risk.

For example, if you have a US stock portfolio but are concerned about a short-term drop in its value, you might consider taking a short position on our Weekend Wall Street index.

As long as the two positions are roughly equal in value and opposite in direction, you’ll minimise the effect of any sudden negative moves over the weekend. That’s because any loss to one position would be offset by a gain to the other.

Open your position

Whether you choose to trade at the weekend, or in our pre-market or post-market sessions, the steps to open your position are always the same. Open an account then learn how to place your first out-of-hours trade.

How to open your out-of-hours trade

Choose a trading method

Create a trading account with us, and you’ll be able to trade pre-market, post-market and at the weekend with spread bets and CFDs. These are financial derivatives, which enable you to speculate on the price of a market rising by going long, or falling by going short.

Alternatively, you can open a share dealing account to invest in shares out-of-hours with our All Sessions stock offering on more than 70 US shares.

Spread betting

Spread betting is a tax-free way to trade.3

You’ll make a prediction about the direction of a market’s price movements, with your profit or loss determined by the accuracy of your prediction and the size of the market movement.

CFD trading

CFD trading works in a similar way to spread betting, but it enables you to offset profits against losses for tax purposes – making CFDs particularly useful for hedging risk.

Unlike spread bets, CGT applies to any CFD profits.3

Share dealing

Share dealing enables you to invest directly in shares. You’ll profit if you sell after they have risen in value.

You’ll also be eligible to receive dividends, and you might get company voting rights.

Select a market

Toggle between the tabs below to see the range of markets available during each session.

Shares

We offer extended hours for trading and share dealing on over 70 All Sessions US shares – including Alphabet, Amazon, Apple, Microsoft and Tesla.

Extended share trading hours

| Market hours (UK time) | |

| Normal stock market dealing hours on US shares | 2.30pm – 9pm Monday to Friday |

| Our extended dealing hours on All Sessions US stocks | 12pm to 10.30pm Monday to Thursday, and 12pm to 10pm Friday |

| Our spread betting and CFD trading hours on All Sessions US stocks | 9am to 1am Monday to Thursday, and 9am to 10pm Friday |

Indices

We offer over 35 more weekly trading hours than our nearest competitor on popular indices including the FTSE 100, Germany 40 and Wall Street.4 These markets enable you to get exposure to a country’s most popular stocks from a single position.

Weekly indices trading hours

| FTSE 100 | Germany 40 | Wall Street | |

| IG | 158 | 158 | 158 |

| City Index | 120 | 120 | 120 |

| CMC Markets | 112 | 121 | 114 |

| eToro | 70 | 98 | 113 |

| Trading 212 | 110 | 110 | 115 |

This data is based on analysis of the FTSE 100, Germany 40 and Wall Street offering from our UK competitors’ websites, and is correct to the best of our ability as of 30 March 2020. Some trading hours have been rounded up or down to the nearest hour. This table is for comparative purposes only, and the data is subject to change.

Forex

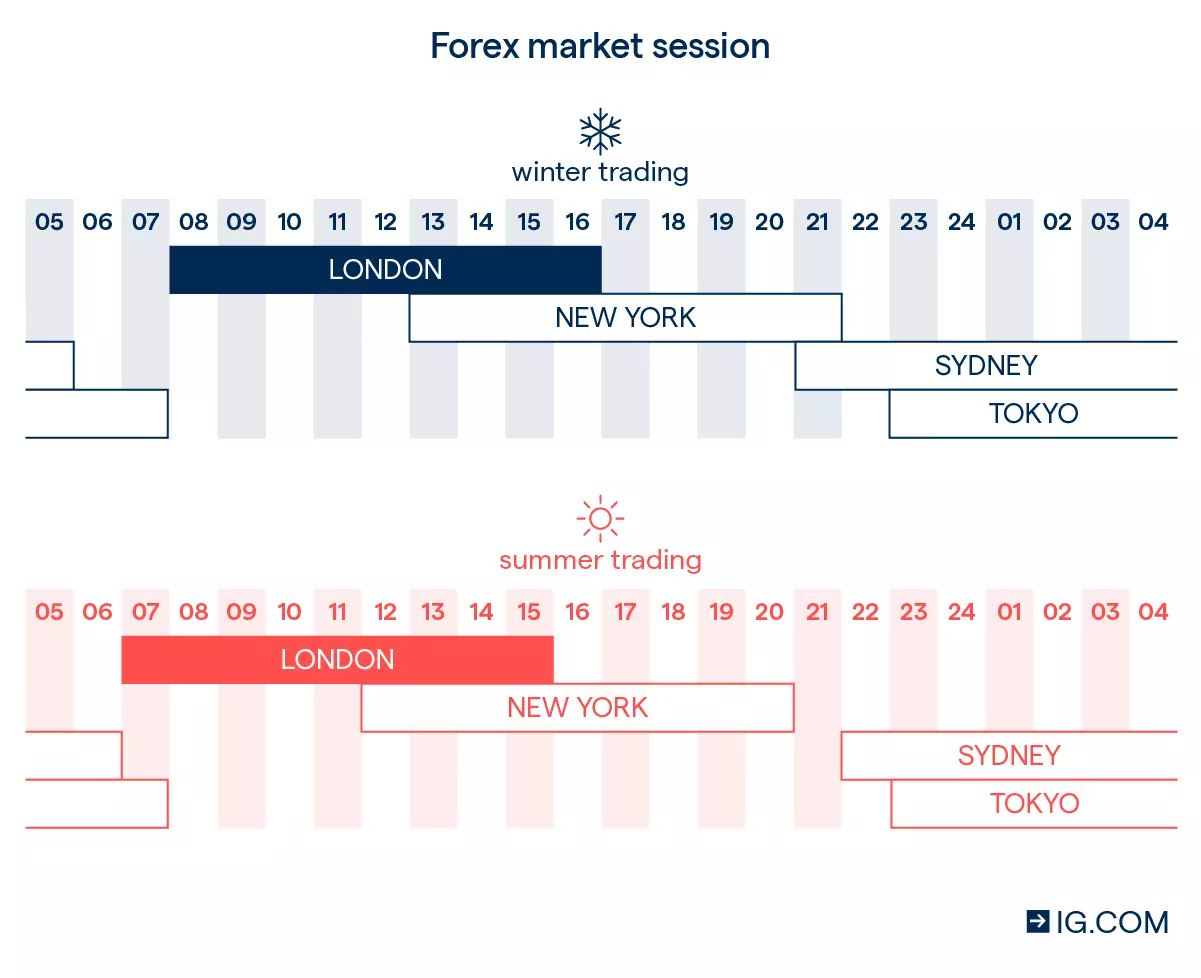

We offer major, minor and exotic currency pairs from 9pm Sunday until 10pm Friday (UK time). We also offer GBP/USD, EUR/USD and USD/JPY at the weekend.

Bear in mind that the forex market’s opening hours will vary in March, April, October and November, as countries shift to and from daylight savings time.

Options

We offer options trading with extended hours on selected weekly and monthly indices options contracts. Our daily options do not have extended hours because we are the market maker – meaning our daily options don’t exist in the underlying market.

- Standard options hours

- Extended options hours

| Market | Daily (UK time) | Weekly (UK time) | Monthly (UK time) |

| FTSE 100 | 7.30am – 4.30pm* | 8.15am – 4.30pm | 8.15am – 4.30pm |

| Germany 40 | 7.30am – 4.30pm* | 8.15am – 4.30pm | 8.15am – 4.30pm |

| Wall Street | 7.30am – 9pm* | 2.30pm – 9.15pm | 2.30pm – 9.15pm |

| Gold | 7.30am – 6.30pm** | 10am – 6.30pm | 10am – 6.30pm |

| Silver | 7.30am – 6.30pm** | - | 10am – 6.30pm |

| Oil | 7.30am – 7.30pm** | 10am – 7.30pm | 10am – 7.30pm |

*Our daily options on the FTSE 100, Germany 40 and Wall Street usually open at 7.30am on Monday (UK time), closing a few minutes before their various expiry times. FTSE 100 and Germany 40 daily options will reopen at 5.10pm (UK time), Wall Street will reopen at 9.40pm (UK time), running to the following day’s close before closing for the weekend at the Friday expiry.

**Our daily options on gold, silver and oil usually open at 7.30am on Monday (UK time), closing a few minutes before their various expiry times. They’ll reopen at 9pm (UK time) that same evening, and run until the following day’s close before closing for the weekend at the Friday expiry.

| Market | Daily (UK time) | Weekly (UK time) | Monthly (UK time) |

| FTSE 100 | 7.30am – 4.30pm* | 4.30pm – 8am | 4.30pm – 8am |

| Germany 40 | 7.30am – 4.30pm* | 4.30pm – 8am | 4.30pm – 8am |

| Wall Street | 7.30am – 9pm* | 9.15pm – 2.30pm | 9.15pm – 2.30pm |

| Gold | 7.30am – 6.30pm** | -[Only during standard hours] | -[Only during standard hours] |

| Silver | 7.30am – 6.30pm** | - | -[Only during standard hours] |

| Oil | 7.30am – 7.30pm** | -[Only during standard hours] | -[Only during standard hours] |

*Our daily options on the FTSE 100, Germany 40 and Wall Street usually open at 7.30am on Monday (UK time), closing a few minutes before their various expiry times. FTSE 100 and Germany 40 options will reopen at 5.10pm (UK time), Wall Street will reopen at 9.40pm (UK time), running to the following day’s close before closing for the weekend at the Friday expiry.

**Our daily options on gold, silver and oil usually open at 7.30am on Monday (UK time), closing a few minutes before their various expiry times. They’ll turn back on at 9pm that same evening (UK time), and run until the following day’s close before closing for the weekend at the Friday expiry.

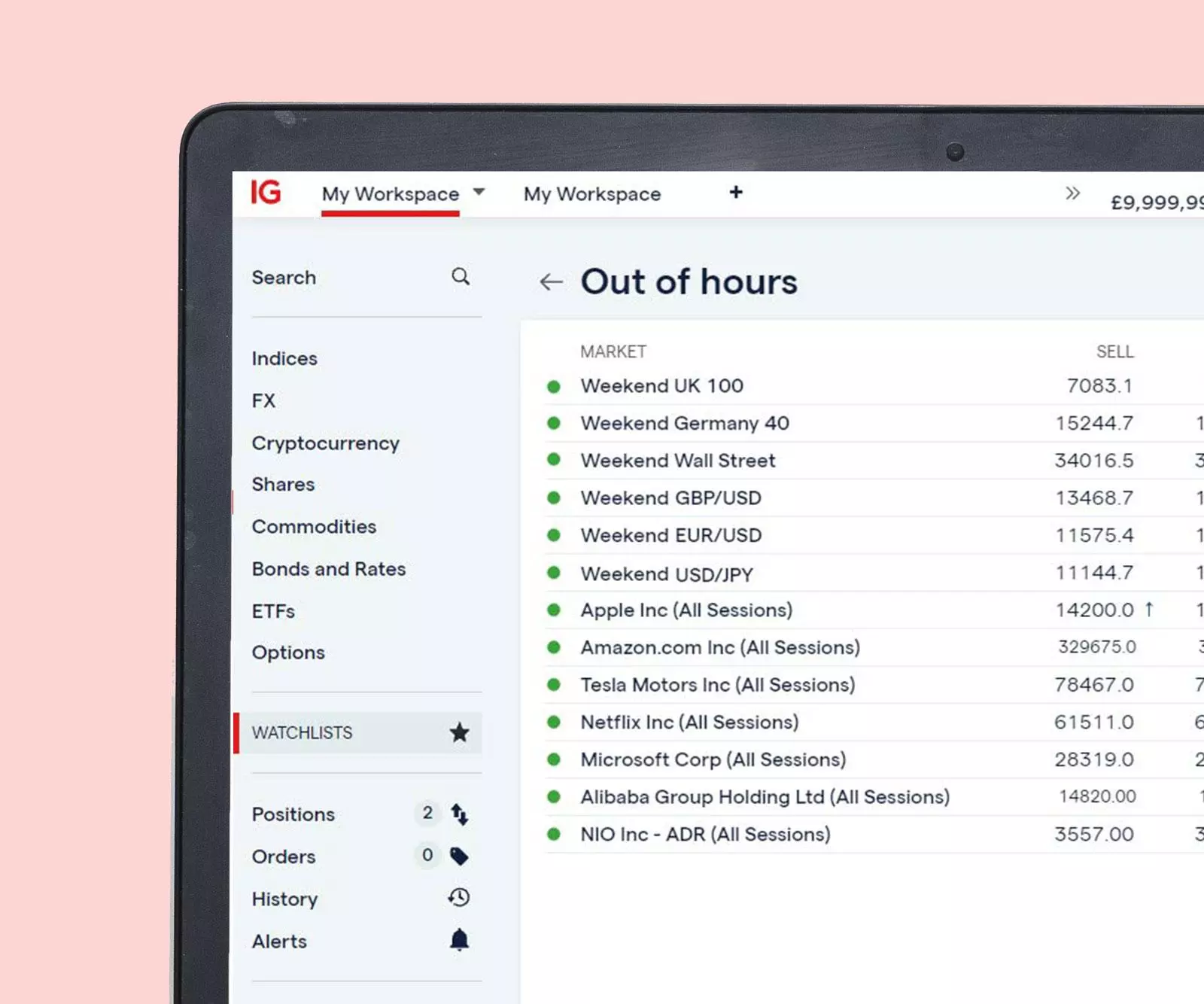

Weekend trading opportunities

Our weekend indices and forex markets are completely separate to their weekday counterparts. This means that rather than trading our weekday ‘FTSE 100’ market on a Saturday and Sunday, you’ll be trading the ‘Weekend UK 100’ market on our trading platform. Or, rather than trading ‘GBP/USD’, you’ll be trading ‘Weekend GBP/USD’.

Weekend market trading hours

| Market | Weekend trading times (UK time) |

| Weekend UK 100 | 8am Saturday – 10.40pm Sunday |

| Weekend Germany 40 | 8am Saturday – 10.40pm Sunday |

| Weekend Wall Street | 8am Saturday – 10.40pm Sunday |

| Weekend HS50 | 8am Saturday – 10.40pm Sunday |

| Weekend GBP/USD | 8am Saturday – 8.40pm Sunday |

| Weekend EUR/USD | 8am Saturday – 8.40pm Sunday |

| Weekend USD/JPY | 8am Saturday – 8.40pm Sunday |

Understand the risks of pre-market, post-market and weekend trading

The risks of pre-market, post-market and weekend trading include:

- Lower liquidity than the main market session. Many market participants prefer to trade during the main session – when prices are generally more stable – meaning there can be fewer active participants to fill the other side of trades out-of-hours

- Higher volatility than the main market session. Lower liquidity can result in more dramatic swings in prices, which can be good or bad – depending on your individual risk appetite

- Wider spreads than the main market session. The spread is the difference between the buy and sell price on offer. Spreads can widen when volatility rises or liquidity falls – both of which occur more frequently out-of-hours

You can manage your risk using stops and limits, which automatically close your trade when the price hits a pre-determined level. Guaranteed stops are the best way to cap risk because these always close your trade at the exact level you specify – even if the market moves quickly or ‘gaps’. A small premium is payable if a guaranteed stop is triggered.

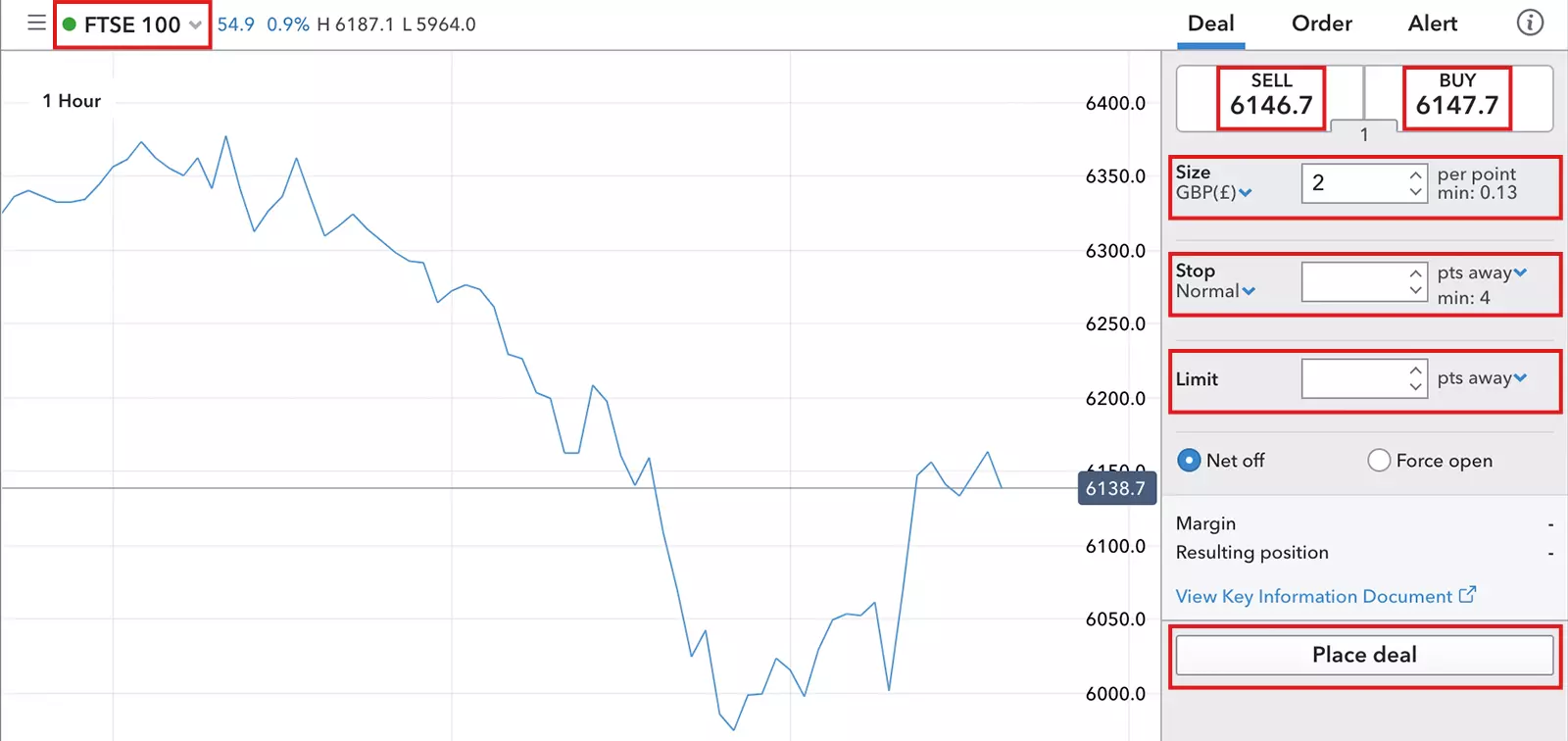

Place your trade

To place a trade during the pre-market, post-market or weekend sessions, create an account and go to our web trading platform or mobile trading app. Once there, follow the steps below:

- Select your market

- Decide whether to sell or buy

- Choose your position size

- Set your stops and limits

- Place your deal

The below screengrab is showing how to open a position on our weekday FTSE 100 offering. Remember that if you want to trade the FTSE 100 at the weekend, you’ll need to search for ‘Weekend UK 100’ on our trading platform.

Alternatively, you can practise using our platform with a demo account. You’ll get £10,000 in virtual funds to build your confidence before trading the live out-of-hours market sessions.

FAQs

What is All Sessions stock trading?

All Sessions stock trading is part of our exclusive out-of-hours offering. It enables you to trade over 70 US shares we offer in our extended share trading and dealing hours. You can trade derivatives on All Sessions stocks, or you can buy and sell the shares outright with a share dealing account.

Our derivative trading hours for All Sessions stocks are 9am to 1am Monday to Thursday, and 9am to 10pm Friday (UK time). For share dealing, our All Sessions stocks are available between 12pm to 10.30pm Monday to Thursday, and 12pm to 10pm Friday (UK time).

What are 'All Sessions' stocks?

All Sessions stocks are over 70 US shares that we offer outside of the main market session for share dealing and trading. Our share dealing times for All Sessions stocks are 12pm until 10.30pm Monday to Thursday, and 12pm until 10pm on Friday (UK time). You can also speculate on our All Sessions stock offering with spread bets and CFDs from 9am until 1am Monday to Thursday, and 9am to 10pm on Friday (UK time).

Will a weekday position move over the weekend?

Your regular positions won’t move in value over the weekend, and a weekday position that is open on a Friday will not roll over into a weekend trading position once the weekend markets open.

But, your weekend positions that are left open after the weekend markets close on a Sunday night will rollover into a regular weekday position when those markets open, and any stops or limits will remain intact.

How can you hedge risk at the weekend?

You can hedge risk at the weekend by taking an opposing position on a Saturday or Sunday that offsets a potential loss to a weekday position. This is possible with our weekend indices and forex markets because they are completely separate to their weekday counterparts.

For example, let’s say you were long on the Germany 40 when the market closed on a Friday. If you became aware of news on Saturday that could cause the market to drop quickly when it reopens, you might decide to go short on the Weekend Germany 40. A loss to your weekday position would then be offset by a gain on your weekend position.

How can you trade out-of-hours?

You can trade out-of-hours by speculating on market prices during the pre-market and post-market sessions, or at the weekend with a weekend trading provider like us.

How do extended hours prices work?

Our extended hours prices work differently depending on the market. For example, our prices for All Sessions US equities are derived from the underlying market. For indices on the other hand, our extended hours prices are created by analysing historical correlations with similar markets.

Why do stocks and other assets spike pre-market and after hours?

Stocks and other assets might spike or experience increased volatility in pre-market and after-hours trading on the back of breaking news announcements or company earnings reports. Whether you choose to trade the pre-market or post-market session will depend on your individual appetite for risk.

Develop your forex knowledge with IG

Find out more about forex trading and test yourself with IG Academy’s range of online courses.

Try these next

Learn how to trade the biggest and most volatile market in the world.

Discover the differences between these two products, and decide which is best for you.

Learn more about shares trading, including our All Session US equity offering.

1 Based on revenue (published financial statements, 2022); for forex based on number of primary relationships with FX traders (By number of primary relationships with FX traders (Investment Trends UK Leveraged Trading Report, May 2023)).

2 24/7 excludes the time from 10pm Friday until 8am Saturday.

3 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

4 Based on analysis of the FTSE 100, Germany 40 and Wall Street offering from prominent UK competitor websites. Information correct to the best of our ability as of 30 March 2020.