How to trade gold

Discover how to speculate on gold with spot prices, futures and options, as well as gold-linked shares and ETFs.

Steps to trading in gold

Are you ready to trade in gold? Take your position in just three steps:

Select a gold market to trade

Choose between our gold markets or a selection of gold stocks and ETFs.

Make a trading plan

Decide whether you would like to trade on CFDs on gold short term, or long term - and how you're going to manage your risk.

Open a live account

Fill in our online form to create a CFD trading account in minutes.

For a more comprehensive overview of how to get started with gold trading and investing, follow our in-depth guide below.

Learn what gold investing and trading are

Gold investing and trading are two different ways to take a position on the future price movement of gold markets.

When you invest in gold, you’d take ownership of the asset upfront and profit if the precious metal rises in price. When you trade gold, you’re taking a position on the underlying price rising or falling – meaning you won’t be taking ownership of the asset itself.

There are several types of gold assets available for you to trade or invest in, depending on whether your interest is in the physical asset or not. These include:

- Gold bullion

Physical gold – in the form of coins and bars – is commonly used as a store of value, for both individual investors and banks. But the expensive safekeeping and insurance requirements often deter more active investors from buying the metal outright

- Spot gold

The spot price of gold is how much it would cost to buy upfront – or on the spot. It is usually the price of one troy ounce of gold. Trading spot gold is a popular means of getting exposure to bullion without having to take ownership of the precious metal

- Gold futures

Futures contracts enable you to exchange gold for a fixed price on a set date in the future. You’d have the obligation to uphold your end of the deal, whether that’s through a physical or cash settlement. Futures contracts are standardised for quantity and quality – only their price is driven by market forces

- Gold options

Options contracts work in a similar way to futures, but with no obligation to execute the trade when buying. Options give you the right to exchange either physical gold or gold futures at a specific price on a specific date. Call options give the holder the right to buy the precious metal, while put options give the holder the right to sell it

- Gold ETFs

Exchange traded funds (ETFs) track the movement of a basket of shares of publicly traded gold mining, refining and production companies. Trading or investing in an ETF gives you much wider exposure than you’d get from a single position, which makes them a popular way of diversifying a portfolio. ETFs are passive investments, which replicate market returns rather than seeking to outperform them

- Gold stocks

Trading on or investing in stocks can be a great way to get indirect exposure to gold. You can gain exposure to every element of the gold industry, from mining and production to funding and sales. It’s important to note that gold stocks don’t always move in the same way as bullion, as there are a lot of other factors that drive the prices of shares.

Understand what moves the price of gold

The price of gold is determined by supply and demand. There are a huge range of factors that can impact the market price, including:

- Global demand

- Mining production

- Interest rates

- The US dollar

- Financial stress and political insecurity

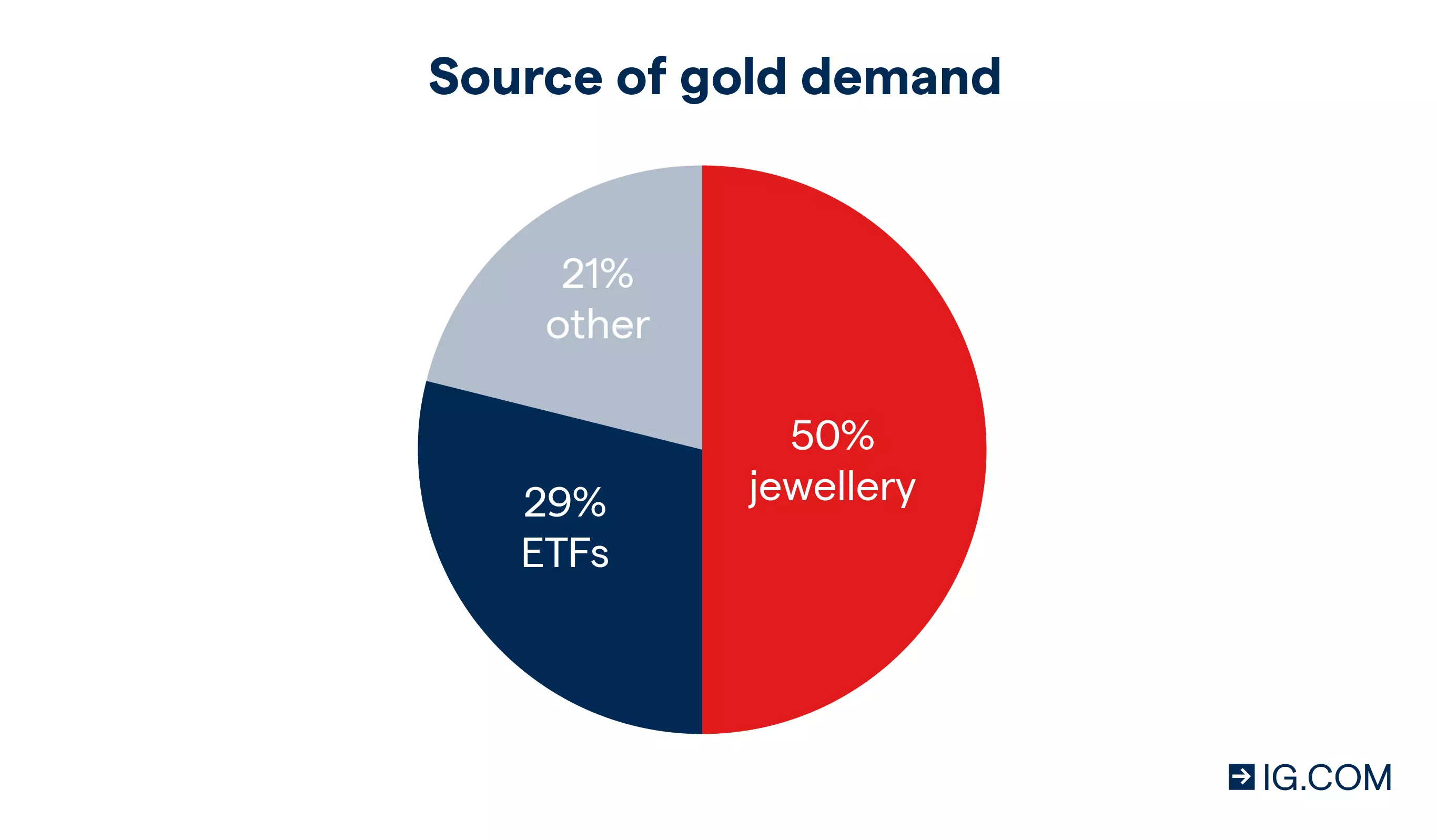

Since the 1970s, the demand for gold has quadrupled every year – driving up the gold price. Gold is used all over the world for a variety of reasons, such as jewellery, technology and as a value store for central banks and investors. In fact, jewellery demand accounts for roughly 50% of the global demand, while 29% comes from exchange traded funds (ETFs).1

A large portion of gold demand comes from middle-class expansion in India, China and South-East Asia.

The rate at which mining companies produce gold is declining, as it’s estimated that most of world’s gold supply has already been dug up. Production declined by approximately 26% between 2011 and 2019, because companies have cut down on exploration to preserve cash.2

To find new gold supplies, scientists have begun developing technologies to detect previously unreachable gold sources, and even exploring the possibility of mining in outer space.

Although there is a finite supply of gold – as it cannot be grown in the same way as some other commodities – what gold there is will always remain in circulation. This means a lot of gold is now recycled to continue to meet demand.

If demand continues to rise and supply continues to fall, gold’s price will rise.

When interest rates rise, gold’s price tends to fall because investors turn to stocks and fixed-income assets that will earn them capital.

Conversely, when rates fall, the price of gold rises as economic uncertainty causes investors to turn to gold as a safe haven to protect their wealth.

Gold and the US dollar have a complicated, but usually inverse, relationship. When the dollar falls, investors looking for an alternative store of value often rush in to buy gold, driving up its price. A falling dollar also tends to increase the value of other currencies, and that greater buying power can increase the demand for gold that was previously unaffordable.

In periods of financial stress and political instability, gold is often seen as a safe-haven investment as it tends to retain its value when other markets fall in price.

For example, during the first three months of 2020, gold prices increased by 13% due to fears about the impact of coronavirus and the following lockdowns on the economy.

Gold as a safe haven

Investors tend to rely heavily on gold in times of political or economic uncertainty, and the metal is often used as a hedging tool against inflation or currency devaluation.

For example, gold increased more than 13% between January and May 2020 during the Covid-19 crisis, due to rising market volatility. Investors started pulling money from cash assets in favour of the precious metal in order to combat the political, economic and social instability.

However, when any investment becomes too popular there’s the risk of a price bubble being created, which could send prices spiralling when it bursts. For this reason, many gold traders choose to diversify into other markets or manage their risk with stop-losses.

Create your gold trading account

Start trading in gold by filling out our online form – you could be ready to trade CFDs in minutes.

If you’re not ready to trade live gold markets, you can build up your confidence in a risk-free environment by creating a demo account.

Find your opportunity

Find your first opportunity using a range of tools available in-platform.

Expert analysis

Get technical and fundamental analysis on gold from our experts

Technical indicators

Discover gold price trends using popular indicators such as MACD and Bollinger bands

Trading alerts

Know as soon as your target price is met with automated trading alerts

Trading signals

Receive actionable ‘buy’ and ‘sell’ signals on gold markets

Open your first trade

There are a variety of gold markets you can trade with us, including our proprietary spot prices, futures contracts and options. Alternatively, you could get indirect exposure to gold via company stocks and ETFs.

Whichever gold market you decide to trade, it’s important to think about whether you’ll go long or short, what position size you’ll take and how you will manage your risk. We offer a range of solutions for risk management, including stop-losses and limit-close orders – these are used to close trades at predetermined levels of loss and profit respectively.

- Spot gold

- Gold futures

- Gold options

- Gold stocks and ETFs

Our gold spot prices are based on the price of the two nearest futures. They’re useful for taking shorter-term positions as there are no-fixed expiries. Plus, you can perform technical analysis over a longer timeframe, as you’ll get continuous pricing across the market’s entire history – rather than just the duration of a single future.

Once you’ve created your account and logged in, you can trade gold spot prices by:

- Searching for gold or finding it under ‘commodities’ in the left-hand menu

- Selecting ‘spot’ at the top of the deal ticket in the right-hand panel

- Choosing your trade size

- Opening your position by clicking ‘buy’ or ‘sell’

When you trade gold futures with us, you’ll be trading CFDs on the underlying price. This means you won’t be entering into a futures contract, but deciding on whether it will become more or less valuable before it expires.

After you’ve opened your account and logged in, simply:

- Search for gold or find it under ‘commodities’ in the left-hand menu

- Choose ‘futures’ at the top of the deal ticket in the right-hand panel

- Select the expiry you’re interested in

- Pick your trade size

- Open your position by clicking ‘buy’ or ‘sell’

At expiry, we’ll roll over your futures contract into the next month, unless you’ve given us an instruction to close your position. Please note that there may be a difference in the price for the next month’s contract.

Options are a popular means of speculating on commodities prices as they give you the right, but not the obligation, to exercise the contract.

Once you’ve created your account and logged in, you’d just need to:

- Select ‘options’ from the menu on the left

- Tick ‘commodities’ and choose between gold daily, weekly, or monthly options

- Pick the option type, strike price and trade size you want

- Open your first position

To get indirect exposure to gold, you could take a position on companies within the gold supply chain, or ETFs – some track the underlying gold price, while others follow a group of gold company shares.

You trade on the underlying price of gold stocks and ETFs with CFDs. As you wouldn’t take ownership of the underlying shares, you can go long or short.

Choose whether to go long or short on gold

When you start trading gold or gold-linked assets via CFDs, you’ll be able to choose between buying and selling the market – also known as going long or short. You’d buy if you expected the asset’s price to rise in a given timeframe, and you’d sell if you thought its price was going to decline.

To understand which way the market is likely to move, it’s important to do thorough research – both technical and fundamental.

Monitor your trade and close your position

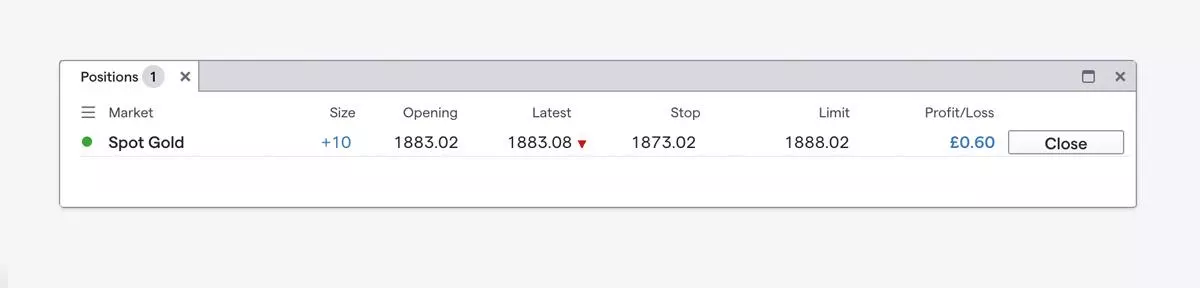

Once you’ve opened your position, you can monitor your profit and loss in the ‘positions’ section of our platform.

While your position is open, you should keep up to date with news and continue performing technical analysis so that you can identify key turning points in the market.

Ready to open your first trade? Create an account now

When you decide it’s time to close your position, you can click ‘close’.

FAQs

How do you trade in gold?

You can trade in gold by buying and selling spot gold, gold futures, gold options, or gold stocks and ETFs. To open a position, you’ll need a CFD account.

What moves gold markets?

The price of gold is moved by the forces of supply and demand. Factors that can play a role include: mining production, inflation and interest rates, political insecurity and safe-haven flows, and the value of the US dollar.

When can I trade gold?

Our proprietary gold spot market is available between 11pm Sunday to 10pm Friday (UK time). Gold futures can be traded 24 hours a day, five days a week, except between 10pm to 11pm (UK time). Daily gold options trade between 7.30am on Monday until 9.15pm on Friday (UK time) – weekly and monthly options are also available.

1 World Gold Council, 2019

2 McKinsey and Company, 2019

3 Deal three or more times in the previous month to qualify for our best commission.

4 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.