Bond trading

Trade on bond prices. Take a position on our global offering using derivatives like CFDs.

Why trade in bonds with us?

Take a position with leveraged

derivatives

Deal in fractions of contracts,

off-exchange, with CFDs

Use an award-winning web-based

platform and mobile

trading app1

Choose from a comprehensive

selection of global

bond markets

Predict on bond price

movements over the short,

and medium term

Trade on the inverse relationship

between interest rates

and bond prices

What are bonds?

Bonds are financial instruments that enable governments and corporates to raise capital. Investors will loan money to the bond-issuer and, in return, receive a series of interest payments at specified dates. At maturity, the bond-issuer will repay the original sum lent – known as the bond’s ‘principal’.

Bonds can be bought and sold on the secondary market like other financial securities – meaning that their prices fluctuate. High interest rates, for example, tend to make bonds less attractive by providing other opportunities to earn returns with low risk. For this reason, interest rates and bond prices tend to have an inverse relationship.

How to trade bonds

With us, you´ll trade on changes in bond prices using CFDs - a type of leveraged derivative. This means that, when trading, you´ll never take ownership of an actual bond. Instead, you´ll take a position on the bond futures market either rising in value or falling.

Your profit or loss will depend on whether you correctly predicted the direction of movement, how much the market has moved, and the size of your position.

But, please remember that all trading incurs significant risk. This is only amplified when trading on leverage. Learn more about how to manage your risk.

Trade bond futures with CFDs

| Assets | Markets | How to trade |

| Bond futures | Government bond futures markets | CFDs |

Why would I trade bonds?

- Trade on the inverse relationship between interest rates and bond prices

- Predict on both rising or falling bond prices

- Take a position in the short to medium term

- Hedge existing investments

Start trading bonds now

Start trading bonds now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

React faster with powerful technology

Our platform and apps are intuitive and highly responsive, so trading opportunities are always within reach

Grow your confidence with an established provider

We’re a FTSE 250 company that’s been leading our industry for nearly 50 years, so our expertise is second to none

Start trading bonds now

Start trading bonds now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

React faster with powerful technology

Our platform and apps are intuitive and highly responsive, so trading opportunities are always within reach

Grow your confidence with an established provider

We’re a FTSE 250 company that’s been leading our industry for nearly 50 years, so our expertise is second to none

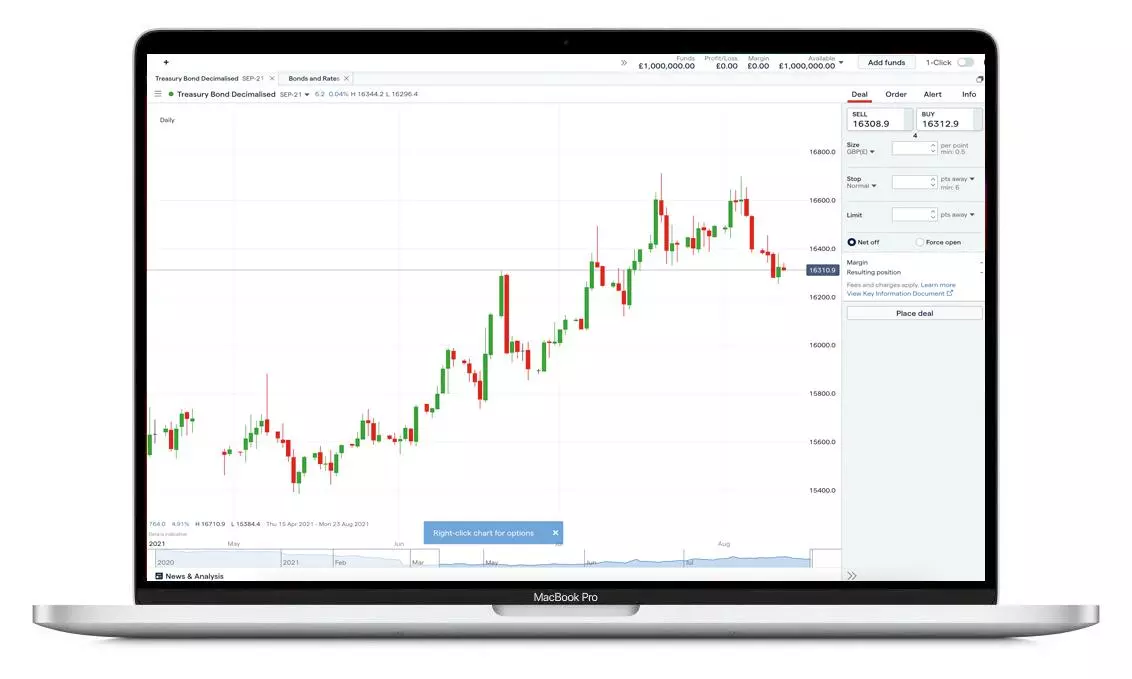

Trade bonds with an award-winning trading platform1

Seize your opportunity on the leading web-based platform and mobile trading app.

- Web-based platform

- Mobile trading app

Take control of your trading with our clean deal ticket, clear price charts, and in-platform news and analysis.

Trade wherever you are, and receive trading alerts and signals on the go through email, SMS or push notifications.

Bond trading costs

- CFD trading costs

| Margin* | Minimum margin requirement of 20% |

| Spread | From 1 point |

*Leverage can magnify both your profits and losses as they’ll be based on the full exposure of the trade, not just the margin required to open it. This means losses as well as profits could far outweigh your margin, so always ensure you’re trading within your means.

Bond markets to watch

- Popular bonds

- US bonds

Prices above are subject to our website terms and conditions. Prices are indicative only.

Open an account now

It’s free to open an account, takes and there’s no obligation to fund or trade.

Open an account in now

It’s free to open an account and there’s no obligation to fund or trade.

Try these next

Trade 70+ US stocks after hours with us.

Learn the mechanics of a forex trade: including pairs, pips and leverage.

See how our technology can help you trade efficiently.

1 Best Finance App, Best Multi-Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024.