After-hours trading on stocks

Volatility doesn’t wait for the main market session. Take a position on over 70 US stocks pre-market open and after-hours.

After-hours trading on stocks

Volatility doesn't wait for the main market session. Take a position on over 70 US stocks pre-market open and after-hours.

Call 010 500 8624 or email newaccounts.za@ig.com to talk about opening a trading account. We're around 24 hours a day from 9am Saturday to 11pm Friday.

Contact us: 0105008624

Why trade after hours with us?

Discover unique opportunities

Go long or short on a range of US stocks outside normal trading hours

Take advantage of volatility

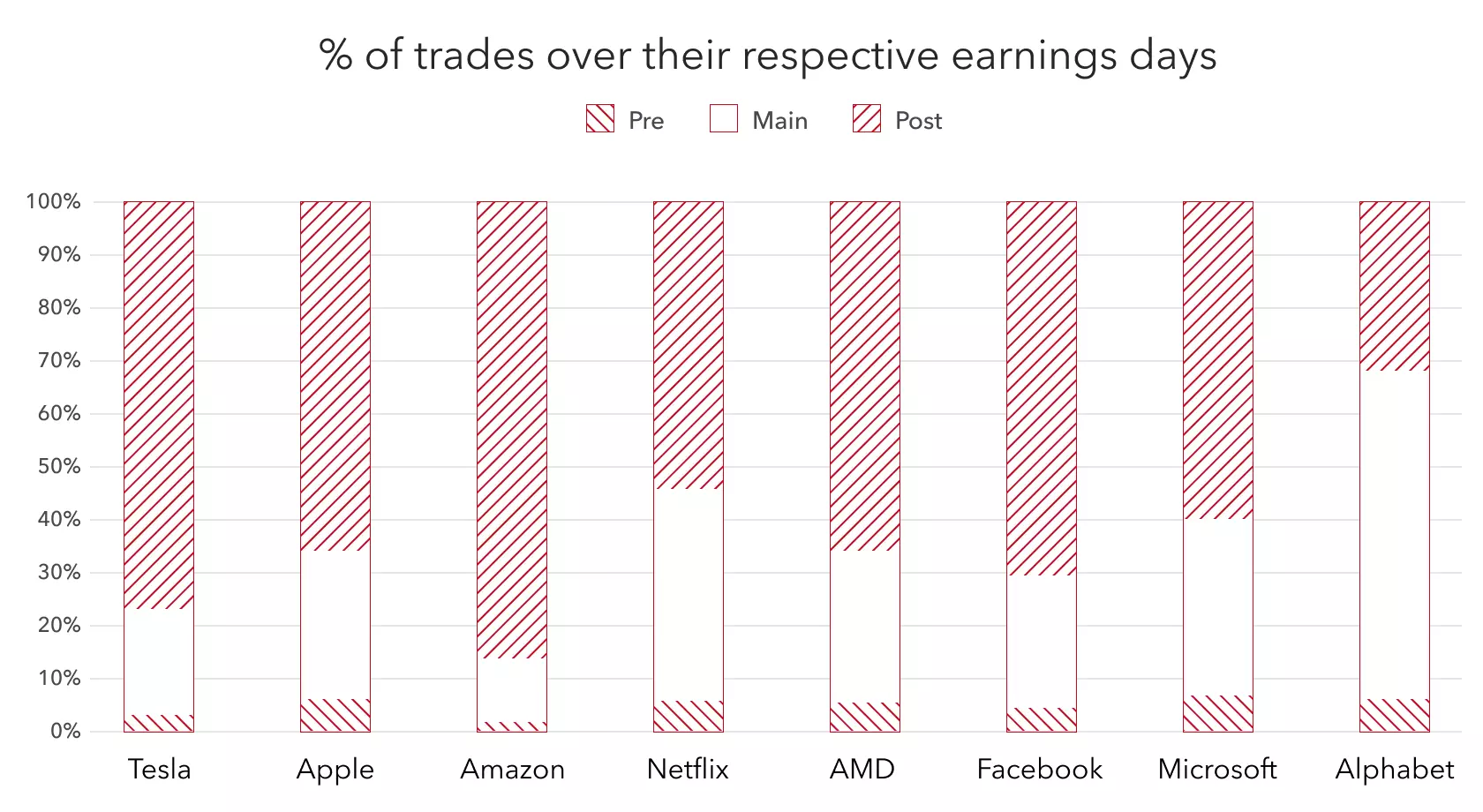

Make the most of price movements – over 80%1 of trades can occur outside of the main session

Get ahead of the competition

Trade earnings announcements and breaking news without waiting for the main session

Choose how you trade

Open a position using CFDs or direct market access (DMA)

What are the risks of after-hours trading?

The risks of pre-market, post-market and weekend trading include:

Lower liquidity: many market participants prefer to trade during the main session when prices are generally more stable. This means there may be fewer active participants to fill the other side of trades out of hours

Higher volatility: lower liquidity can result in more dramatic swings in prices, which can be good or bad – depending on your individual risk appetite

Wider spreads: the difference between the buy and sell price, known as the spread, can widen when volatility rises or liquidity falls

You can manage your risk using stops and limits, which automatically close your trade when the price hits a pre-determined level. Guaranteed stops are the best way to cap risk, because these always close your trade at the exact level you specify – even if the market moves quickly or ‘gaps’. A small premium is payable if a guaranteed stop is triggered.

What are pre-market and after-hours shares trading?

Pre-market and after-hours trading are extensions of the market session. They enable you to find opportunities before and after normal trading hours.

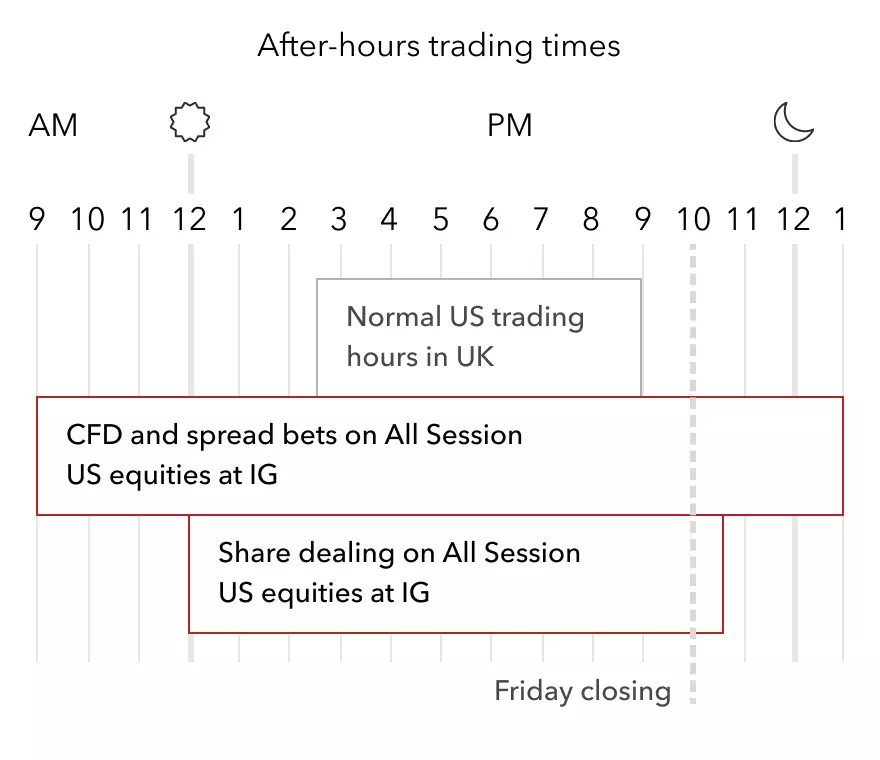

Most UK traders can only trade the US stock market from 2.30pm to 9pm (UK time), but with our extended hours you can trade for much longer.

- CFD on All Session US shares

9am to 1am Monday to Thursday, and 9am to 10pm Friday (UK time)

You’ll find our extended hours markets labelled ‘All Session’, to distinguish them from stocks only available in normal US market hours.

Why would I want to trade shares before or after-hours?

Trading on All Session stocks enables you to take advantage of any opportunities that happen outside the main trading window – like volatility around US company earnings and news announcements.

The importance of out-of-hours trading

Stock prices can see significant volatility as traders and investors react to company earnings announcements. The amount of movement largely depends on whether or not the results are in line with analysts’ estimates.

As most US companies release their earnings outside of the main session, the majority of trading takes place in the pre- and post-market sessions. This makes out-of-hours trading vital for taking advantage of earnings volatility.

This is just one example of how to use out-of-hours trading to your advantage. You can also capitalise on price movements around macroeconomic data releases, and major news events.

What stocks can I trade after hours?

Trade over 70 key US stocks before and after-hours with us, including Apple, Facebook and Amazon.

NASDAQ

Airbnb Inc

American Airlines

Advanced Micro Devices Inc (24 Hours)

Alphabet

Amazon

Apple

Baidu

Beyond Meat Inc

Cisco Systems

Beyond Meat Inc

eBay

Facebook

Gilead Sciences

Google

Intel Corp

JD.com

Micron Technology

Microsoft

Netflix

NVIDIA

PayPal

Peloton Interactive Inc

PowerShares QQQ Trust

QUALCOMM

Tesla Motors

Zoom Video Communications Inc

NYSE

3M

Alcoa

Alibaba Group

American Express

American International Group

AT&T

Bank of America

Berkshire Hathaway

Best Buy

Boeing

Caterpillar

Chevron

Citigroup

Coca-Cola

Delta Air Lines

Exxon Mobil

Ford Motor

General Electric

General Motors

Goldman Sachs Group

Halliburton

Hewlett Packard

Home Depot

IBM

Johnson & Johnson

JPMorgan Chase & Co

McDonald's

Merck & Co

MGM Resorts International

Morgan Stanley (24 Hours)

NIKE

NIO Limited

Oracle

Pfizer

Procter & Gamble

Schlumberger Ltd

Snap Inc (24 Hours)

Transocean

Twitter

United Technologies

UnitedHealth Group

Verizon Communications

Visa

Wal-Mart Stores

Walt Disney Co

Wells Fargo

Open an account now

*Demo accounts are only available for spread betting and CFD trading.

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to 17,000 global markets, with reliable execution

React faster with powerful technology

Our platform and apps are intuitive and highly responsive, so trading opportunities are always within reach

Grow your confidence with an established provider

We’re a FTSE 250 company that’s been leading our industry for nearly 50 years, so our expertise is second to none

*Demo accounts are only available for spread betting and CFD trading.

Start trading now

Start trading now

Fast execution on a huge range of markets

Enjoy flexible access to 17,000 global markets, with reliable execution

React faster with powerful technology

Our platform and apps are intuitive and highly responsive, so trading opportunities are always within reach

Grow your confidence with an established provider

We’re a FTSE 250 company that’s been leading our industry for nearly 50 years, so our expertise is second to none

How to trade shares out of hours

Trade CFDs to free up your capital with leverage. Get direct market access for increased visibility and control.

CFD trading

Trade the difference in a share’s price from when you open the position and when you close it. CFDs are a useful hedging tool.

DMA

Trade directly in the order book with our shares direct market access (DMA) service for advanced traders. Simply enable DMA on your CFD account, and find it in the ‘order’ tab for ‘all sessions’ shares.

How much does share trading before or after hours cost?

When you trade out of hours with us, our spread and commission are the same as those you’d get during regular market hours.

However, underlying market spreads can widen due to reduced liquidity. So, you might find you pay more to open or close a trade.

Try these next

Learn how to buy and sell shares online with us

Use this guide to learn how to trade IPOs

You won’t find as many 24/72 markets anywhere else

1Based on Amazon.com earnings (13 Jan - 14 Feb).

224/7 excludes the hours from 10pm Fri to 8am Sat, and 20 mins just before the weekday market opens on Sunday night.